|

|

Lecture notes, cheat sheets

Investments. The influence of investments on the implementation of structural changes in the Russian economy (lecture notes)

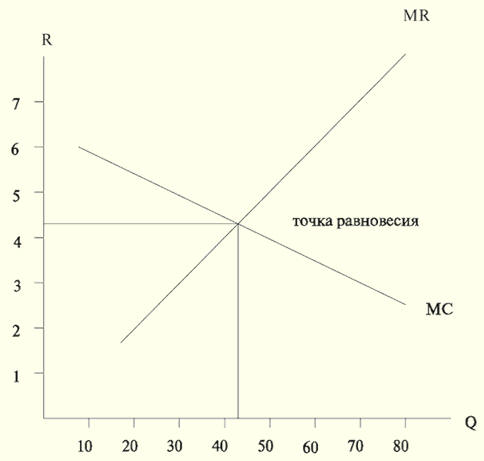

Directory / Lecture notes, cheat sheets Table of contents (expand) LECTURE No. 15. The impact of investments on the implementation of structural changes in the Russian economy Investments in the economic system perform three main functions: 1) ensure the growth and quality of fixed capital; 2) carry out structural economic shifts; 3) accelerate the implementation of the latest achievements of scientific and technological progress. Of great importance is the ratio between accumulation and consumption as part of the national income. When considering the problems of expanded reproduction, special attention is usually paid to accumulation. This is the main lever for ensuring economic growth and improving the living standards of the population. At the same time, the investment process is considered as an integral part of the accumulation process. These are, although in many respects similar, but still different in their content processes. The reproductive process involves balancing investments. Therefore, in order to get out of the current crisis situation in Russia, it is necessary to achieve a balance of proportions: investment fund - accumulation fund - consumption fund. The theoretical model of the relationship between these funds can be represented as follows. First, the logical goal of the entire reproductive process is consumption. If investment and accumulation are torn away from this goal, then they become meaningless and a heavy burden falls on the shoulders of the people, at the expense of which these irrational expenses must be compensated. The optimization of the economic structure requires that savings and investments should be of a consumer nature from the very beginning, in the short or long term. Secondly, the main logical purpose of investment is to ensure the growth of national income, and in its composition - savings and consumption funds. Moreover, this growth must be carried out in such a way that each additional unit of capital investment provides a greater increase in income than the costs that caused it. This is an indispensable requirement for the optimal functioning of the economy. To analyze this dependence, it is advisable to use limiting values: marginal capital investment and marginal income. Based on the fact that at any given moment an increase in investment is accompanied by a decrease in their return, marginal income decreases, while specific capital costs increase. [10] The optimal point is at the intersection of the marginal revenue and marginal investment cost curves. On the graph, this can be represented as follows (Fig. 1).

