|

|

Lecture notes, cheat sheets

State and municipal finances. Interbudgetary relations (lecture notes)

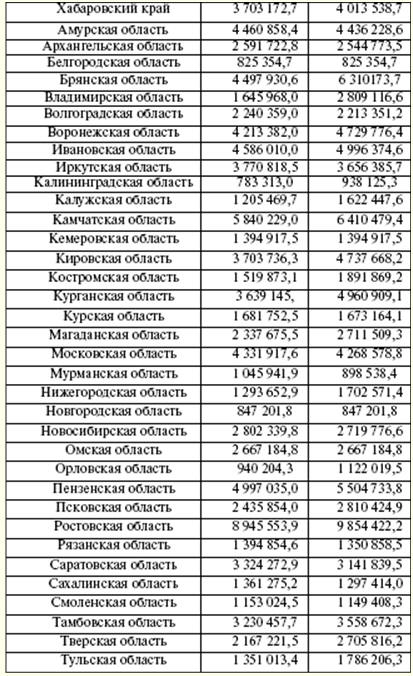

Directory / Lecture notes, cheat sheets Table of contents (expand) LECTURE No. 6. Interbudgetary relations The main approaches to the formation of financial relations between the federal budget and the budgets of the constituent entities of the Russian Federation and municipalities are based on the legislative principles of the Budget Code of the Russian Federation (BC RF), resolutions and orders of the Government, as well as on regulatory legal acts of the constituent entities of the Russian Federation, municipalities. The methods of strengthening budgetary federalism are being improved every year. The reasons for this are the summing up of the past financial year, the forecast of Russia's socio-economic development for the medium term, the annual Message of the President of the Russian Federation to the Federal Assembly of the Russian Federation, and programs for the development of budgetary federalism in the Russian Federation. The main task facing the executive bodies is to bring federal legislation into line with the legislation on the delimitation of powers between state authorities of the Russian Federation, state authorities of the constituent entities of the Russian Federation and local governments. In 2005, Federal Law No. 04.07.2003-FZ of 95 "On Amendments and Additions to the Federal Law" On the General Principles of Organization of Legislative and Executive Bodies of State Power of the Subjects of the Russian Federation "and, in part, the Federal Law of 06.10.2003 No. 131-FZ “On the general principles of organizing local self-government in the Russian Federation””, in accordance with which the relevant amendments to the Budget and Tax Codes of the Russian Federation were prepared. Changes in tax legislation concern the centralization in the federal budget of 6,5% of the corporate income tax rate, the rest, i.e. 17,5%, should be credited to regional budgets. At the same time, regional authorities can independently decide to reduce the income tax rate (but not lower than 13,5%). At the disposal of the central budget remains the enrollment in full of the land tax and revenues from the tax on the extraction of minerals and oil (95% of revenues). The distribution of tax revenues between the levels of the budget system is fixed by the Budget and Tax Codes, since this creates conditions for the introduction of medium- and long-term budget planning, increases the stability and predictability of territorial budget revenues. There has been a significant expansion of the budgetary powers of state authorities of the constituent entities of the Russian Federation and local governments in the formation of expenditures of the corresponding budgets. In accordance with the legislation, the volume and procedure for making payments are determined by the regions and municipalities. After the State Duma approved the legislative initiatives of the Government of the Russian Federation regarding the reduction of the unified social tax rate (from 35,6% to 26%) and the transfer of the bulk of in-kind benefits to certain categories of citizens in cash, the regions received a significant increase in revenues. In addition, there have been changes in the direction of improving the financial position of enterprises in the housing and communal sector and transport organizations, and the transparency of financial support for state obligations to provide benefits has increased. As a result, there was an increase in the resource potential of the regions, and revenues to the budget system of the Russian Federation increased. Distribution of the unified social tax: 1) to the federal budget - 20,0% of revenues; 2) to the budget of the Pension Fund of the Russian Federation - 14,0%; 3) to the budget of the Social Insurance Fund of the Russian Federation - 2,9%; 4) to the budget of the Federal Compulsory Medical Insurance Fund - 1,1%; 5) to territorial compulsory medical insurance funds - 2,0% of receipts. Law No. 131-FZ "On the General Principles of Organizing Local Self-Government in the Russian Federation" provided an opportunity for state authorities of constituent entities and local authorities to independently resolve issues of determining the level of remuneration for workers in the public sector in various industries. Local authorities have gained complete independence from