|

|

Lecture notes, cheat sheets

Investments. Lecture notes: briefly, the most important

Directory / Lecture notes, cheat sheets Table of contents

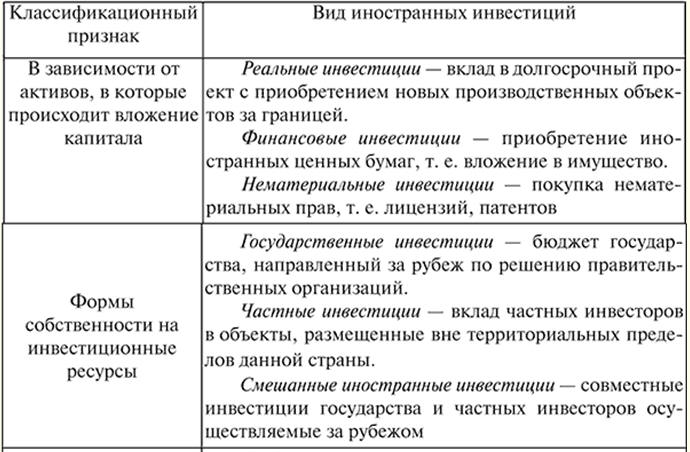

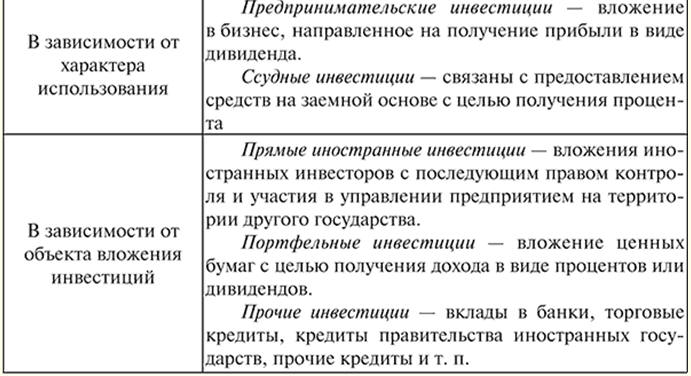

LECTURE No. 1. Essence, definition, classification and types of investments 1. Essence and definition of investments Investment - this is an investment of the capital of the subject in something to subsequently increase their income. A necessary link in the process is the replacement of worn-out fixed assets with new ones. At the same time, the expansion of production can be carried out only through new investments aimed not only at creating new production capacities, but also at improving old equipment or technologies. This is what makes the economic sense of investment. Investments are considered as a process that reflects the movement of value, and as an economic category - economic relations associated with the movement of value invested in fixed assets. Totality of costs - this is a long-term investment of capital in various areas of the economy, implemented in the form of a targeted investment of capital for a certain period in various industries and sectors of the economy, as well as in business and other types of activities to generate income. The very concept of "investment" means capital investments in sectors of the economy, not only at the enterprise, but also within the country and abroad. Investment - this is saving money for tomorrow in order to be able to get more in the future. One part of the investment is consumer goods, they are put aside in stock (investments to increase stocks). But the resources that are directed to the expansion of production (acquisition of buildings, machines and structures) - this is another part of the investment. 2. Classification and types of investments Investments are divided into: 1) intellectual ones are aimed at the training and retraining of specialists in courses, the transfer of experience, licenses and innovations, joint scientific developments; 2) capital-forming - the cost of major repairs, the acquisition of land; 3) direct - investments made by legal entities and individuals who have the right to participate in the management of the enterprise and wholly own the enterprise or control at least 10% of the shares or share capital of the enterprise; 4) portfolio - not giving the right to investors to influence the work of firms and companies invested in long-term securities, the purchase of shares; 5) real - long-term investments in the sector of material production; 6) financial - debt obligations of the state; 7) hoarding - this is the name of investments made with the aim of accumulating treasures. They include investments in gold, silver, other precious metals, precious stones and products made from them, as well as collectibles. A common specific feature of these investments is the lack of current income on them. Profit from such investments can be received by the investor only due to the growth in the value of the investment objects themselves, that is, due to the difference between the purchase and sale prices. For a long time in Russia, the hoarding type of investment represented practically the only possible form of investment, and for many investors it still remains the main way of storing and accumulating capital. Signs investments are: 1) making investments by investors who have their own goals; 2) the ability of investments to generate income; 3) purposeful nature of capital investment in investment objects and instruments; 4) a certain period of investment; 5) the use of different investment resources, characterized in the process of implementation by demand, supply and price. According to the nature of the formation of investments in modern macroeconomics, it is customary to distinguish between autonomous and induced investments. The formation of new capital, regardless of the rate of interest or the level of national income, is called autonomous investment. The emergence of autonomous investments is associated with external factors - innovations (innovations), mainly related to technical progress. Some role in this emergence is played by the expansion of foreign markets, population growth, as well as coups and wars. An example of autonomous investment is the investment of state or public organizations. They are associated with the construction of military and civil structures, roads, etc. The formation of new capital as a result of an increase in the level of consumer spending falls under induced investment. The first impetus to economic growth is given by autonomous investments, causing a multiplier effect, and already being the result of increased income, induced investments lead to its future growth. It would be wrong to associate the growth of national income only with productive investment. Despite the fact that they directly determine the increase in production capacity and output, it should still be noted that this growth is also significantly, although indirectly, influenced by investments in the sphere of non-material production, and the global trend is that their importance in further increase in economic potential increases. Funds held for investment are primarily in the