|

|

Lecture notes, cheat sheets

State and municipal finances. State extra-budgetary fund (lecture notes)

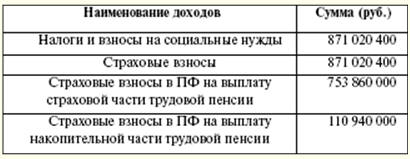

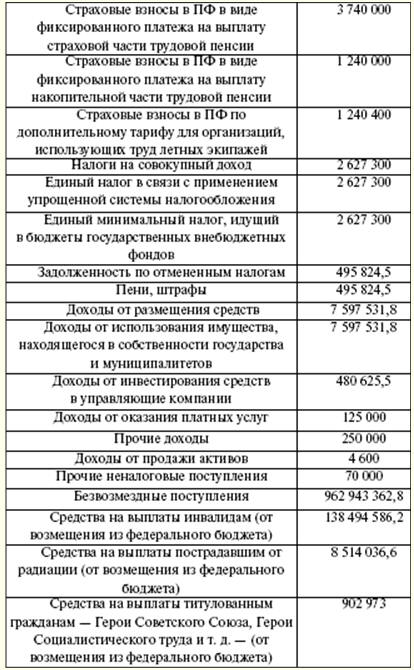

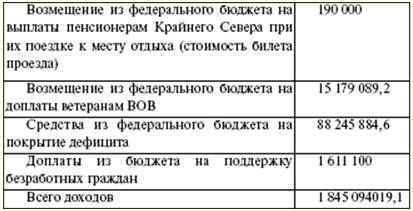

Directory / Lecture notes, cheat sheets Table of contents (expand) LECTURE No. 9. State off-budget fund The date of creation of off-budget social funds was adopted on October 10, 1991, when the Law "On the Fundamentals of the Budget Structure and Budget Process in the RSFSR" was adopted. For the first time, according to this law, pensions and medical care were allocated from the Soviet Union budget to separate state funds. Subsequently, the Law was abolished, and the funds continue to function on the basis of the Budget Code, adopted on July 31, 1998, and other regulatory legal acts. The Fund is a non-profit unit that accumulates financial resources and redistributes them for social, charitable, cultural, educational or other socially useful purposes. State funds are managed by federal and regional authorities and are intended to exercise the rights of citizens to social security in old age, social security in case of illness, disability, in case of loss of a breadwinner, the birth and upbringing of children, material security in case of unemployment, to receive free medical care. These rights are enshrined in the Constitution of the Russian Federation. At present, there are three non-budgetary funds: a pension fund, a social insurance fund, and a mandatory medical insurance fund. Until 2001, there was an employment fund, where employers' contributions were accumulated. The funds of the fund were redistributed to provide support in the field of employment. Now the financing of programs aimed at developing employment is provided by the federal budget. The specificity of off-budget funds is the consolidation of sources of income and their strictly targeted use. State funds are considered to be relatively independent financial and credit institutions. They use the funds received for purposes regulated by the state. It is the state that determines the size and structure of insurance social payments. Funds are formed at the expense of the unified social tax (UST). UST is included in the cost of products, works, services, is calculated from the amount of wages and is subject to monthly deductions. Very often there are cases of concealing the real size of wages, as a result of which the funds and the federal budget receive huge amounts of money. Therefore, the state authorities decided to create a regressive scale for calculating the UST and applying all kinds of benefits for this tax. From an economic point of view, hiding the true size of labor is unprofitable, since the payer cannot reduce taxable income by the real amount of UST. The unified social tax has been put into effect since 2001 by the Tax Code of the Russian Federation (TC RF). UST taxpayers are organizations, individual entrepreneurs, individuals who are not recognized as individual entrepreneurs, lawyers, notaries engaged in private practice. The objects of UST taxation are payments and remuneration accrued by taxpayers in favor of individuals under labor and civil law contracts. For taxpaying organizations, benefits are provided in the form of exemption from paying the UST. These include: 1) organizations of any organizational and legal forms that have employees with disabilities of I, II, III groups. The tax is not paid if, in aggregate, all amounts of salaries and other remuneration during the calendar year do not exceed 100 rubles; 2) public organizations of disabled people, among whose members disabled people make up more than 80%. Similarly to the first case, the amount of all payments should not exceed 100 rubles. in the current tax period; 3) organizations whose authorized capital consists only of contributions from organizations of persons with disabilities. The amount of payments for each working individual should not exceed 100 rubles; 4) institutions of educational, cultural, health-improving, physical culture, sports, scientific, information and other social areas created in favor of the disabled. UST is calculated and paid for each fund. The rate is set at 26%. With the amount of payments in the amount of up to 280 rubles. (cumulatively) the tax distribution is determined by the share distribution between the funds: 1) 20% - to the federal budget; 2) 2,9% - to the Social Insurance Fund; 3) 1,1% - to the Federal Health Insurance Fund; 4) 2% - to the territorial health insurance fund. The taxpayer has the right to apply the regressive scale when calculating the tax. The more payments, the less tax is paid. So, when overcoming the threshold of payments in the amount of 600 rubles. a mixed rate is applied, i.e. absolute and relative values are used: 1) RUB 81 + 280% (of the amount exceeding 2) - to the