the Federal Center to set the timing and rate of increase in this item of expenditure. An important point in increasing the revenue side of the budget is the monetization of benefits. Benefits for federal civil servants and employees of law enforcement agencies for free travel on all types of public transport in urban, suburban and local communications have been converted into cash. To improve the effectiveness of solving the current problems of territorial budgets, interbudgetary transfers play an important role in terms of funds provided to the budgets of the constituent entities of the Russian Federation and local budgets. Their intended purpose and composition are formed on the basis of federal budget expenditures, taking into account changes in budget and tax legislation. Transfers are made through the Federal Fund for Financial Support of the Subjects of the Russian Federation, the Regional Development Fund, the Regional and Municipal Finance Reform Fund and the Compensation Fund. Forms of interbudgetary transfers provided from the federal budget are determined by the Budget Code of the Russian Federation. These include: 1) budget loan - this is a form of financing budget expenditures, which provides for the provision of funds to legal entities or other budgets on a returnable and reimbursable basis; 2) dotatsyy - these are budget funds provided to the budget of another level of the budget system of the Russian Federation on a gratuitous and irrevocable basis. Subsidies are made from the Federal Fund for Financial Support of the Subjects of the Russian Federation. They are provided subject to compliance by state authorities of the constituent entities of the Russian Federation and local governments with the budgetary legislation of the Russian Federation and the legislation of the Russian Federation on taxes and fees; 3) subvention - these are budget funds provided to the budget of another level of the budget system of the Russian Federation or to a legal entity on a gratuitous and irrevocable basis for the implementation of certain targeted expenditures. Subventions are deducted from the Federal Compensation Fund; 4) subsidy - these are budget funds provided to the budget of another level of the budget system of the Russian Federation, to an individual or legal entity on the terms of shared financing of targeted expenses. They are provided subject to compliance by state authorities of the constituent entities of the Russian Federation and local governments with the budgetary legislation of the Russian Federation and the legislation of the Russian Federation on taxes and fees. The main forms of transfers from the federal budget are budget loans, subsidies, subventions, subsidies. Budget loans from the federal budget are provided for no more than a year. This distinguishes the budget loan from other types of transfers, as it operates on the principles of repayment. The amount of credit is determined when drafting the federal budget. Each entity has the right to acquire this kind of financial income. However, the entities of the entity must have a good credit history. There should not be any debt (for the repayment of an already taken loan, tax deductions, etc.) to the Center. Like any other loan, the budget loan is carried out at interest rates established by the federal law on the federal budget for the next financial year. The problem arises if the provided budget loans are not repaid on time. In this case, the balance of such loans is equalized by subsidies from the Federal Fund for Financial Support of the constituent entities of the Russian Federation, deductions from federal taxes and fees, taxes provided for by special tax regimes and subject to transfer to the budget of the constituent entity of the Russian Federation. State authorities are responsible for the use of budget credits. Thus, the legislation prohibits the transfer of a credit resource from the regional budget to legal entities. Grants are classified as intergovernmental transfers. As part of the federal budget, a special fund for subsidized deductions to the regions is being formed - the Federal Fund for Financial Support of the Subjects of the Russian Federation. The purpose of creating this Fund was to equalize the budgets of the constituent entities of the Russian Federation. The volume of the Federal Fund for Financial Support of the Subjects of the Russian Federation, subject to approval for the next financial year, is