form of cash. There are fixed asset costs that are clearly categorized as either capital costs or ordinary operating costs. Capital costs typically include: 1) additions: new fixed assets that increase production capacity without replacing existing equipment; 2) renewal or replacement of equipment purchased to replace the same fixed assets of approximately the same capacity; 3) improvement or modernization of capital expenditures, leading to the actual replacement or change of fixed assets. Production costs include: maintenance and repair, depreciation, insurance, taxes, property. Investments are made through lending, direct cash outlays, and the purchase of securities. From a financial point of view, the purpose of capital investment analysis is to avoid unnecessary capital expenditures through appropriate planning and budgeting of capital expenditures. This requires: constant updating of the means of production, identifying the need to replace or improve equipment. Don't wait, even if it can work for a few more years, the final wear and tear of fixed assets can be dangerous. It is extremely important to have funds in order to finance capital expenditures without jeopardizing the long-term financial plans of the enterprise. Investment resources are all produced means of production. All types of tools, machines, equipment, factory, warehouse, vehicles and distribution network used in the production of goods and services and their delivery to the final consumer. Investment goods (means of production) are different from consumer goods. The latter satisfy the needs directly, while the former do it indirectly, providing the production of consumer goods. When referring to the money that is used to purchase machinery, equipment, and other means of production, managers often speak of "money capital." Real capital is an economic resource, money or financial capital, machinery, equipment, buildings and other productive capacities. In fact, investments represent the capital by which wealth is multiplied. Investments are classified: 1) in terms of investments: a) real; b) financial; 2) by investment period: a) short term b) medium-term; c) long-term; 3) for the purpose of investment: a) straight lines; b) portfolio; 4) in terms of investments: a) production; b) non-production; 5) by forms of ownership of investment resources: a) private; b) state; c) foreign; d) mixed; 6) by region: a) inside the country; b) abroad; 7) by risk: a) aggressive; b) moderate; c) conservative. According to the terms of investments, short-, medium- and long-term investments are distinguished. For short-term investments, investment of funds for a period of up to one year is typical. Under medium term investments understand the investment of funds for a period of one to three years, and long-term investments are invested for three or more. According to the forms of ownership, private, state, foreign and joint (mixed) investments are distinguished. Under private (non-state) investments understand the investment of private investors: citizens and enterprises of non-state ownership. Public investment - these are public investments carried out by authorities and administrations, as well as enterprises of the state form of ownership. They are carried out by central and local authorities and administration at the expense of budgets, extra-budgetary funds and borrowed funds. The main investments include investments of foreign citizens, firms, organizations, states. Under own (mixed) investments understand the investments made by domestic and foreign economic entities. On regional distinguish between investments within the country and abroad. Domestic (national) investment includes the investment of funds within the country. Investments abroad (foreign investments) are understood as investments of funds abroad by non-residents (both legal entities and individuals) in objects and financial instruments of another state. Joint investments are carried out jointly by the subjects of the country and foreign states. On a sectoral basis, investments are distinguished in various sectors of the economy, such as: industry (fuel, energy, chemical, petrochemical, food, light, woodworking and pulp and paper, ferrous and non-ferrous metallurgy, mechanical engineering and metalworking, etc.), agriculture, construction , transport and communication, wholesale and retail trade, public catering, etc. Investments made in the form of capital investments are divided into gross and net. Gross investment - are used to maintain and increase fixed capital (fixed assets) and stocks. They are made up of depreciation, which is the investment resources necessary to compensate for the depreciation of fixed assets, their repair, restoration to the previous level that preceded production use, and from net investment, i.e. capital investment in order to increase fixed assets for the construction of buildings and structures , production and installation of new, additional equipment, renovation and improvement of existing production facilities. At the micro level, investment plays a very important role. They are necessary to ensure the normal functioning of the enterprise, a stable financial condition and an increase in the profits of an economic entity. A significant