Rice. 1. The ratio of marginal investment investments and marginal income. R - income; MR - marginal revenue; MC - marginal investment; Q - the amount of investment. Thirdly, optimal functioning assumes that the investments made not only cause an increase in national income, but also cause an increase in the consumer fund. This can be achieved under the following conditions: 1) when a constant rate of accumulation is maintained; 2) when it decreases, but this decrease is compensated by an increase in the return of accumulated resources. This, in turn, requires a certain investment policy that determines not only economic growth, but also the distribution of investment resources between the relevant sectors of the economy in such a way that it equally determines the growth of both investment industries and industries producing consumer goods and services. There is also an inverse relationship, namely: the increase in national income is the most important source of expansion of investment. Consequently, accumulation and investment activity are closely interrelated. This is clearly visible when we consider capital investments in dynamics (in comparable prices) and compare them with the dynamics of national income in its physical volume (i.e., also in comparable prices). The absolute size of accumulation and capital investment in expanded reproduction depends on the volume of national income for a given share of accumulation. The greater the national income, the greater the savings, and for a given share of it, the greater the funds allocated for capital investments. [eleven] And vice versa, the greater the investment and the increase in production assets caused by them, the higher the possibilities of increasing the physical volume of the national income. The level of efficiency of investments in investments is also very important. The greater the efficiency of the investments used, the more fully and quickly they are embodied in fixed assets, the more progressive and higher the technical level of these funds, the higher the quality of construction work, the greater the growth in production, labor productivity in the national economy, and the increase in physical national volume. Ultimately, the choice of the most efficient production method is carried out only through the implementation of one or another investment program. The production function used in economic analysis describes technologically efficient methods of production. When maximizing the amount of profit, the enterprise must choose from the list of investment projects that represent technologically efficient production methods, the one that helps to minimize costs, or, in other words, the most cost-effective way. Consideration of the functional structure of the gross domestic product, more precisely, of its part used for capital investments, is of great importance in economic analysis. Based on these materials of the economic development of countries, one can see the emerging relationships between the structure of the gross domestic product and the dynamics of its investments. In the post-war years, the level of capital investment in developed countries was higher than in the years preceding the Second World War, which became a special factor in the expansion of the domestic market and the main reason for a certain acceleration in production rates in these countries. A higher level of capital investment is maintained in them with the help of large investments in the development of new industries and the radical reconstruction of production. Government policy also plays a significant role, which, with the help of accelerated depreciation and tax levers, pushes companies and enterprises to increase capital investments. In more developed countries, 30-40% of capital investments are carried out by the state itself. It finances investments in manufacturing industries and some sectors of social infrastructure, and in some countries also in housing construction. The highest level of capital investment in the postwar years is characteristic of Japan. This trend continued into the 1990s. A lower level of investment is a feature that characterizes the economic development of England and the USA (Table 2). The data presented in Table 2 can be general guidelines for optimizing the ratio of investments and the structure of Russia's gross national product. It should be noted that in Russia the share of capital investments in the gross domestic product is somewhat lower than in the developed countries of the West. But in general, the differences are insignificant, which creates the appearance of the well-being of the economy. This currently has a decisive impact on the dynamics of the ratio of investment and savings and consumption funds. [12] Table 2 Structure of consumption of gross domestic product of developed countries,%