determined by multiplying the volume of the said Fund, subject to approval for the current financial year, by the inflation rate forecast for the next financial year (consumer price index). The volume of financial resources of the fund is approved in the second reading, and the distribution of subsidies takes place in the third. The total amount of subsidies from the Fund allocated to the subject of the Russian Federation is determined by the formula: FFPR = U1 + U2 + U3, where FFSR is the total amount of subsidies from the Fund allocated to the subject of the Russian Federation; U1- the amount of subsidies from the Fund allocated to the subject of the Russian Federation at the first stage; U2- the amount of subsidies from the Fund allocated to the subject of the Russian Federation at the second stage; U3- the amount of subsidies from the Fund allocated to the subject of the Russian Federation in special cases. At the first stage, the level of estimated budgetary security for the distribution of subsidies from the Fund is determined (it should not exceed the level established as the first criterion for equalizing the estimated budgetary security). Determined by the formula: U1 = The degree of reduction of the gap between the estimated budgetary sufficiency of the constituent entities of the Russian Federation and the level established as the first criterion for equalizing the estimated budgetary sufficiency is taken equal to 85% . At the second stage, the amount of subsidies from the Fund is distributed among the subjects of the Russian Federation, the level of estimated budgetary security of which, taking into account subsidies from the Fund distributed at the first stage, does not exceed the level established as the second criterion for equalizing the estimated budgetary security, and is determined by the formula: U2 = (the amount of donations from the Fund for the next financial year, excluding the amount of funds defined as additional grants - U2) x The amount of funds required to bring the level of estimated budgetary security of a constituent entity of the Russian Federation, taking into account subsidies from the Fund distributed at the first stage, to the level established as the second criterion for equalizing the estimated budgetary security / The total amount of funds required to bring the level of estimated budgetary security of all subjects of the Russian Federation, taking into account subsidies from the Fund distributed at the first stage, to the level established as the second criterion for equalizing the estimated budgetary provision. The Ministry of Finance of the Russian Federation is obliged to send data to the constituent entities by August 1 of the current financial year to calculate the distribution of funds from the Federal Fund for Financial Support of the constituent entities of the Russian Federation for the next financial year. Until October 1 of the current financial year, the said Ministry reconciles the initial data with the executive bodies of state power of the constituent entities of the Russian Federation. Making any changes to the initial data on the calculation of subsidies from the Federal Fund after October 1 is no longer allowed. After all calculations have been made, the project for the distribution of subsidies from the Federal Fund for Financial Support of the Subjects of the Russian Federation is submitted to the State Duma. Further, as already noted, the draft budget of the Federal Fund is adopted in the third reading of the law on the federal budget in the Federation Council. At the disposal of the Government of the Russian Federation of January 28.01.2005, 80 No. 6-r. the distribution of subsidies by regions is approved. Measures to ensure the balance of budgets are subsidized (Table XNUMX). The Ministry of Finance of the Russian Federation is obliged to send grants to the place of their destination. Table 6

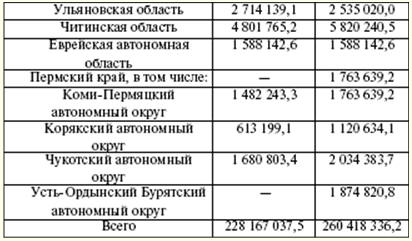