part of the investments is directed to the socio-cultural sphere, to the branches of science, culture, education, health care, physical culture and sports, computer science, environmental protection, for the construction of new facilities in these industries, the improvement of the equipment and technologies used in them, and the implementation of innovations. There are investments in people and human capital. This is an investment primarily in education and health care, in the creation of funds that ensure the development and spiritual improvement of the individual, the strengthening of people's health, and the extension of life. The effectiveness of the use of investments largely depends on their structure. The structure of investments is understood as their composition by types, by direction of use, by sources of financing, etc. Profitability - this is the most important structure-forming criterion that determines the priority of investments. Non-state sources of investment are aimed at profitable industries with a fast capital turnover. At the same time, sectors of the economy with low profitability of invested funds remain not fully invested. Overinvestment leads to inflation, while underinvestment leads to deflation. These extremes of economic policy are managed by an effective strategy in the areas of taxes, public spending, monetary and fiscal measures implemented by the government. In the system of reproduction, regardless of its social form, investments play the most important role in the renewal and increase of productive resources, and, consequently, in ensuring certain rates of economic growth. In the representation of social reproduction as a system of production, exchange and consumption, investments relate to the first stage of production and constitute the material basis for its development. 3. Real and financial investments Financial investments are the purchase of securities, and real investments are capital investments in industry, agriculture, construction, education, etc. With real investments, the main condition for achieving the intended goals is the use of relevant non-current assets for the production of products and their subsequent sale. This includes the use of the organizational and technical structures of a newly formed business to withdraw profits in the course of the statutory activities of an enterprise created with the attraction of investments. Financial investments represent an investment of capital in various financial investment instruments, mainly securities, in order to achieve the set goals of both a strategic and tactical nature. Investing in financial assets is carried out in the course of the enterprise's investment activity, which includes setting investment goals, developing and implementing an investment program. The investment program involves the selection of effective financial investment instruments, the formation and maintenance of a portfolio of financial instruments balanced by certain parameters. Setting investment goals is the first and determining all subsequent stages of the financial investment process. Financial investments are divided into strategic and portfolio. Strategic financial investments should help to realize the strategic goals of the enterprise development, such as expanding the sphere of influence, sectoral or regional diversification of operations, increasing market share by "capturing" competing enterprises, acquiring enterprises that are part of the vertical technological chain of production. Therefore, the main factor influencing the value of the project for such an investor is the receipt of additional benefits for its main activity. Therefore, strategic investors are mainly enterprises from related industries. Portfolio financial investments are made with the aim of making a profit or neutralizing inflation as a result of the effective placement of temporarily free cash. Investment instruments in this case are profitable types of monetary instruments or profitable types of stock instruments. The latter type of investment is becoming more and more promising as the domestic stock market develops. From the financial manager in this case requires a good knowledge of the composition of the stock market and its instruments. Financial investments include investments: 1) in shares, bonds, other securities issued by both private enterprises and the state, local authorities; 2) in foreign currencies; 3) in bank deposits; 4) in objects of hoarding. Financial investments are only partially directed to increase real capital, most of them are unproductive investment of capital. In a market economy, the structure of financial investment is dominated by private investment. Public investment is an important instrument of deficit financing (the use of public borrowing to cover budget deficits). Investing in securities can be individual and collective. Individual investment is the acquisition of government or corporate securities at the initial placement or on the secondary market, on the stock exchange or over the counter market. Collective investment is characterized by the acquisition of shares or shares of investment companies or funds. Investing in securities offers investors the greatest opportunities and the greatest