federal budget; 2) RUB 11 - to the Social Insurance Fund; 3) 5000 rub. - to the Federal Health Insurance Fund; 4) 7200 rub. - to the territorial health insurance funds. The general rate of unified social tax from the amount of payments exceeding 600 rubles is 000 rubles. + 104% from the excess of 800 rubles. Contributions to the pension fund are made separately from the UST and are divided into insurance, basic, funded parts. Each off-budget fund has its own budget, which is filled from legally fixed sources of income and distributed to strictly defined areas. Draft budgets of state non-budgetary funds are compiled independently, then submitted to the legislative bodies for consideration. Accompanying materials and documents are accepted simultaneously with the project. The decision to accept or reject a project is made by the Federal Assembly of the Russian Federation. The consideration process takes place in the third reading of the federal budget. A positive decision in favor of the approved budget of an off-budget fund is fixed by a legislative act. Draft budgets of territorial off-budget funds are submitted by the executive regional authorities for consideration by the legislative bodies of the subjects, are considered together with the draft budget for the next financial year and approved in the form of a legislative act. The budget of the off-budget fund consists of income and expenditure items. Incomes of the state non-budgetary funds are formed at the expense of obligatory insurance payments, voluntary contributions, gratuitously received funds. Expenses of state off-budget funds are determined exclusively by the legislation of federal and regional significance. The execution of the budgets of state off-budget funds is carried out by the treasury. Misappropriation of extrabudgetary funds is a criminal offense. At the end of the financial year, the fund's employees draw up a report on the execution of the budget and, upon submission by the Government, are submitted to the Federal Assembly for consideration. The approval of the budget is of a legislative nature. The Pension Fund of the Russian Federation (PF RF) is the largest of the off-budget social funds. In terms of financial resources, it ranks second after the Federal Fund. The Pension Fund of the Russian Federation was formed during the collapse of the USSR. According to clause 1 of the Regulations on the Pension Fund of the Russian Federation, the Pension Fund of the Russian Federation is an independent financial and credit institution and was established for the purpose of state management of the finances of pension provision in the Russian Federation. In addition, the Pension Fund is recognized as a state institution carrying out pension insurance activities. Fund resources are in federal ownership. According to the legislation, the FIU provides: 1) targeted collection and accumulation of insurance premiums; 2) capitalization of PFR funds, as well as attraction of voluntary contributions to it; 3) control over the receipt of insurance premiums by the PFR; 4) organization and maintenance of personalized records of insured persons; 5) interstate and international cooperation of the Russian Federation on issues of pensions and benefits. PFR funds are used to pay state pensions for old age, for long service, for the loss of a breadwinner, disability pensions, military personnel, material assistance to the elderly, allowances for children under 1,5 years old, allowances for single mothers, pensions for victims of the Chernobyl accident. Payments of state pensions and allowances occupy a huge proportion of the fund's expenditures. Pensions for military personnel, social benefits for burial, expenses for raising pensions for participants in the Great Patriotic War are reimbursed from the federal budget. In addition, the federal budget reimburses the payment of insurance premiums for the period of caring for a child up to 1,5 years, the period of military service. At the same time, the corresponding non-insurance periods will be included in the insurance period of such persons. The amount of federal budget funds allocated for compensation to the Pension Fund of the Russian Federation for each insured person is included in the estimated pension capital of the insured person, from which the insurance part of the labor pension is calculated. The amount of compensation for each insured person is determined as follows. The amount of budget funds for reimbursement is divided by the projected period of payment of labor pension (on average, it is 18 years). This amount goes to the budget of the Pension Fund on a monthly basis. Expenses associated with the reimbursement of non-insurance periods are fixed by laws on the federal budget for the financial year. Table 11 Structure of income and expenses of the Pension Fund for 2007. Pension Fund income

