|

|

Lecture notes, cheat sheets

Investments. Foreign investment (lecture notes)

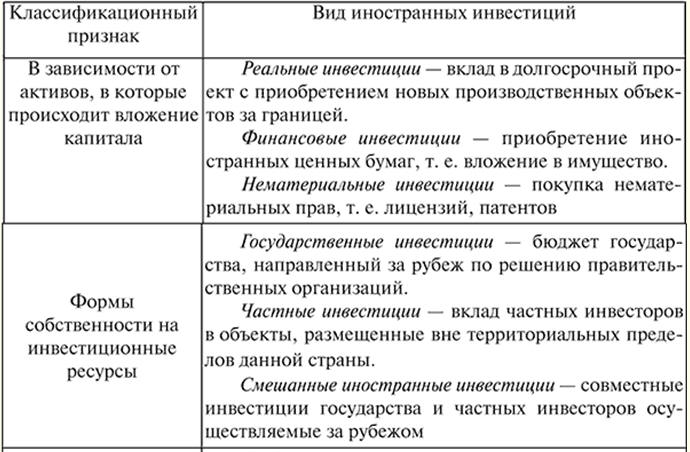

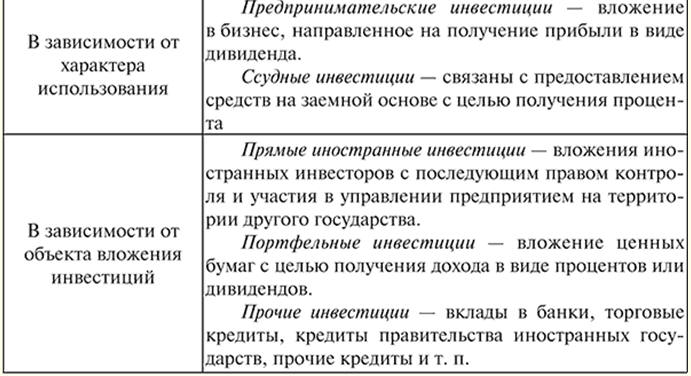

Directory / Lecture notes, cheat sheets Table of contents (expand) LECTURE № 3. Foreign investments 1. Capital outflow In recent years, enterprises and entrepreneurs who have accumulated large capital have appeared in Russia. Large funds are transferred to Western banks due to the unstable economic situation in the country. It was expected that Russia would turn to foreign lenders to finance larger investments as the country acclimatized to market relations. This does not happen, therefore the outflow of monetary resources from Russia is several times greater than their inflow. In 1993, Russia issued larger loans to foreign borrowers than it borrowed itself. Russia's current account surplus (where citizens lend more money than they borrow) was about $10 billion. This increased the investment "hunger" in the country and led to a further weakening of the national currency. A significant part of the funds accumulated by Russian businessmen, under the influence of the risk of a possible social explosion, with inflation and the continuous fall of the ruble, is transferred to Western banks or used to purchase securities and real estate. The Russian economy is too unstable for long-term investments. In this regard, enterprises use their funds not for capital investment within the country, but for issuing loans abroad. Exporting companies mostly keep their earnings in foreign bank accounts instead of being in Russia and channeling them into new investments. This process, known as capital flight, is illegal in most cases. Still, it is much safer to invest capital in a foreign bank with a stable economy than in an unstable Russian economy. The large-scale outflow of foreign currency outside of Russia forced the adoption of organizational and legal measures to strengthen control over the return of foreign exchange earnings to the country. In order for Russian enterprises not to be afraid to invest in the Russian economy, it is necessary to create conditions for reducing investment risk. The magnitude of the risk can be reduced by lowering inflation, the adoption of stable economic legislation based on market potentials. The main sources of capital flight can be both legitimate and illegitimate. Legitimate sources include authorized investments in the economies of other countries as the creation of joint ventures or subsidiaries. The total scale of the outflow of currency cannot be accurately measured, since financial statistics, of course, take into account only their legal part. The technology of carrying out market reforms presupposes consistency. Together with the stimulation of capital inflows, measures should be taken immediately to prevent the outflow of capital abroad. 2. Types of foreign investment Based on effective cooperation between countries, the flow of investment capital is becoming increasingly important. Foreign investment is the contribution of foreign capital to the assets of national companies. This can be done both in cash and in commodity form. Foreign investment is what helps to stabilize the country's economy and contributes to its growth. Classification of foreign investments