The larger the amount of subsidies, the lower the level of budgetary security observed in the region. The subjects with a minimum level of subsidized income include the Udmurt Republic, the Republic of Khakassia, the Belgorod Region, the Kaliningrad Region, the Murmansk Region, and the Novgorod Region. The rest of the regions are classified as regions with medium and low budget security. The most needy, the so-called recipient regions, include the Republic of Dagestan, the Republic of Sakha, the Altai Territory, and the Chechen Republic. The total increase in subsidy receipts in 2007 compared to 2006 was 13% (increased by 1,3 times). Subsidies are another way to support regional budgets. Transfers of this type are designed to provide equity financing for infrastructure development programs of the constituent entities. In addition, with the help of subsidies from the federal budget, regional authorities form funds for municipal development as part of their budgets. For these purposes, the Federal Fund for Regional Development is being created under the federal budget. The volume of the Fund is approved in the third reading of the law on the federal budget. There is a certain competition between social regional programs, federal targeted programs that apply for co-financing. The selection of the highest priority is carried out in accordance with the legislation and regulatory legal acts of the President of the Russian Federation and the Government of the Russian Federation. The final decision on the provision of subsidies is made after calculating the indicators of the subject's budgetary security. Calculation of indicators is carried out at the last moment, when subsidies have already been distributed. The calculation is based on the analysis of the provision of the subject of the Russian Federation, social engineering infrastructure, investments of investment resources in fixed capital. In accordance with Decree No. 18.08.2005 of August 524, 2005 "On Approval of the Rules for Granting Subsidies from the Federal Regional Development Fund in XNUMX", a subject of the Russian Federation is entitled to receive the Fund's funds if: 1) the level of estimated budgetary security of a constituent entity of the Russian Federation after the distribution of subsidies from the Federal Fund for Financial Support of the constituent entities of the Russian Federation does not exceed the average level for the Russian Federation by more than 10%; 2) the level of provision of a constituent entity of the Russian Federation with social and engineering infrastructure facilities and investments in fixed capital per capita is lower than the average level for the Russian Federation by 60%. For subjects eligible to receive subsidies, the Ministry of Finance of the Russian Federation calculates the share of the subject in the amount of funds from the Federal Regional Development Fund. For this purpose, the formula is used: D = (Our x Hus x I / BO) / (Our x Hus x I / BO), where D - the share of the subject of the Russian Federation in the total amount of the Fund's resources; Оur - the general deviation of the level of provision of a constituent entity of the Russian Federation with social and engineering infrastructure facilities and investments in fixed capital per capita from the average level for the Russian Federation; Чus - the number of permanent population of the subject of the Russian Federation; I - index of budget expenditures of the constituent entity of the Russian Federation; BO - the budgetary security of the subject after the distribution of subsidies. In addition, the level of co-financing of the development of public infrastructure of regional and municipal significance at the expense of the Federal Fund of the regional level is calculated: Us = 0,5 / BO, where Us - the level of co-financing of the development of public infrastructure of regional and municipal significance; 0,5 - the average level of co-financing of the development of public infrastructure of regional and municipal importance. The level of co-financing of the development of public infrastructure of regional and municipal significance at the expense of the Fund cannot exceed 75% of the total funds of the Fund and the consolidated budget of the constituent entity of the Russian Federation provided for the implementation of these goals. Subsidies of federal significance can be directed to the development of social infrastructure facilities (preschool and educational institutions, state municipal health care institutions), as well as engineering infrastructure facilities. In accordance with this, the subjects of the Russian Federation determine measures for the development of engineering infrastructure. At the same time, the implementation of measures should be within a period of no more than three years. Regional authorities must provide information on the amount of funds from the consolidated budget of the subject before a certain date. If the specified information