2. FIU expenses

For several years, the reform of the pension system has been going on. In May 1998, a program for the transition from a pay-as-you-go to a mixed pension system was approved. According to forecast calculations of the Ministry of Economic Development, by 2010 an employee will give about 10% of his salary to an accumulation fund. By 2010, the average pension in the country will be 2608 rubles. Until 2010, the distribution system for current pensioners will remain. Pensions will be indexed throughout the period. The transition to the funded system is due to the implementation of the following legislative acts. In the pension system of the Russian Federation, principles have been fixed that guarantee the insured person, upon the occurrence of an insured event, the payment of a pension in an amount proportional to the amount of funds paid for him by the employer. The Federal Law of April 1, 1996 No. 27-FZ "On Individual (Personalized) Accounting in the System of Compulsory Pension Insurance" was put into effect. Since January 2002, all pension contributions have been transferred to an individual account with the Central Bank. The purposes of individual accounting are: 1) creation of conditions for the appointment of labor pensions in accordance with the results of the work of each insured person; 2) ensuring the reliability of information about the length of service and earnings that determine the amount of a labor pension when it is assigned; 3) creation of an information base for the implementation and improvement of the pension legislation of the Russian Federation; 4) development of the interest of insured persons in paying insurance premiums to the Pension Fund of the Russian Federation; 5) creation of conditions for control, together with the tax authorities, over the payment of insurance premiums; 6) information support for forecasting the costs of paying labor pensions, determining the rate of insurance contributions to the Pension Fund of the Russian Federation, calculating macroeconomic indicators for pension insurance; 7) simplification of the procedure and acceleration of the procedure for assigning labor pensions to insured persons. Individual accounting in the mandatory pension insurance system should be based on the following principles: 1) the unity of compulsory pension insurance in the Russian Federation (at all levels of the power structure); 2) universality and mandatory payment of insurance premiums to the Pension Fund of the Russian Federation; 3) availability for each insured person of information on the rules for calculating pensions and other information; 4) compliance of information on the amounts of insurance premiums submitted by each insured, including an individual who independently pays insurance premiums. At the same time, the Tax Code was undergoing changes regarding the size of the tax rates distributed among the funds. On the basis of Federal Law No. 31.12.2001-FZ of December 198, XNUMX "On Amendments and Additions to the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation on Taxes and Duties," there have been changes in the very structure of the social tax. The percentages credited to the Pension Fund were withdrawn from the UST. The size of the UST itself has been reduced. Federal Law No. 17.12.2001-FZ of December 173, XNUMX "On Labor Pensions in the Russian Federation" introduced the main changes relating to the exercise of citizens' rights to labor pensions. On the basis of this law, as noted above, the labor pension should consist of three parts: basic, insurance, funded. The basic part of the labor pension is financed from the federal budget in the process of reimbursement, the insurance part is formed from the amounts of insurance premiums paid by the insured to employees, the funded part consists of the amounts of insurance premiums paid by employers for employees on the funded part of the labor pension, as well as income received from investing these funds in various assets. The procedure for investing pension savings and transferring these funds to non-state pension funds is regulated by two federal laws. 1. Federal Law No. 24.07.2002-FZ of July 111, XNUMX "On investing funds to finance the funded part of labor pensions in the Russian Federation". This law determined the basic rules of relations for investing pension savings, and also established the rights and obligations of the parties responsible for the formation and investment of funds. State bodies under this law act as supervisory authorities. In 2003, the Ministry of Finance was the regulatory and supervisory body in the field of investment of pension funds. In the same period, the functions of regulation, control and supervision in the field of formation and investment of pension funds were transferred to the Federal Commission for the Securities Market. Already by 2004, control and supervision over the formation and investment of the above funds is carried out by the Federal Service for Financial Markets. According to Art. 7 of the Law "On investing funds to finance the funded part of the labor pension in the Russian Federation", the federal executive body performs the following functions: 1) control over compliance by the subjects of relations on the formation and investment of pension savings; 2) adopts, within its competence, regulatory legal acts on the issues of regulation, control and supervision in the field of formation and investment of pension savings; 3) holds tenders for the selection of a specialized depository for concluding an agreement with the Pension Fund of the Russian Federation on the provision of services of a specialized depository; 4) holds tenders for the selection of management companies for concluding trust management agreements with them; 5) send, within its competence, to the subjects of relations on the formation and investment of pension savings, requests for information related to their activities on the formation and investment of pension savings; 6) applies within its competence on issues of conducting inspections of subjects and participants in relations for the formation and investment of pension savings funds to federal executive authorities; 7) issues, within its competence, instructions to the subjects of relations on the formation and investment of pension savings on the elimination of violations of the legislation on the formation and investment of pension savings; 8) considers the reports of the Pension Fund of the Russian Federation on the receipt of insurance premiums for financing the funded part of the labor pension and the direction of investment of pension savings; 9) considers audit reports on the reporting of the subjects of relations on the formation and investment of pension savings; 10) establishes, within its competence and in agreement with the federal executive body, whose competence includes regulation of the activities of the relevant subjects of relations, supervision and