diversity. This applies to all types of transactions carried out in transactions with securities, as well as the types of securities themselves. All over the world, this type of investment is considered the most affordable. Investing in foreign currencies is one of the simplest types of investment. It is very popular among investors, especially in a stable economy and low inflation. There are the following main ways of investing in foreign currency: 1) purchase of cash currency on the currency exchange; 2) conclusion of a futures contract on one of the currency exchanges; 3) opening a bank account in foreign currency; 4) purchase of cash foreign currency in banks and exchange offices. The absolute advantages of investing in bank deposits are the simplicity and accessibility of this form of investment, especially for individual investors. Financial investments, acting as a relatively independent form of investment, at the same time are also a link on the way to converting capital into real investment. Since joint-stock companies are becoming the main organizational and legal form of enterprises, the development and expansion of production of which is carried out using borrowed and borrowed funds (issue of debt and business securities), financial investments form one of the channels for capital inflow into real production. When establishing and organizing a joint-stock company, in the event of an increase in its authorized capital, new shares are first issued, followed by real investments. Thus, financial investments play an important role in the investment process. Real investments are impossible without financial investments, and financial investments receive their logical conclusion in the implementation of real investments. Real investments include investments: 1) in fixed capital; 2) into inventories; 3) into intangible assets. In turn, investments in fixed assets include capital investments and investments in real estate. Capital investments are made in the form of investment of financial and material and technical resources in the creation of the reproduction of fixed assets through new construction, expansion, reconstruction, technical re-equipment, as well as maintaining the capacities of existing production. In accordance with the classification adopted in the world, real estate means land, as well as everything that is above and below the surface of the earth, including all objects attached to it, regardless of whether they are of natural origin or created by human hands. Under the influence of scientific and technological progress in the formation of the material and technical base of production, the role of scientific research, qualifications, knowledge and experience of workers is increasing. Therefore, in modern conditions, the costs of science, education, training and retraining of personnel, and so on, are essentially productive and in some cases are included in the concept of real investment. Hence, in the composition of real investments, the third element stands out - investments in intangible assets. These include: the right to use land, natural resources, patents, licenses, know-how, software products, monopoly rights, privileges (including licenses for certain types of activities), organizational costs, trademarks, trademarks, research and development - design development, design and survey work, etc. 4. Short-term and long-term investments Long-term investments are invested for a period of three or more years, short-term investments for a period of one year or more. Efficient management of all areas of the enterprise's activities ensures successful development in the conditions of reasonable competition. This also directly relates to the complex process of long-term investment. As you know, the correct and rapid implementation of measures in this area allows the enterprise not only not to lose the main advantages in the fight against competitors for retaining the sales market for its products, but also to improve production technologies, and therefore ensure further efficient functioning and profit growth. Within the framework of a single strategic plan, developed in order to ensure the implementation of the general concept, all major management functions are carried out. The importance of strategic planning cannot be overestimated. The management of such areas of activity as production, marketing, investment requires consistency with the overall goal (general concept of development) facing the enterprise. The distribution of resources, relations with the external environment (market knowledge), organizational structure and coordination of the work of various departments in one direction allows the enterprise to achieve its goals and make the best use of available funds. The choice of ways of investment development within the framework of a single strategic plan is not an easy task. Achieving the set goals is associated with the development and implementation of special strategies. Long-term investment strategy is one of them. This is a rather complicated process, since many internal and external factors affect the financial and economic condition of the enterprise in different ways. Evaluation of the effectiveness of capital investments requires the solution of a