Common sense and world practice show that a certain increase in the well-being of the people is achieved not by reducing the rate of accumulation, but, on the contrary, with its sufficiently high growth rates and a high level of national income. To maintain the rate of production accumulation at a sufficiently high level, appropriate conditions are needed, such as: a high or continuously increasing level of production efficiency, i.e., an increase in the return on production costs. In other words, each cycle of reproduction must be carried out at a higher technical level. Only under this condition it becomes expedient to increase investment costs. Therefore, an important feature of the modern investment strategy is such an increase in the efficiency of the national economy, which will expand the boundaries of accumulation, stop the decline, and subsequently stabilize the rate of production accumulation. In recent years, there has been a decrease in the rate of production accumulation, which was caused by a reduction in the return on assets. If the return on the resources used decreases below the equilibrium point, then their accumulation becomes unprofitable, since the costs (i.e., capital investments) exceed the income received from their investment - the return. In addition, this may lead to an absolute decrease in the consumption fund. In the 1990s the investment sphere experienced extremely great tension. At that time, funds were spent not so much and not only to increase the technical production level, but in all significant amounts - to compensate for its declining efficiency. As a result, there is an overaccumulation of the production apparatus on a backward, low technical and technological base. In the conditions of the prevailing situation of economic instability, with a high level of inflation, to make intensive investments in the sphere of production, to make intensive accumulation becomes absolutely meaningless. In addition, the existing investment complex in Russia is inefficient and cumbersome, and the investment cycle is unreasonably extended in time. From the resources used, the return is usually expected in 15-20 years. This is quite a long time. From the invested funds, given the pace of the modern scientific and technological revolution, in general, you can get absolutely no effect, but, on the contrary, be at a loss. In such situations, the fundamental contradiction between consumption and accumulation is not resolved: accumulation at the present time is not realized by a corresponding increase in consumption in the future, that is, the future is extremely distant. The modern scientific and technological revolution requires that the investments made begin to give a return in 1,5-2 years: only with such terms is the contradiction between accumulation and consumption found. Stretching the terms of construction and development of production facilities for a period of more than 10 years turns investment activity into a cost area for many years. It is clear that under these conditions maintaining the rate of accumulation at a sufficiently high level is unacceptable, because it increases the already unbridled inflation and contributes to the "overheating" of the economy. Therefore, under such conditions, only a radical improvement in the structure of accumulation, in other words, the structure of investment, will lead to an increase in the economic efficiency of the national economy, and further to an increase in the level and quality of consumption. As is known, accumulation until very recently did not fulfill its role in reproduction, namely: it did not serve as an effective factor in the development of the national economy. The predominant place in accumulation was occupied by expenses for military production, and in general all economic development was subordinated to military needs. Personal consumption came last. Due to this state of affairs, the national economy could not and cannot properly absorb the high rate of accumulation. [13] This manifests itself, in particular, in the following: 1) the "repair" character of accumulation; 2) extremely low technical level of the civil sector of the economy; 3) huge construction in progress; 4) extended investment cycle; 5) construction of facilities according to outdated projects. It follows from the foregoing that it is economically justified to reduce the rate of production accumulation in the Russian economy in recent years. The replication of obsolete equipment that produces goods that cannot withstand any competition on the world market, that do not fully satisfy people's needs for high-quality everyday goods is completely unnecessary. In this case, it is better to stop the dissipation of financial and material resources, stop the unjustified use of resources. In fact, it is possible to expand production on a technical and technological basis only when the sector of the economy that produces investment goods is restructured in a timely manner. Today, mechanical engineering, for example, can ensure a large rate of accumulation only by increasing the output of unreliable and traditionally archaic equipment. It follows from this that this form of investment should be abandoned. But it is not so easy to make the transition to a more progressive type of accumulation. This requires quite a lot of money, and most importantly - time. Based on this, conclusions follow: in the national income, the share of the accumulation