control over it, the procedure, forms and deadlines for reporting the subjects of relations on the formation and investment of pension savings, unless otherwise not provided for by law; 11) publish annually in the mass media reports on pension savings and financial results of their investment, as well as audit reports; 12) apply to the court with claims to protect the rights and legitimate interests of the owner of pension savings funds, to eliminate the consequences of violations of the legislation of the Russian Federation and to compensate for harm caused by the subjects of relations on the formation and investment of pension savings funds as a result of violations of the law. In addition to state control by the financial service, public control has been established. Public control over the formation and investment of pension savings is carried out by the Public Council. The Public Council includes representatives of all-Russian associations of trade unions and all-Russian associations of employers. The procedure for the formation of the council is determined by the President of the Russian Federation and Federal Law No. 01.05.1999-FZ of May 92, XNUMX "On the Russian Tripartite Commission for the Regulation of Social and Labor Relations". The structure of the Public Council may include citizens of the Russian Federation from other associations and organizations (organizations of professional participants in the securities market). Where is it allowed to invest pension money? According to the Law, the following investments are allowed: 1) government securities of the Russian Federation issued by the Government; 2) government securities of constituent entities of the Russian Federation circulating on the institutional securities market; 3) bonds of Russian issuers circulating on the institutional securities market; 4) shares of Russian issuers established in the form of open joint stock companies circulating on the organizational securities market; 5) shares of index investment funds investing in government securities of foreign countries; For 2003-2009 restrictions on the share in the investment portfolio of funds placed in securities of foreign issuers are established: a) in 2003 - 0%; b) in 2004-2005 - 5 %; c) in 2006-2007. - ten %; d) in 2008-2009 - fifteen %; 6) mortgage-backed securities circulating on the institutional securities market. 7) cash in rubles on accounts with credit institutions; 8) ruble deposits in credit institutions; 9) in foreign currency on accounts with credit institutions. Pension savings funds cannot be used to purchase securities issued by management companies, brokers, credit and insurance organizations, and to purchase securities of issuers in respect of which pre-trial rehabilitation measures are being carried out or bankruptcy proceedings have been initiated. 2. Federal Law No. 07.05.1998-FZ of 75 "On Non-State Pension Funds". Federal Law No. 75-FZ was amended by Federal Law No. 10.01.2003-FZ of January 14, XNUMX "On Amendments and Additions to the Federal Law "On Non-State Pension Funds". The new version of the law enshrined the powers of non-state bodies in the field of pension insurance. The activities of the fund for non-state pension provision of the fund participants are carried out on a voluntary basis and include the accumulation of pension contributions, the placement and organization of the placement of pension reserves, accounting for the fund's pension obligations, the assignment and payment of non-state pensions to the fund participants. The activities of the fund as an insurer for compulsory pension insurance include the accumulation of pension savings, the organization of investment of pension savings, accounting for pension savings of insured persons, the appointment and payment of the funded part of labor pensions to insured persons. The Fund is endowed with the functions determined by the charter: 1) develop the rules of the fund; 2) conclude contracts on compulsory pension insurance; 3) accumulates pension contributions and pension savings; 4) maintains pension accounts of non-state pension provision and pension accounts of the accumulative part of the labor pension; 5) inform depositors about the amount of accounts; 6) determines the investment strategy when investing pension savings; 7) forms the property intended to ensure the statutory activities; 8) organize the investment of pension savings; 9) takes measures provided for by the legislation of the Russian Federation to ensure the safety of the fund's resources at the disposal of the management company; 10) perform actuarial calculations; 11) appoints and makes payments of non-state pensions to participants; 12) appoints and makes payments of the funded part of the labor pension to insured persons (legal successors); 13) appoints and pays professional pensions; 14) other functions. The main responsibilities of non-state funds should include: 1) planning their activities in accordance with Russian legislation on the pension system; 2) mandatory familiarization of depositors, participants and insured persons with the rules of the fund, enshrined in the charter of this non-profit organization; 3) carrying out its activities on the principles of transparency: keeping open records of its obligations to contributors in the form of maintaining pension accounts for non-state pension provision and pension accounts for the funded part of labor pensions; 4) accounting for reserves of all pension accumulations; 5) providing once a year to contributors, participants and insured persons information on the status of their personalized pension accounts. This duty is linked to the principle of transparency; 6) payment of non-state pensions or redemption amounts in accordance with the terms of the concluded pension agreement between the Fund and contributors; 7) transferring redemption amounts to another fund on behalf of a contributor or participant in accordance with the terms of the pension agreement. An important point in the work of a non-state pension fund is the coordination of decisions jointly with the insured person. In order to ensure its obligations, the fund creates an insurance reserve, which is established by the authorized body of the federal level. According to the provisions of the Law "On Non-State Pension Funds", the placement of pension reserves and the investment of pension savings are based on the following principles: 1) ensuring the safety of these funds; 2) ensuring profitability, diversification and liquidity of investment portfolios; 3) determining an investment strategy based on objective criteria that can be quantified; 4) accounting for the reliability of securities; 5) information openness of the process of placing pension reserves and investing pension savings for the fund, its depositors, participants and insured persons; 6) transparency of the process of placing pension reserves and investing pension savings for state, public