is not submitted before this deadline, the region automatically loses the right to receive subsidies from the Fund. After the 10th day of the month following the reporting period (reports on the use of funds from the consolidated budget for the social needs of the region and municipality are provided to the Ministry of Finance of the Russian Federation), the necessary funds are transferred. However, the Fund has the right to provide financing before the specified period, if the regional authorities co-finance at the expense of the Fund. If the deadlines for financing social development programs are violated, the actions of regional authorities contradict the RF Budget Code, then the flow of funds is suspended. If the violations are not corrected within three months, the given region loses the funds allocated to it, and the withdrawn subsidies are distributed among other regions. The funds received from the Fund can be spent by the entity on the formation of funds to support municipalities as part of its budgets. The further route of funds is the same. Subsidies should be spent on the development of preschool and educational institutions, health care facilities, and engineering infrastructure facilities. In the future, the executive authorities of the subjects should report on the targeted use of the allocated funds. To determine the provision of the subject with objects of social and engineering infrastructure and investments in fixed assets per capita, a special indicator is calculated. This indicator is based on the deviation of the level of provision of the subject with the listed objects from the average of the same indicator in Russia. The overall deviation is calculated based on the data provided by the Federal State Statistics Service regarding deviations in the respective industries. An example of calculating the indicator: Our =ΔD + ΔSH + ΔB+ ΔW + ΔI, where Tsd is the general deviation of the level of provision of a constituent entity of the Russian Federation with social and engineering infrastructure facilities and investments in fixed capital per capita from the average level for the Russian Federation; ΔD - deviation of the level of provision of the subject with preschool institutions from the average level in Russia; ΔSh - deviation of the level of provision of the subject with general educational institutions from the average level in the Russian Federation; ΔB - deviation of the level of provision of the subject with health care institutions from the average level in the Russian Federation; ΔЖ - deviation of the level of provision of a constituent entity of the Russian Federation with engineering infrastructure facilities from the average level for the Russian Federation; ΔI - deviation of the level of provision of the subject of the Russian Federation with investments in fixed assets per capita from the average level for the Russian Federation; The deviation of the level of provision of the subject of the Russian Federation with preschool institutions is determined by the formula: ΔD = (DRF-Dsub) / DRF, where SRF is the coverage of children by preschool institutions on average in the Russian Federation; Dsub - coverage of children by preschool institutions in the constituent entity of the Russian Federation. The formula for the deviation of the level of educational institutions in the region: ΔSh = (ShRF - Shsub) / ΔShRF, where (SRF - the share of the number of students studying in the second shift, in the Russian Federation; Shsub - the proportion of the number of students studying in the second shift in the subject. The formula for the deviation of the availability of healthcare facilities in the constituent entity of the Russian Federation: ΔDB = (BRF - Bsub) / BRF, where BRF is the number of hospital beds per 10 thousand people on average in Russia; Bsub - the number of hospital beds per 10 thousand people in a constituent entity of the Russian Federation. ΔZh = (ZhRF - Zhsub) / ZhRF, where ZhRF is the area of comfortable housing per capita on average in the Russian Federation; Zhsub - the area of comfortable housing per capita in the subject of the Russian Federation. ΔI = (IRF - Isub) / IRF, where IRF is the volume of investment in fixed capital per capita on average in the Russian Federation; Isub - the volume of investment in fixed capital per capita in a constituent entity of the Russian Federation. As you know, Russia has applied for participation in the Winter Olympics. The