number of different problems. But the choice of a long-term investment strategy can only be made after thorough research is carried out to ensure the adoption of the optimal variant of management decisions. Such an approach at the first stage of strategic planning forces a broader and more versatile look at the use of various analytical techniques and models that justify the adoption of a specific strategic direction. Recently, the construction of models that contribute to the assessment of the prospects for the investment development of enterprises has become increasingly popular. Modeling allows managers to select the most characteristic properties, structural and functional parameters of the control object, as well as highlight its main relationships with the external and internal environment of the enterprise. The main tasks of modeling in the field of financial and investment activities are the selection of options for management decisions, forecasting priority areas for development and identifying reserves to improve the efficiency of the enterprise as a whole. The use of various kinds of matrices, the construction and analysis of models of the initial factors of systems has gained wide popularity in long-term investment. The production and economic potential means the availability of fixed assets and technologies corresponding to the current level of technical development, a sufficient amount of own working capital, highly qualified management and production personnel, as well as a sufficient amount of own financial resources and the possibility of free access to borrowed funds. There are three indicators on the basis of which the investment strategy is chosen: the production and economic potential of the enterprise, the attractiveness of the market and the characteristics of the quality of the product (works, services). Each of them is a complex indicator. Each specific situation implies a certain line of behavior in long-term investment. If we evaluate them according to common features, such as the volume of capital investments, types of reproduction of fixed assets, time of investment, degree of acceptable risk, and some others, then it is proposed to single out five possible strategies for long-term investment: 1) aggressive development (active growth); 2) moderate growth; 3) improvement at a constant level of growth; 4) curbing recession and developing new products; 5) active conversion or liquidation. The strategy of moderate growth allows enterprises to somewhat reduce the pace of their development and growth in production volumes. Now there is no need to significantly increase your production potential in a relatively short time. If this market has already been formed, then the enterprise, as a rule, should invest in the progressive expansion of its activities, as well as allocate funds to increase its competitive advantages, in particular, to improve the quality characteristics of its products, to the service sector, which will also benefit competitive struggle. LECTURE No. 2. Characteristics and economic essence of investments 1. Forms and methods of state regulation The state regulates investment activity for the development of market relations in the country. The regulatory role of the state increases in a crisis, as well as reforms. Conversely, it weakens when the economy is stable and buoyant. State regulation of investment activity is carried out by state authorities of the Russian Federation in accordance with the Federal Law of February 25.02.1999, 39 No. XNUMX-FZ "On investment activity in the Russian Federation, carried out in the form of capital investments". Forms and methods of state regulation, as well as the procedure for making decisions and conducting an examination of projects, are disclosed in the third chapter of this law. State regulation includes: 1) indirect regulation (regulation of the conditions of investment activity); 2) direct participation of the state in investment activities. The task of indirect regulation is to create favorable conditions for the implementation of investment activities. This regulation has helped to develop various methods of influence that stimulate the development of investment activities. Methods of influence include: protecting the interests of investors, depreciation policy, tax policy and other measures of influence. Favorable conditions for the development of investment activities are carried out by: 1) the establishment of tax regimes that are not of an individual nature; 2) protecting the interests of investors; 3) provision of land and natural resources for use on preferential terms; 4) expanding the construction of social and cultural facilities with a large use of funds from the population or other non-budgetary sources; 5) creation and development of an information and analytical network for ratings; 6) application of antimonopoly policy; 7) expanding opportunities for lending; 8) development of financial leasing in the Russian Federation; 9) revaluation of fixed assets in accordance with inflation rates; 10) assistance in creating their own investment funds. The direct participation of the state in investment activities assists in the implementation of capital investments at the expense of the federal