supervision and control bodies, a specialized depository, and accountability to them; 7) professional management of the investment process. Funds can place pension reserves on their own, or they can use the services of a management company (there may be several of them). The funds place their pension reserves in government securities of the Russian Federation, bank deposits and other assets, the list is presented above. The main purpose of "holding" pension assets is the preservation of the pension reserve and its growth. If the funds are transferred to the management company, its obligations include the return of the amounts transferred to it. This implies the responsibility of the management company to the Fund. In Russia, there are only a few companies that can ensure the return of reserves. Income received: from investments of pension reserves are spent on the current maintenance of the fund, on investments in the property of the fund, and most importantly, on replenishing the funds of pension reserves. Coverage of expenses related to ensuring the statutory activities of the fund is also carried out through the use of property intended to ensure the statutory activities of the fund, and income received from the placement of pension reserves and investment of pension savings. In developed countries, the retirement age exceeds the Russian one. All Japanese work until the age of 70. In the US, life expectancy is 76,7 years, and the retirement age for citizens is 65. In Italy, men retire at 65 and women at 60. France raised the retirement age to 62,5. In the UK, the retirement age is 65 for men and 60 for women. In Russia, the retirement age comes for men at 60 years old, for women at 55 years old. At the same time, it is proposed to raise the retirement age. In Kazakhstan, the retirement age for women has been raised to 58 years, for men - to 63. This trend is observed in many countries of the former USSR. A distinctive feature of the Danish pension system is the delegation of authority for social security to the municipal level - the commune. Local authorities have the right to provide assistance to their citizens in the form of pensions and benefits. Assistance is issued in the form of bank checks. On public transport, benefits are provided to the weakly protected segments of the population: pensioners, students, children, the disabled, the unemployed. The Folketing, the Danish parliament, reimburses communes for social welfare costs. Denmark is one of the few European countries where social security and health care benefits are provided mostly free of charge. The law on the basis of which there is social assistance has been in force since 1974. In Canada, there is a system of social assistance for pensioners. Programs are being prepared at the federal and regional levels to provide these categories with benefits. They are entitled to free dental care, public transportation, and subsidized housing. The retirement age in Canada is 65. The amount of the pension is quarterly indexed: since July 1, 2006, it has increased by 0,7% and amounted to $466,63 per month. Separately, programs are prescribed to provide Canadian war veterans with pensions and various benefits. Veterans can reimburse the cost of buying clothes, trips to shops, banks, churches, and friends. In addition, benefits are provided in the form of free home care services, medicines, hearing aids and other medical devices. In England the retirement age is 60 for women and 65 for men. The amount of payments does not depend on the length of service and on the level of salary in the past. But British pensioners live off dividends from investments in non-state pension funds. Thanks to this, they can afford good living conditions, expensive medicines, and travel. In the United States, combat veterans have many tax benefits, are entitled to free medical care, have benefits when buying a home, and transportation benefits. In Israel, veterans receive a lifetime pension of $1,5 per month. Victims of terrorist attacks are equated to the category of veterans and receive the same pension. In Germany, more than half of the population are pensioners (this is the second largest number of people over retirement age in the world). The retirement age is 65 years. The average pension for men is 1391 euros, for women - 1115 euros. The budget of the pension system (state and non-state pension funds) is about 220 million euros. The German pension system is distributive and entirely dependent on the length of service and salary of the employee. About 20% of wages are deducted to the pension fund. However, all these funds are not enough to provide for a large category of pensioners. Therefore, there is a procedure for additional payment of part of the pension from the federal budget. There is a possibility of receiving an industrial pension. At the expense of the company's profits, a pension fund is created. After 10 years of work at this enterprise, the employee is already entitled to receive an industrial pension. If a pensioner dies, his wife or minor children can receive his state pension. Such a pension will already be paid in a smaller amount. Another type of pension is private. During working age, a citizen "saves for his retirement" in non-state pension funds. In the US, there is a problem with pensions. Much attention is paid to this problem by the President. We are talking about reforming the social system built on the basis of the 1935 Law on Social Security. The law primarily determines the list of needy categories of the population, types of insurance (retirement by age, pension for dependents, social insurance for the disabled), sources of financing social problems and the degree of responsibility of contributors, and more. The American pension system is pay-as-you-go. Even 50 years ago, 16 working Americans supported one retiree; now there are three workers for one retiree. According to the forecasts of the UN Social Committee, in 20 years in the USA one pensioner will be supported by two workers. As a result, the growing financial responsibility for the maintenance of older citizens falls on the shoulders of the working-age population. The average pension in America is $14 a year. This amount is 200% of the total income of the population. Spread this amount out over 16 workers and each one must contribute $1000 to the National Insurance Fund. Currently, an able-bodied citizen pays $4700. In 20 years, the amount will increase by $2400 to $7100 per year. Not everyone will be able to pay such fees. Already by 2018, the revenues to the National Insurance Fund will not be enough for social benefits. In 2027, the fund's budget deficit will be more than $200 billion. By 2042, pension payments will amount to $10,4 trillion. Doll. The way out of this situation is likely to be an increase in the payroll tax to 18%. Now it is approximately equal to 12%. The solution to this problem is already ready. Citizens born