fund should always be set at such a level that the economy can effectively master it; the rate and accumulation fund at a certain moment should be set at a level that would allow mastering the highest level of achievements of the scientific and technological revolution at that moment. If there are no certain effective technical and technological innovations, then accumulation becomes inexpedient. It will not provide a corresponding increase in quality and consumption. If there are such innovations, then the means, whatever they may be, will pay off handsomely. Therefore, it is unacceptable to talk about whether the rate of accumulation is low or high, regardless. It is necessary to talk about the extent to which this level of accumulation is provided with scientific and technical innovations and how much, in turn, this accumulation contributes to the future development of the scientific and technological revolution, the introduction of its results into production and an increase in the quality and volume of consumption. Thus, it follows from the foregoing that the currently observed process of absolute reduction of the accumulation fund is of an objective nature. It is necessary to pass through the stage of absolute reduction of production accumulation. One cannot see in the low rate and absolutely declining production accumulation only a manifestation of deindustrialization and deinvestment, the fallacy of economic reforms, as is often interpreted. There should always be a reasonable approach, based precisely on a sober assessment of the current situation. Another thing is that the period of structural changes in the investment complex and investment programs should not be artificially prolonged, because this has the most detrimental effect on the level of personal consumption and the willingness of the population to implement economic reforms. [14] The formation of the considered proportion between consumption and accumulation is revealed in more detail when analyzing the distribution of investments between specific sectors of the economy, for example, between those economic sectors whose economic activity is associated with the full satisfaction of the personal needs of people, and those that work for the reproduction of investment resources (for production). In this regard, it is of particular importance to consider such a structure of investments that characterizes their consumption in the main production, social and production infrastructures. Starting this analysis, first of all, it is necessary to take into account the experience of developed countries accumulated in this regard. It shows that the focus on the constant expansion of the production of fuel, raw materials, materials mainly leads to an economic situation that has a paradoxical formula: the greater the volume of material resources produced in the form of raw materials, fuel, metals, the greater their shortage. In the Soviet period, a similar approach to the development of the economy was typical, and even now it is largely preserved. Constant growth actually leads to an unjustified increase in the so-called incremental costs associated with growth (from energy to the creation of certain infrastructure), increasing the scarcity of other resources. Most industries, especially mining, electric power, metallurgy, are the most capital-intensive links in the industrial cycle; to a large extent they work for themselves, involving with each additional ton of fuel and mineral raw materials an increasing number of equipment and machines, labor, energy and materials. An impressive share of the increase in the production of initial semi-products and materials is "eaten up" by their growing waste in other areas of the national economy that are consumers of these products. Under these conditions, production investments that reduce the consumption of materials, for an increasing number of positions, become economically much more profitable than future investments in industries that are extensively increasing production volumes. Based on calculations, the costs of measures to save resources in production are currently 3-5 times less than the costs of increasing resource extraction. Meanwhile, the effectiveness of such resources is steadily increasing. On the basis of trends towards an absolute reduction in the size of extraction of almost all types of resources and an increase in the cost of extraction of many types of raw materials, the economic range of effective measures to save material resources is also expanding. The structure of the economy that has developed today, as you know, is characterized by an extremely large share of non-consumer sectors of the economy, which are characterized by high resource intensity, which is the main reason for the excess demand for investment goods, raw materials and energy. Structural policy, which led to such results, not only negatively affects the development of the socio-cultural sphere, but also hinders the development of productive forces in general. The long-term growth of production to meet predominantly non-consumer needs, on the one hand, deprived society of the necessary material incentives for further socio-economic development, and on the other hand, worsened the material basis for investing in the economy. A paradoxical situation has arisen: the more effort and money is spent on the production of means of production, the more the national economy experiences a