budget. Forms of direct participation are: 1) development and financing of projects implemented by the Russian Federation, as well as those financed from the federal budget; 2) preparation of estimates for the technical re-equipment of facilities financed from the federal budget; 3) provision of state guarantees at the expense of the budgets of the constituent entities of the Russian Federation; 4) placement of funds on the terms of payment, urgency and repayment; 5) securing part of the shares in state ownership, the sale of which through the securities market is possible only after a certain period of time; 6) conducting an examination of investment projects in accordance with the legislation of the Russian Federation; 7) protection of the Russian market from the supply of obsolete energy-intensive and unreliable materials; 8) development of norms and rules and control over their observance; 9) issue of bonded loans; 10) involvement in the investment process of temporarily suspended construction projects and state-owned facilities; 11) provision of funds based on the results of auctions to Russian and foreign investors. The procedure for making decisions regarding state capital investments is determined by Art. 13 of the Federal Law of February 25.02.1999, 39 No. XNUMX-FZ "On investment activities in the Russian Federation carried out in the form of capital investments". Decisions are made in accordance with the legislation of the Russian Federation by public authorities. The federal budget of the Russian Federation provides for expenditures on financing state capital investments. They should be part of the costs for the implementation of federal and regional targeted programs. The Accounts Chamber of the Russian Federation exercises control over the efficient use of funds. All investment projects are subject to expert review prior to their approval. This is carried out regardless of the sources of funding and forms of ownership of the object. An examination is carried out to prevent violation of the rights of individuals and legal entities and the interests of the state, as well as to assess the effectiveness of capital investments. In accordance with Ch. 5 of the Federal Law "On investment activity in the Russian Federation, carried out in the form of capital investments" regulation of investment activity is carried out by local governments. The methods and forms of such regulation are the same as at the federal level. But others can also be used, but not contrary to the legislation of the Russian Federation. 2. Profit as a source of investment All increase in profit is determined by the price factor. Organizations try to make up for the lack of financial resources by increasing the prices of their products. However, higher prices lead to problems with the sale of products, and as a result, leads to a decline in production. This can threaten the bankruptcy of many enterprises. The government is developing measures that will make it easier for firms to generate the necessary financial resources for the development of production, especially since they now represent one of the main sources of capital investment in the economy. However, given the expectation of high inflation and the lack of competition for the market for manufactured products in many industries, the release of resources to finance capital investment does not in itself have an important impact on investment decisions. Rising inflation depreciated the firms' own funds received from depreciation deductions, and this source of capital investment actually devalued. In order to increase the sustainability of such accumulations of enterprises, in August 1992 the government decided to revaluate fixed assets to establish their book value, which would correspond to prices and reproduction conditions. An increase in the cost of depreciation and the fixed assets of organizations in proportion to the rate of inflation gives an increase in the sources of own funds for financing capital investments. Anti-inflationary protection of the sinking fund could become one of the significant measures to increase domestic investment activity through constant indexation of the book value of fixed assets. The sharp increase in the state budget deficit makes it impossible to count on solving investment problems through centralized sources of financing. If budgetary funds are insufficient as a potential source of public investment, the enterprise will be forced to switch to lending instead of non-repayable budget financing. Control over the targeted use of credit benefits will be strengthened. To create guarantees of loan repayment, a system of pledge of property in real estate, for example, land, will be extended. This is stated in the Law of May 29.05.1992, 2872 No. XNUMX-I "On Pledge". Centralized state investments are planned to be directed to the implementation of regional programs, the creation of very effective structural facilities, overcoming the consequences of emergency situations, natural disasters, maintaining federal infrastructure, and solving the most pressing economic and social problems. Attracting public funds to the investment sphere by selling shares of privatized organizations and investment funds is not only a source of