The financial resources of the company are short-lived, so it is very difficult to replenish them by attracting various loans and borrowings. This is influenced by a high rate of profit and a low level of taxation. Failure of fixed production assets should not exceed 25% of production capacity. In 2006 it was 50%. Therefore, in order to ensure the reproduction process, the volume of investment annually must range from 100 to 170 million dollars. There are a number of advantages of attracting foreign investment to the country: 1) the possibility of obtaining additional financing for large investment projects; 2) transfer of experience accumulated by the investor country in the world market; 3) stimulation of the development and growth of domestic investment; 4) gaining access to the latest technologies and methods of organizing production; 5) assistance in resolving the financial difficulties of the country. On the territory of the Russian Federation, investments of foreign capital in objects of entrepreneurial activity are carried out on the basis of the Federal Law of July 9, 1999 No. 160-FZ "On Foreign Investments in the Russian Federation". A foreign investor can be: foreign legal entities, organizations that are not legal entities, citizens permanently residing abroad, as well as foreign states. Foreign investments in Russia can be made by: 1) equity participation in enterprises together with citizens of the country; 2) creation of new enterprises owned by foreign investors; 3) acquisition of property and securities; 4) obtaining rights to use land and natural resources; 5) conclusion of agreements providing for other forms of application of foreign investments. Foreign investments are divided into: direct, portfolio, etc. Direct foreign investments are investments that provide for long-term relationships between partners. Foreign direct investment is more than just financing of capital investment in the economy, although it is necessary for Russia. These investments are also a way to increase the productivity and technical level of Russian enterprises. A foreign company brings with it new ways of organizing production, new technologies and direct access to the world market. Influencing the national economy as a whole, foreign direct investment is of paramount importance. Their role is as follows: 1) the ability to expand investment processes, raise and revive the economy; 2) transfer of experience, training in various know-how; 3) stimulation of production investments; 4) assistance in the development of medium and small businesses; 5) elimination of unemployment and increase in the income level of the population. Portfolio foreign investment - the acquisition of rights to future income by investing in shares of foreign enterprises without acquiring a block of shares. In this case, it is not necessary to create new production facilities and control them. Portfolio investment methods: 1) purchase of securities on the market of foreign states; 2) purchase of securities in their country; 3) capital contribution to foreign mutual funds. Portfolio investments differ from direct investments in that they are not tasked with controlling the enterprise. Other investments - loans from foreign financial organizations guaranteed by the government of the borrowing country. This type of foreign investment accounts for more than 57% of total investment. The state guarantees the export of private capital. Insurance of private investors by the state is practiced in many countries. The regulation of foreign investment between countries is carried out by the conclusion of international treaties. There are a number of reasons why it is difficult to attract foreign capital in Russia today: 1) the lack of a stable legal framework makes it difficult to regulate the activities of foreign investors; 2) deterioration in the material situation of the majority of the population; 3) active growth of corruption and crime in entrepreneurial activity; 4) underdeveloped infrastructure, including transport, communications, communication system, hotel service; 5) unstable political situation; 6) high taxes and duties. But Russia may be of interest to foreign investors: 1) rich and inexpensive natural resources; 2) young highly qualified and quickly trained personnel; 3) large domestic market; 4) cheap labor force; 5) possibility of participation of foreign investors in privatization; 6) quick superprofit. With the right use of opportunities, Russia can come out on top among other Western European countries. Official policy is to support foreign direct investment, but for the reasons described above, foreign companies find it very difficult to invest in the Russian economy. The ranking of the countries of the world community according to the investment climate index or its inverse risk index is a generalizing criterion for the investment attractiveness of a country and a criterion for foreign investors. Today in Russia the legal conditions for the activity of foreign investors are critical in comparison with other countries. The government is currently working on amendments to the Foreign Investment Law. It is planned to exempt organizations with foreign investment from paying import duties and taxes on the necessary production materials and give them the right to own land when creating new enterprises. Thanks to this, investments from abroad should be more promising. 