shortage of them. [15] The type of economic growth, in which for a long time from the branches that make up the II division of social production, accumulations in the branches of heavy industry overflowed, led to a progressive lag in the services, food and light industries. The heavy industry was unable to provide industries that manufacture consumer goods with technological equipment and modern technology, since the vast majority of its goods were of a military nature, and this, in turn, dooms the state to large scale imports from abroad. It follows from this that the goal of structural policy in the short term should be the reorientation of appropriate resources to the development of industries that satisfy the consumer needs of people. For Russia in this regard, the US can be a reference point, where industry accounts for 60% of total production. It should be noted that for Russia this figure is close, because the country is rich in natural resources that ensure the development of agriculture, as well as most branches of the light and food industries. In the structure of social production, the most common aspects include: sectoral and functional. Functional consists of objects and tools of labor, the worker himself, who is the main productive force, as well as such links as production or main production, social and production infrastructure. The main production is the material and production sectors that are directly engaged in the manufacture of investment goods and commodities. The increase in national wealth to a greater extent depends on these industries and their technical level. These include: 1) raw material complex; 2) fuel and energy complex; 3) machine-building complex; 4) metallurgical complex; 5) agro-industrial complex; 6) chemical complex; 7) production of consumer goods; 8) construction and investment complex. The sphere of industrial production in Russia occupies 54,5%, and, for example, in the UK - 29,8%, the USA - 26,2%, France - 29,6%, Japan - 33,8%. Accordingly, the service sector accounts for 26,2%; 67,7%; 71,1%; 64,2%; 58,6%; agriculture, respectively, - 19,3%; 2,5%; 2,7%; 6,2%; 7,6%. At the level of individual economic units, sectors and industries, the production of gross domestic product is measured by the indicator of gross value added. 1989-1992 about 4/5 of gross value added comes from the sphere of material production; During this period, among the industries of the non-material sphere, the share of financial intermediation services increased most significantly (from 0,6% to 4,4%), such as insurance and lending. It can be seen that the vast majority of the national product is produced precisely in the sphere of main production, where, unlike in developed countries, the structure of the national product is different. The next link in the national economy is the production infrastructure, which includes a system of industry design and technology institutes, production management at the level of the industry or its large sub-sectors, transport, communications, trade, warehousing, business services in the form of franchising, consulting, engineering, maintenance, switch, leasing, hiring, rating, offset, offshore, etc. Subdivisions of this sphere, providing services to the main production, help to increase its efficiency and improve working conditions, in fact, increasing national wealth. In developed countries, the manufacturing services sector is a large and highly efficient sector of the economy. In the USA, for example, more than 1/5 of the gross national product is created in transport, communications and trade. [16] In Russia, this figure was 1991% in 6, and 1993% in 18. Domestic statistics in the sphere of production infrastructure also includes the types of services that form an independent separate sector of the economy in developed countries. To the financial infrastructure, more and more takes the form of a complete independent education, which is regulated by the specific features of the activity. Therefore, it becomes a separate functional sector of the national economy. The financial infrastructure includes the financial and credit system, the system of modern office work, the banking network, etc. In general, the main production and production infrastructure form the sphere of material production. In connection with the development of society, the need for intangible benefits that are created in the non-productive sphere is increasing, which determines the viability of the social infrastructure. Social infrastructure is non-material production in which non-material types of wealth are created, which play a crucial role in the development of members of society, the growth of their professional knowledge, abilities and skills, the enhancement of cultural and educational levels, and the protection of health. Social infrastructure includes the following sectors: 1) health protection and physical culture; 2) general secondary, secondary specialized, vocational and higher education, a system of advanced training for employees, etc.; 3) housing and communal services; 4) passenger transport and communications; 5) consumer services for the population; 6) culture and art; 7) tourism and sports. Experience shows that social infrastructure in developed countries is gradually turning into one of the main areas of human activity. This is convincingly evidenced by data on the US economy for 1990. Table 3 Share of sectors of the US economy in 1990