investment, but also one of the ways to protect citizens' own savings from inflation. The investment activity of the population can be stimulated by setting higher interest rates on personal deposits in investment banks compared to other banking institutions, attracting monetary resources from the population for housing construction, providing citizens who participate in investing in an enterprise with a certain right to purchase its products at factory price, etc. For the influx of household savings into the capital market, intermediary financial organizations are needed. However, it is necessary to provide protection for those who want to invest their own money in stock values. For this purpose, strict state control is established over organizations claiming to attract funds from the population. The main factor influencing the state of internal opportunities for financing capital investments is financial and economic instability. The savings of enterprises and the population are depreciated due to inflation, which significantly reduces the investment opportunities of these enterprises. However, the lack of domestic investment capacity can be considered relative. 3. Regulatory support of investment activities The regulation of investment activity should be rational in terms of results and balanced in terms of flexibility. This is not possible without the creation of certain legal forms. The law establishes the regulatory framework, determines the position of the subject of investment activity, establishes legal responsibility, determines the various uses of investment activity and controls relations between participants, including with the state. Legal norms have several characters: permissive, prohibitive, binding and stimulating. In a market economy, the main role of economic and legal regulators is to stimulate and direct the investment process for the balanced development of the national economy. Legal regulation of investment activity in the Russian Federation is carried out by two laws. The first is special investment legislation, the second is civil and economic. Investment legislation controls and directs the procedure for attracting domestic and foreign investment. Basic legal acts of general regulation: 1) Civil Code of the Russian Federation; 2) Land Code of the Russian Federation; 3) Tax Code of the Russian Federation; 4) Subsoil law; 5) Law on the Central Bank of the Russian Federation; 6) Law on banks and banking activities; 7) Law on privatization of state and municipal enterprises; 8) legislative acts on taxation, foreign trade activities, etc. Several laws of special regulation: 1) Federal Law of July 9, 1999 No. 160-FZ "On Foreign Investments of the Russian Federation"; 2) Federal Law No. 5-FZ of March 1999, 46 "On the Protection of the Rights and Legitimate Interests of Investors in the Securities Market"; 3) Federal Law of October 29, 1998 No. 164-FZ "On financial lease (leasing)"; 4) Federal Law of July 16, 1998 No. 102-FZ "On Mortgage (Pledge of Real Estate)"; 5) Federal Law of February 25, 1998 No. 39-FZ "On investment activities in the Russian Federation carried out in the form of capital investments"; 6) Federal Law of July 21, 1997 No. 112-FZ "On subsoil plots, the right to use which may be granted under the terms of production sharing"; 7) Federal Law No. 22-FZ of April 1996, 39 "On the Securities Market"; 8) Federal Law of December 30, 1995 No. 225-FZ "On Production Sharing Agreements". Special legal regulation of investment activity is represented by regulatory legal acts, therefore it is of a complex nature. Three levels of normative acts of the regulatory framework for investment activities: 1) legislative: a) supreme legal force - federal constitutional and federal laws; b) international treaties; c) the legislation of the subjects of the federation; 2) by-laws: a) decrees of the President of the Russian Federation; b) intergovernmental resolutions; c) government regulations; d) foreign economic agreements of the subjects of the Russian Federation; e) departmental acts - orders and resolutions of the ministries and departments of the Russian Federation; f) resolutions and decisions of local self-government bodies; 3) local, represented by a system of acts of an individual nature: a) administrative acts of participants in investment activities; b) legal agreements (based on international public and private law, civil and labor law of the Russian Federation). For the subject of investment, it is important to know all the main provisions of the law in order to avoid mistakes that can subsequently lead to poor results. It is necessary to stimulate investment activity due to high investment risks and the high cost of credit resources. The current system of incentives is implemented in the form of tax and customs benefits and is of a fiscal nature. Tax incentives provided by the constituent entities of the federation to investors apply to all taxes that make up the budget of investors. The most common benefits are: 1) on income tax; 2) property tax; 3) transport tax; 4) tax on operations with securities; 5) excises in extractive industries. Previously, benefits were provided cautiously and on a very limited spectrum, recently - almost everywhere and with great