3. Ways and measures to attract foreign investment Attracting investments (both national and foreign) to the Russian economy is a necessary means of eliminating the investment "hunger" in the state. An important point is the insurance of investments against non-commercial risks. Russia's accession to the Multilateral Investment Guarantee Agency (MIGA), which insures activities against political and other non-commercial risks, is an important step in this area. Rules and laws should provide a guarantee of their application to the activities of potential investors. The legal regime in Russia is unstable, as it is in a stage of constant reform. The state's need for foreign investment amounts to 10-12 billion dollars per year. Although, in order for foreign investors to make such investments, very significant changes in the investment climate are needed. In the near future, the legal framework for the functioning of foreign investment will have to be improved through the adoption of the latest editions of the Law on Investments, the Law on Free Economic Zones and the Law on Concessions. Legislative definition of land ownership rights will also be of great importance. In order to facilitate foreign investors' access to information on the situation in the Russian investment market, the State Information Center for Investment Promotion was created, which organized a bank of proposals from the Russian side on investment objects. To improve the investment climate and stabilize the economy, a number of significant measures are required, which are aimed at creating both general conditions for the development of civilized market relations in the country, and specific ones directly related to solving the issue of attracting foreign investment. The primary measures of a general nature are: 1) achievement between various structures of power, political parties and other public organizations of national consent; 2) speeding up the work of the State Duma on criminal legislation and the Civil Code, the purpose of which is to create a civilized non-criminal market in the country; 3) radicalization of the fight against crime; 4) limiting the rate of inflation by all measures known in world practice, with the exception of non-payment of salaries to workers; 5) revision of tax legislation in the field of production stimulation, as well as its simplification; 6) mobilization of free funds of the population and enterprises for investment needs by increasing interest rates on deposits and deposits; 7) introduction in the construction of a system of payment for objects for the final construction products; 8) launching the bankruptcy mechanism provided for by law; 9) the provision of tax incentives to banks, foreign and domestic investors who make long-term investments in order to fully compensate them for losses from a very slow turnover of capital compared to other areas of their activity; 10) formation of a common market with free movement of goods, capital and labor in the republics of the former USSR. Among the measures to enhance investment should be noted: 1) urgent consideration and adoption by the Duma of a new law on foreign investment in Russia; 2) adoption of laws on concessions and free economic zones; 3) creation of a system for receiving foreign capital, which includes a competitive and wide network of state institutions, commercial banks and insurance organizations that insure foreign capital against commercial and political risks, information and intermediary centers that are engaged in the selection and ordering of relevant projects for Russia, the search for investors, interested in their implementation and prompt execution of turnkey transactions; 4) creation in Russia in a short time of a national system for monitoring the investment climate; 5) development and adoption of a program to strengthen the ruble exchange rate and transition to its full convertibility. These measures significantly help inflow of foreign and national investments. Author: Maltseva Yu.N. << Back: Characteristics and economic essence of investments (Forms and methods of state regulation. Profit as a source of investment. Regulatory and legal support for investment activities) >> Forward: Investment project (Types and life cycle of an investment project. Development of an investment project)

The existence of an entropy rule for quantum entanglement has been proven

09.05.2024 Mini air conditioner Sony Reon Pocket 5

09.05.2024 Energy from space for Starship

08.05.2024

▪ ASRock H510 Pro BTC + motherboard ▪ 31" monitor LG 31MU95 with a resolution of 4096x2160 pixels ▪ A camera that works like the retina of the human eye

▪ section of the site Metal detectors. Article selection ▪ article by Walter Raleigh. Famous aphorisms ▪ article Which writer got the stone that lay on Gogol's first grave? Detailed answer ▪ Telegrapher article. Standard instruction on labor protection ▪ Article Spoon Bending. Focus secret

Home page | Library | Articles | Website map | Site Reviews www.diagram.com.ua |

Arabic

Arabic Bengali

Bengali Chinese

Chinese English

English French

French German

German Hebrew

Hebrew Hindi

Hindi Italian

Italian Japanese

Japanese Korean

Korean Malay

Malay Polish

Polish Portuguese

Portuguese Spanish

Spanish Turkish

Turkish Ukrainian

Ukrainian Vietnamese

Vietnamese

See other articles Section

See other articles Section