before 1950 will be entirely dependent on state pensions. For them, the social system will be distributive. The able-bodied population younger than 1950 of birth will invest a part of pension contributions into individual investment accounts. The accumulated funds in these accounts can bring additional income if they are invested in profitable industries. However, there is no guarantee of income from investments. The system of individual accounts will be managed by public authorities. At the moment, the system of investing pension funds in non-state funds exists for state federal employees. The premium payment system is as follows: 1) 4% of contributions - the employee pays for individual insurance; 2) 2,2% of contributions - the employer pays for the old insurance system; 3) 6,2% of contributions - the employer pays for the old insurance system from the pay fund. During the first year, each employee will be able to invest no more than $1000 into an individual account. The disadvantage of the new system will be the risks associated with investing in assets. Americans should be prepared for the fact that the size of their pension will be significantly reduced. In Russia, the new model of the pension system involves the calculation of pensions based on the employee's wages in full. The entire work experience of a citizen is taken into account. The development of the domestic pension system is supposed to leave the old distribution model. The same model implies personalized accounting of pension savings and pension obligations of the state. Thus, the modern system of pension relations is mixed. From 2025, the final transition to the accumulative system will take place, and the distribution system will cease to exist. Starting from 2010, pensioners will be able to receive old-age pensions accumulated during their seniority. However, the storage system has both advantages and disadvantages. Therefore, the two systems must exist together, complementing each other. The old system is essentially redistributive between groups with different income levels, and the new pension model involves using wages to calculate pensions. However, the level of salaries is different, and, accordingly, the size of the pension will also differ. The distribution system is based on the principle of generational solidarity. According to the new model, a citizen's funds, gradually accumulating, will be spent only on his pension. On the other hand, the question is raised about citizens who have not accumulated a pension for themselves (low wages, insufficient work experience). This category of citizens will be "thrown" below the poverty line. An important difference between the new pension model and the old one is a completely different pension indexation scheme. A one-year inflation and wage growth forecast will be made. These indicators will form the basis for the budgeting of the Pension Fund and will be taken into account when indexing pensions. In 2007, the average pension was set at 3072,13 rubles. The cost of living for a pensioner is 2133,1 rubles. As you can see, the average pension exceeds the subsistence minimum by almost 30%. The number of people who have reached retirement age in Russia amounted to 39 million people. An innovation of the Benefits Law is a change in the procedure for granting benefits to citizens who are entitled to them. Since last year, a new system of benefits began to operate. Its main principle is the provision of benefits in cash. The functions of paying these amounts are assigned to the Pension Fund of the Russian Federation and its territorial bodies. When the law on the monetization of benefits came into force, amendments were made to replace in-kind benefits with cash. Federal Law No. 22.08.2004-FZ of 122 amended the federal laws "On Veterans", "On the Social Protection of the Disabled in the Russian Federation", "On the Social Protection of Citizens Exposed to Radiation as a Result of the Chernobyl Nuclear Power Plant Disaster", "On state social assistance. The monthly cash payment is established and paid by the territorial body of the Pension Fund of the Russian Federation. According to the law on benefits, if a citizen is entitled to receive a monthly cash payment under several provisions of the law, the monthly cash payment is established according to one of them, which provides for a higher amount. A similar situation develops if a citizen is entitled to receive benefits under several federal laws or regulations. In this case, the citizen must choose which benefit (to which legislative act) to time the cash payment. As early as January 1, 2006, a monthly cash payment, taking into account the cost of a set of social services, is issued to citizens who have refused to receive full or partial social services. The government pays special attention to pensioners - residents of the Far North. Decree of the Government of the Russian Federation of 01.04.2005 No. 176 "On Approval of the Rules for Reimbursing Expenses for Paying Travel Costs to Pensioners Who Are Recipients of Labor Pensions for Old Age and Disability and Living in the Far North and Equivalent Localities, to a Place of Rest on the Territory Russian Federation and vice versa" defines the rules for providing compensation for pensioners living in the Far North. Financing programs in the regions In 2000-2006 The Pension Fund of the Russian Federation financed the programs of spending on helping pensioners, on maintaining the material and technical base of social organizations, on eliminating the consequences of natural disasters, and on gasification of houses. In particular, for assistance in gasification of households of non-working pensioners in 2002-2006. 420,7 million rubles were allocated at the expense of the PFR. For the period 2003-2006. assistance was provided to 35,2 thousand people. For the period from 2000 to 2006. expenses for the celebration of Victory Day were financed in the amount of RUB 1 million. To improve the living conditions of elderly citizens and disabled people in social service institutions, the Fund allocated funds in the amount of 503,9 million rubles to strengthen the material and technical base. The funds were spent on major repairs, the purchase of medicines and equipment. The PF funds financed measures to eliminate the consequences of emergencies and natural disasters. For 2001-2006 Fund funds were allocated in the total amount of 436,8 million rubles, of which 341,1 million rubles were allocated for the provision of targeted social assistance, and 2002 million were spent on the construction of residential buildings for victims of the flood in 95,7 in the Southern Federal District million rubles Last year, payments were made for compulsory health insurance for pensioners. In total, about 11 million rubles were spent for these purposes. More than 165,3 million people received medical care. Table 12 Funding for social programs 2000-2006. in million rubles.