variety. This is a peculiar trend on the part of the regional authorities. Basically, the scheme for granting tax benefits by the subjects of the Federation depends on: 1) the amount of investment; 2) the type of activity of the subject; 3) the duration of the provision of benefits; 4) purpose of investments. There are three main directions for the development of the system for stimulating investment activity: 1) provision of budgetary funds to non-state structures on a returnable basis; 2) implementation of the principle of property rights (capital investments are allocated from the federal budget for the development of federal property, and from the municipal budget - for the development of municipal property); 3) equality of investors' rights - guarantees of rights and protection of investments are provided to all investors. Regulations are inherently aimed at providing additional tax incentives and providing budgetary guarantees to investors. To initiate a stable investment recovery, a favorable environment for investment activity is needed, as well as the development of methods and forms of economic regulation that take into account the real investment situation. The role and place of the state in the transitional economy in general and in particular in the investment process is a debatable topic among scientists. Their main goal is to find an answer to the question about the specific role of the state in a market economy. The main task of the state is to create favorable conditions for the growth of private investment while limiting its function as a direct investor. The transitional economic system, disabled, requires more active participation of the state. This is shown by the Russian economic practice of the past decade. The participation of the state is carried out not only in creating a legal basis for the activities of private investors, but also in direct investment to achieve the necessary structural changes. It is impossible to overestimate the special role of public investment. This is the most important lever for modernizing the structure of the national economy, overcoming certain disproportions that have accumulated in the Soviet and post-Soviet periods. LECTURE № 3. Foreign investments 1. Capital outflow In recent years, enterprises and entrepreneurs who have accumulated large capital have appeared in Russia. Large funds are transferred to Western banks due to the unstable economic situation in the country. It was expected that Russia would turn to foreign lenders to finance larger investments as the country acclimatized to market relations. This does not happen, therefore the outflow of monetary resources from Russia is several times greater than their inflow. In 1993, Russia issued larger loans to foreign borrowers than it borrowed itself. Russia's current account surplus (where citizens lend more money than they borrow) was about $10 billion. This increased the investment "hunger" in the country and led to a further weakening of the national currency. A significant part of the funds accumulated by Russian businessmen, under the influence of the risk of a possible social explosion, with inflation and the continuous fall of the ruble, is transferred to Western banks or used to purchase securities and real estate. The Russian economy is too unstable for long-term investments. In this regard, enterprises use their funds not for capital investment within the country, but for issuing loans abroad. Exporting companies mostly keep their earnings in foreign bank accounts instead of being in Russia and channeling them into new investments. This process, known as capital flight, is illegal in most cases. Still, it is much safer to invest capital in a foreign bank with a stable economy than in an unstable Russian economy. The large-scale outflow of foreign currency outside of Russia forced the adoption of organizational and legal measures to strengthen control over the return of foreign exchange earnings to the country. In order for Russian enterprises not to be afraid to invest in the Russian economy, it is necessary to create conditions for reducing investment risk. The magnitude of the risk can be reduced by lowering inflation, the adoption of stable economic legislation based on market potentials. The main sources of capital flight can be both legitimate and illegitimate. Legitimate sources include authorized investments in the economies of other countries as the creation of joint ventures or subsidiaries. The total scale of the outflow of currency cannot be accurately measured, since financial statistics, of course, take into account only their legal part. The technology of carrying out market reforms presupposes consistency. Together with the stimulation of capital inflows, measures should be taken immediately to prevent the outflow of capital abroad. 2. Types of foreign investment Based on effective cooperation between countries, the flow of investment capital is becoming increasingly important. Foreign investment is the contribution of foreign capital to the assets of national companies. This can be done both in cash and in commodity form. Foreign investment is what helps to stabilize the country's economy and contributes to its growth. Classification of foreign investments