federal government has developed and implemented the target program "Development of Sochi as a mountain climatic resort (2006-2014)". Since 2006, subsidies have been allocated from the federal budget to ensure the ongoing management of the federal targeted program. The main manager of funds is the Ministry of Economic Development and Trade of the Russian Federation. The direct executor of the program is the federal state unitary enterprise "Joint Directorate of the Federal Target Program". The basis for granting a subsidy is an agreement on the provision of subsidies concluded between the Ministry of Economic Development and Trade of the Russian Federation and the United Directorate. The Ministry of Economic Development and Trade of the Russian Federation transfers to the Joint Directorate the functions of a customer-builder, state capital investments, and financing of program activities. These functions include: 1) functions of the customer-developer for the construction sites and objects of the Program; 2) functions for financing state capital investments; 3) functions to attract a management company on a competitive basis; 4) collection and systematization of statistical information on the implementation of program activities; 5) monitoring the results of program activities; 6) calculation of performance and efficiency indicators for the implementation of program activities; 7) preparation of quarterly reports on the results of the implementation of the federal target program; 8) preparation of a budget request for the next financial year; 9) introduction and ensuring the use of information technologies in order to manage the implementation of the Program and control the progress of program activities. Every quarter, the Ministry of Economic Development and Trade of the Russian Federation, within the established limits, transfers the subsidy from the personal account through the Treasury to the contractor. In 2006, about 5 million rubles were allocated from the federal budget. And in 2007, it is planned to allocate 15 million rubles from the federal budget for these purposes. The directorate submits a quarterly report on the use of subsidies, and the Ministry of Economic Development and Trade of the Russian Federation monitors the proper use of targeted funds. If a violation is discovered, the contractor (directorate) will lose funds. Abnormal weather phenomena that affect the economic life of the country are becoming an urgent topic. In 2006, the federal budget allocated funds to the constituent entities to compensate for damage to agricultural producers due to weather anomalies. During the winter period 2005-2006. many crops of winter crops and perennial fruit plantations perished. Subsidies for these purposes were provided within the limits of budget allocations and limits of budget commitments. The regions affected by the abnormal winter weather had to submit to the Ministry of Agriculture of the Russian Federation documents on the death of plants due to unfavorable agrometeorological conditions. These include the results of an examination on the death of winter crops and perennial fruit plantations. Based on these data, the federal government, represented by the Ministry of Agriculture of the Russian Federation, decides on the allocation of subsidies. The most affected territories were the Republic of Bashkortostan (143 thousand rubles), the Republic of Tatarstan (440 thousand rubles), the Krasnodar Territory (110 thousand rubles). The Ministry of Agriculture of the Russian Federation brings the list of recipients of targeted funds with an indication of the amount for each recipient to the Treasury. Regional authorities must report to the Ministry of Agriculture for the use of subsidized funds. Since 2007, the federal target program “Social development of rural areas until 2010” began to operate. This program provides for the construction of housing for young families and young professionals living and working in rural areas, and the implementation of measures to develop gasification and water supply in rural areas. The distribution of federal budget funds for the above purposes is carried out on the basis of the need of the subject of the Russian Federation for specialists in the agro-industrial and social sphere, taking into account their need for housing; the number of young families in need of better living conditions. Preference is given to those regions that provide a larger contribution