The Social Insurance Fund is a specialized financial and credit institution under the Government. It was formed by Presidential Decree No. 7 of August 1992, 822 "On the Social Insurance Fund in the Russian Federation" and operates on the basis of Government Decree No. 12.02.1994 of February 101, XNUMX. The funds of the Fund are state property. The budget of the Fund is approved by the Government of the Russian Federation, the report on its execution is also considered and approved by this body. Contributions to the Social Insurance Fund (FSS) are deducted from the employee's salary. The amount of payments is included in the cost of products and services. The UST rates for social payments are: 1) up to 280 rubles. - 000%; 2) from 280 rubles. up to 001 rubles - 600 rubles. + 000% from the amount exceeding 8120 rubles; 3) more than 600 rubles. - 000 rubles; For agricultural producers and residents of the Far North, lower rates apply: 1) up to 280 rubles. - 000%; 2) from 280 rubles. up to 001 rubles - 600 rubles + 000% from the amount exceeding 5320 rubles; 3) more than 600 rubles. - 000 rub. Organizations operating in the field of information technology have a lower tax base: 1) up to 75 rubles. - 000%; 2) from 75 rubles. up to 001 rubles - 600 rubles. + 000% from the amount exceeding 2175 rubles; 3) more than 600 rubles. - 000 rub. Organizations-residents of techno-innovative economic zones, lawyers, individual entrepreneurs are exempted from the obligation to pay social benefits. To fulfill its social security obligations, the FSS collects funds from: 1) insurance premiums of economic entities, regardless of the form of ownership; 2) insurance premiums of citizens; 3) income from investing the Fund's funds in government securities and bank deposits; 4) voluntary contributions of citizens and legal entities; 5) receipts from the federal budget for spending funds for certain cases (for example, for payments to victims of the Chernobyl nuclear power plant); 6) other receipts. In accordance with paragraph 6 of Decree of the Government of the Russian Federation of February 12.02.1994, 101 No. XNUMX "On the Social Insurance Fund of the Russian Federation", the following tasks are assigned to the FSS: 1) provision of state-guaranteed benefits for temporary disability, pregnancy and childbirth, for women registered in the early stages of pregnancy, at the birth of a child, for caring for a child up to the age of one and a half years, as well as social benefits for burial or reimbursement of the cost of the guaranteed list funeral services, health resort services for employees and their children; 2) participation in the development and implementation of state programs for the protection of the health of workers, measures to improve social insurance; 3) implementation of measures to ensure the financial stability of the Fund; 4) development, together with the Ministry of Labor and Social Development of the Russian Federation and the Ministry of Finance of the Russian Federation, proposals on the size of the rate of insurance premiums for state social insurance; 5) organization of work on training and advanced training of specialists for the state social insurance system, explanatory work among insurers and the population on social insurance issues; 6) cooperation with similar funds of other states and international organizations on social insurance issues. The Fund's funds are directed to the payment of benefits: 1) due to temporary disability; 2) pregnancy and childbirth; 3) women registered in the early stages of pregnancy; 4) at the birth of a child; 5) upon adoption of a child; 6) to care for a child until he reaches the age of one and a half years; 7) for burial; 8) for additional days of caring for a disabled child until they reach the age of 18; 9) payment for vouchers for employees and their children to health resorts. The Fund's funds are directed to partial payment for vouchers, the maintenance of sports schools, partial payment for vouchers to children's country health camps located on the territory of the Russian Federation for children of working citizens; travel expenses to and from the place of treatment. The Fund's current activities are supported by the Fund's savings. Money is allocated for research work on social insurance issues. The Fund's funds are used strictly for the purposes enshrined in the