The table is compiled according to the data: world economic development trends. The volume and quality of social services very clearly characterize the standard of living of the population and the economic progress of the country. For a long time, the underestimation of this sphere caused a significant lag in precisely those industries that now determine the level of civilization and development of society. Among other things, this is manifested in the low level of development of such industries as consumer services, health care, the material and technical base of science, secondary and higher education, etc. Of course, the economic aspects for solving this problem are laid down in material production. But we must also keep in mind the fact that in modern conditions the economic progress of the country is significantly hampered due to the absence of pronounced national motives in the spiritual sphere. Therefore, when creating the economic program of the state, it is necessary to include the sectors of social infrastructure in the list of priority areas. The material and technical base in a developed economy takes on a stable character at a certain stage. Basically, the growth occurs due to its qualitative improvement, which contributes to a slight increase in production services. In general, the volume of the service sector here is carried out at the expense of social infrastructure. It is this change in the very structure of the service sector that must be considered a natural phenomenon. The study of the structure of the national economy in terms of identifying its large blocks (main production, social and industrial infrastructure) allows you to more accurately determine the priority areas for investments in investments. The need to improve the economic structure inevitably determines the improvement of the investment structure as the main effective resource for the implementation of major economic transformations. The analysis of the sectoral investment structure is an addition to the above study of their impact on structural shifts in the economy. But if earlier attention was concentrated on the macroeconomic structure, then in this case the main emphasis is on studying microeconomic proportions at the sectoral level. The sectoral distribution of investments is a decisive influence on the formation of all economic proportions and rates of economic growth as a whole. The sectoral investment structure is the ratio of various financial resources directed to the development of individual sectors of the national economy. By themselves, sectoral proportions do not add up. They depend on the funds that are directed to the development of any industries. Therefore, the improvement of the sectoral structure of investments is a special means of improving the entire structure of the national economy. A high share in the modern structure of the economy is occupied by raw materials industries, as well as the manufacture of intermediate products. At present, the problem is to produce as many finished consumer goods and means of labor from the intermediate product as possible. Accelerating the development of industries that produce consumer goods means increasing the efficiency of investments. If the investment process is carried out on a new technical basis, then real opportunities are created to maintain stable rates of reproduction at relatively lower material and production costs. The effectiveness of new technology lies precisely in the extent to which it contributes to the production of finished products, including consumer goods. [17] The outstripping growth rates of finished products compared with the growth of the necessary means of production mean that in the construction of new enterprises and technical reconstruction it is necessary to focus on such equipment that will allow maintaining the growth rates of national income and gross product at a higher level than the growth in the number of means of production. Based on an analysis of the structural relationships between national income and gross national product, we can say that in recent years, the most priority in the sectoral structure is the production of an intermediate product. At present, prices are growing to a greater extent precisely for the products of the fuel and energy, chemical, and metallurgical complexes, where more than half of all industrial profits are accentuated. This is a counter to structural economic shifts and reproduces a very dangerous trend in production. As a rule, the structure of the economy is the most stable element of economic dynamics. In order to change it, it will take a long time and huge investments, as well as a purposeful adaptation of the economy to the rational personal and social needs of the population. Under certain conditions, an extremely important task is the transfer of material and financial resources from the military-industrial complex and heavy industry to industries that develop consumer goods and services that ensure the priority of high-tech industries, as well as the construction complex, the formation of a significant sector for the production of high-tech goods for import-substituting industries and for export. This should be subject to pricing and financial and credit policy, the system of state regulation of the release of the final product. Logically, in a growing economy, the sectoral structure of investment should change in such a way that the share of those industries with higher capital productivity increases. [18] Literature 1. Investment return - M.; KNORUS, 2006. - 432 p. 2. Idrisov A. B., Kartyshev S. V., Postnikov A. 3. Strategic planning and analysis of investment efficiency. M.: Information and publishing house "Filin", 1998; 1998; Guidelines for evaluating the effectiveness of investment projects. 3. Investment activity. M.: KNORUS, 2006. 432 p. 4. Investment activity. M.: KNORUS, 2006. 432 p. 5. Political economy. Economic Encyclopedia. vol. 1. M.: Nauka, 1968. S. 548 6. Investments: Textbook. M.: KNORUS, 2006. 7. Investment activity. M.: KNORUS, 2006. 432 p. 8. Investment activity. M.: KNORUS, 2006. - 432 p. 9. Gracheva M. V. Analysis of project risks. M.: CJSC "Finstatinform", 1999. 10. Economy of foreign countries. M.: Higher school, 1990. S. 95. 11. Economy of foreign countries, M.: Higher school, 1990, p. 95. 12. Economy of foreign countries. M.: Higher school, 1990. S. 95. 13. Political economy. Economic Encyclopedia. vol. 1. M.: Nauka, 1968, p. 548 14. Political economy. Economic Encyclopedia. vol. 1. M.: Nauka, 1968, p. 548 15. Political economy. Economic Encyclopedia. v.1. M.: Nauka, 1968. S. 548 16. According to the Russian Ministry of Statistics. 17. The national economy of Russia. Statistical Yearbook. K. Tekhnika, 1994. S. 14. 18. Political economy. Economic Encyclopedia. vol. 1. M.: Nauka, 1968. S. 548 Author: Maltseva Yu.N. << Back: Investment Crisis in Russia

▪ Psychology of work. Lecture notes ▪ Foreign literature of ancient eras, the Middle Ages and the Renaissance in brief. Crib

The existence of an entropy rule for quantum entanglement has been proven

09.05.2024 Mini air conditioner Sony Reon Pocket 5

09.05.2024 Energy from space for Starship

08.05.2024

▪ Space Rider Orbital Laboratory

▪ site section Power Amplifiers. Article selection ▪ article Bad habits and their social consequences. Basics of safe life ▪ Article When did heart transplants begin? Detailed answer ▪ article Seaming machine operator. Standard instruction on labor protection ▪ article Coins out of thin air. Focus Secret

Home page | Library | Articles | Website map | Site Reviews www.diagram.com.ua |

Arabic

Arabic Bengali

Bengali Chinese

Chinese English

English French

French German

German Hebrew

Hebrew Hindi

Hindi Italian

Italian Japanese

Japanese Korean

Korean Malay

Malay Polish

Polish Portuguese

Portuguese Spanish

Spanish Turkish

Turkish Ukrainian

Ukrainian Vietnamese

Vietnamese

See other articles Section

See other articles Section