to the total volume of agricultural production in the Russian Federation and have a larger budget deficit. Subsidies are allocated to the constituent entities of the Russian Federation only if the necessary regulatory and legal framework in the housing sector exists on their territory. In addition, regional authorities should participate in the equity financing of measures to provide housing for young families and young professionals. The total need of the constituent entities of the Russian Federation for housing for young families and young professionals is defined as the sum of the need for the total area of housing for the listed categories of the population employed in organizations of the agro-industrial complex and the social sphere in the countryside. The need for federal budget funds for the construction of housing for young families and professionals is determined based on the average market value of 1 m2 the total area of housing in rural areas of the subject. This indicator is approved by the Ministry of Regional Development of Russia and adjusted taking into account the specifics of housing construction in rural areas by a factor of 0,75 and an inflation factor. The authorities of the subject must submit an application and a package of documents for obtaining subsidies. The calculation is based on the number of the rural population of a constituent entity of the Russian Federation and the levels of provision with centralized water supply and gasification with natural gas in rural areas. The limit of federal budget funds for the constituent entities of the Russian Federation is determined differently: by the number of permanently resident rural population in the whole of the Russian Federation; the number of permanently resident rural population of the subject of the Russian Federation and the equalization coefficient: L = (Lgod / NRF x Ns) + (Lgod / NRF x Nc) x K, where L is the limit of funds from the federal budget of a constituent entity of the Russian Federation for the development of gasification and water supply in rural areas; Lgod - the annual limit of federal budget funds; НRF - the number of permanent rural population of the Russian Federation; Нс - the number of permanent rural population of another subject of the Russian Federation; K - equalization coefficient. It is used to calculate the limit in case of uneven provision of gasification and water supply in rural areas across the constituent entities of the Russian Federation. This coefficient is determined by the formula: K = (PRF - Ps) / 100, where PRF - the average percentage of provision with water supply and gas pipelines for the rural population of the Russian Federation; Пс- the percentage of provision of the rural population of the subject of the Russian Federation with water supply and gas pipelines. The program continues to operate to reimburse part of the cost of paying interest on investment loans received by agricultural producers in Russian credit institutions in 2006-2007. for up to 5 years. Funds are reimbursed only if the loan money is spent on targeted needs: for the purchase of breeding stock, breeding stock of fish, machinery and equipment for livestock complexes and industrial fishing. Subsidies will be allocated in the following order: 1) 2006-2007 - agricultural producers and organizations of the agro-industrial complex for the purchase of breeding stock, machinery and equipment for livestock complexes; 2) 2007 - to organizations engaged in industrial fish farming, regardless of their organizational and legal form, for the purchase of breeding material of fish, machinery and equipment for industrial fish farming. Target funds are provided to the borrower on the terms of timely repayment and payment of the loan. Interest paid is non-refundable. To receive targeted funds, the borrower submits to the state authority of the constituent entity of the Russian Federation an application for the provision of targeted funds with the attachment of such documents as: 1) a copy of the bank's decision on the readiness to provide a loan to the borrower; 2) a schedule of repayment of the loan and payment of interest on it certified by the bank; 3) a certificate from the tax authority confirming that the borrower has no overdue debts on tax and other obligatory payments. In 2007, the state plans to allocate subsidies among federal budget items: 1) for the introduction of innovative educational programs in state and