Regulations on the FSS. It is not allowed to transfer social insurance funds to the personal accounts of the insured. As part of the FSS, a social insurance development fund is formed. It is formed by levying penalties and various fines in the amount of 20%. For 2007, the Management Board of the Fund and the Government of the Russian Federation approved income in the amount of 258 thousand rubles (including 806 thousand rubles for compulsory social insurance) and expenses in the amount of 047,5 thousand . rub. (including 169 thousand rubles for compulsory social insurance). In spending the budget of the FSS, the lion's share is occupied by social payments. Financing of benefits for the protection of citizens exposed to radiation as a result of the Chernobyl disaster, as a result of nuclear tests at the Semipalatinsk test site, as a result of exposure to radiation after the accident at the Mayak production association, is carried out in the amount of 30 thousand rubles. Financing of expenses for providing the disabled with technical equipment and veterans with prostheses is carried out in the amount of 6 thousand rubles. Payment for the cost of vouchers with a stay of no more than 21 days, and for patients with diseases and consequences of injuries of the spinal cord and brain no more than 42 days to sanatorium-and-spa institutions is made in the amount of 7 thousand rubles. RUB 669 thousand will be spent by the Fund on the capital construction of its divisions. A separate article highlights the expenditure of funds for the payment of a monthly allowance for caring for a child until he reaches the age of one and a half years. The amount of these payments depends on the category of eligible parents. For citizens who are not subject to compulsory social insurance, 12 thousand rubles will be allocated from the FSS budget. For citizens exposed to radiation and falling under the articles of the Law "On State Benefits to Citizens with Children", payments in the amount of 243 thousand rubles will be provided. Significant amount RUB 3 thousand will be used to pay the full cost of the tickets. The list of free vouchers is established by law. As noted above, the tasks of the Foundation include research work in the field of social insurance. 52 thousand rubles were allocated for financing these purposes. Due to interbudgetary transfers, regional authorities can solve the social problems of their citizens locally. For example, since January 1, 2007, the amount of social benefits has increased in the Samara Region. Non-working mothers receive payments for child care in the amount of 1,5 thousand rubles. Those who went to work after maternity leave are paid 40% of earnings (but not more than 6 thousand rubles). Also, since January 1, cash benefits for the maintenance of orphans have increased - up to 4 thousand rubles. for every child. Benefits for the care of the disabled increased to 480 rubles. The regional government is trying to increase the budgetary maintenance of military personnel and other categories that depend on the budget. This year the salaries of state employees were increased by 10%. Author: Novikova M.V. << Back: State control in Russia

▪ Civil law. Parts I, III and IV. Crib

The existence of an entropy rule for quantum entanglement has been proven

09.05.2024 Mini air conditioner Sony Reon Pocket 5

09.05.2024 Energy from space for Starship

08.05.2024

▪ 7nm ARM processor for self-driving cars ▪ The rotation of Mars is accelerating every year ▪ The retina of the eye can withstand jet lag

▪ section of the site Electrician's Handbook. Article selection ▪ article Imitation of the skin of the model. Tips for a modeller ▪ article How fast does hair grow? Detailed answer ▪ article Dactylorhiza spotted. Legends, cultivation, methods of application ▪ article Starter car. Encyclopedia of radio electronics and electrical engineering ▪ article The knots untied themselves. Focus Secret

Home page | Library | Articles | Website map | Site Reviews www.diagram.com.ua |

Arabic

Arabic Bengali

Bengali Chinese

Chinese English

English French

French German

German Hebrew

Hebrew Hindi

Hindi Italian

Italian Japanese

Japanese Korean

Korean Malay

Malay Polish

Polish Portuguese

Portuguese Spanish

Spanish Turkish

Turkish Ukrainian

Ukrainian Vietnamese

Vietnamese

See other articles Section

See other articles Section