municipal educational institutions. In total, it is planned to allocate 3 thousand rubles; 2) for monthly monetary remuneration for class leadership in state and municipal educational institutions. In total, it is planned to allocate 11 thousand rubles; 3) for the construction and reconstruction of public roads and artificial structures on them, carried out as part of the implementation of the Federal Targeted Investment Program for 2007 (sub-program "Roads" of the federal target program "Modernization of the transport system of Russia (2002-2010)" ). In 2007, 39 thousand rubles will be allocated; 4) for cash payments to medical personnel of feldsher-midwife stations (heads of feldsher-obstetric stations, feldshers, midwives, nurses, including visiting nurses), doctors, feldshers (midwives) and nurses of institutions and units of emergency medical care of the municipal system healthcare. For these activities, financial resources were allocated in the amount of 11 thousand rubles; 5) for the exercise of powers for primary military registration in territories where there are no military commissariats - 1 thousand rubles; 6) for activities to organize a health-improving campaign for children in 2007 - 1 thousand rubles; 7) for partial reimbursement of expenses of the budgets of the constituent entities of the Russian Federation for the provision of social support measures. For repressed persons, 2 thousand rubles are provided, for veterans - 449 thousand rubles, for children (child benefits) - 936 thousand rubles; 8) for the overhaul of hydraulic structures owned by the constituent entities of the Russian Federation, municipal property, and mismanaged hydraulic structures - 1 thousand rubles; 9) for the construction and modernization of public roads, including roads in settlements (with the exception of federal roads) - 31 thousand rubles; 10) to pay compensation for a part of the parental fee for the maintenance of a child in state and municipal educational institutions that implement the main general educational program of preschool education. The amount of subsidies is provided based on: a) 20% of the average parental fee for the maintenance of a child in state and municipal educational institutions implementing the basic general educational program of preschool education - for the first child; b) 50% of the average parental fee for the maintenance of a child in state and municipal educational institutions that implement the main general educational program of preschool education - for the second child; c) 70% of the average parental payment for the maintenance of a child in state and municipal educational institutions that implement the basic general educational program of preschool education - for the third and subsequent children in the family. In total, 8 thousand rubles were allocated this year. for subsidies. In general, subsidies from the Regional Development Fund in 2006-2007. (Table 7) are distributed by regions as follows. Table 7

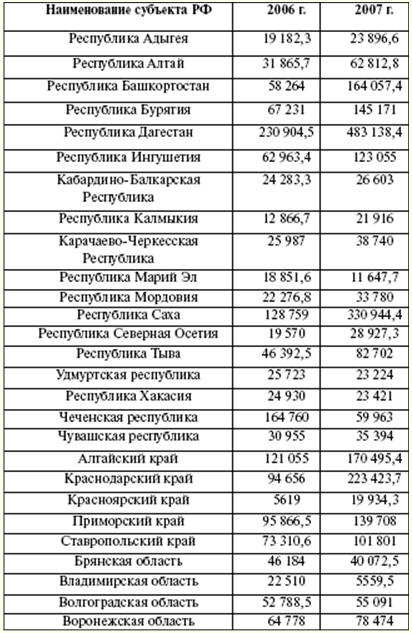

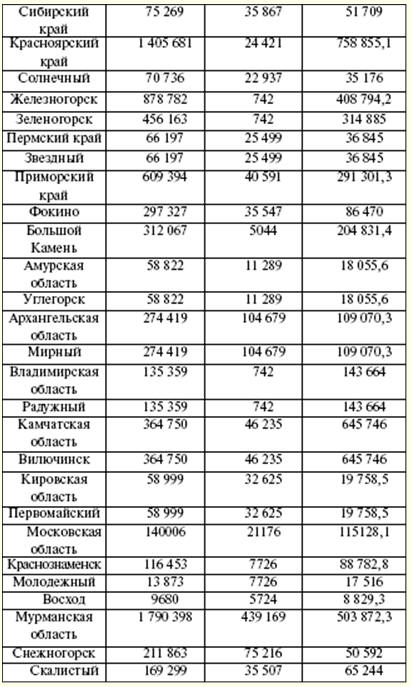

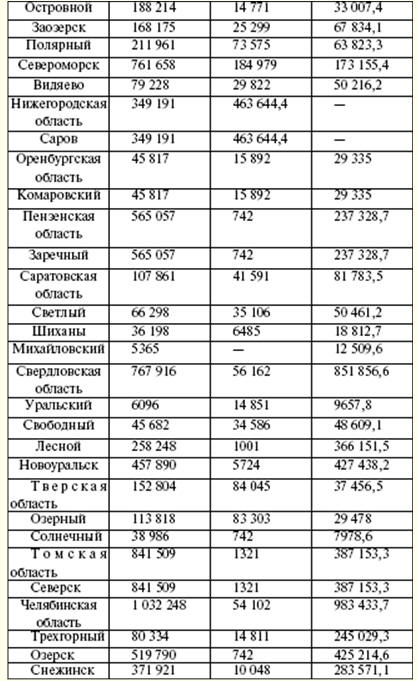

The largest volume of subsidies goes to the regions of the North Caucasus (Republic of Dagestan, Republic of Ingushetia, Rostov region), northern regions (Republic of Sakha, Irkutsk region, etc.), Krasnodar Territory. As can be seen, by and large, there has been an increase in financial resources in 2007 compared to 2006. A sharp jump is noted in the equity financing of the Chita region, the Rostov region, and the Krasnodar Territory. However, the flow of funds to the Saratov Region, the Orenburg Region, the Oryol Region, etc., has decreased compared to 2006. Perhaps this is due to the sufficient provision of the budget of the above-mentioned entities for financing social programs. As already noted, if the state authorities of the constituent entities of the Russian Federation and local governments fail to comply with the conditions for providing interbudgetary transfers from the federal budget, the Ministry of Finance of the Russian Federation has the right to suspend their provision. Subventions are an exception to this rule. This type of transfer comes from the Federal Compensation Fund for constituent entities of the Russian Federation and municipalities. The Federal Compensation Fund is formed as part of the federal budget in order to provide subventions for the fulfillment of spending obligations. Subventions from the Federal Compensation Fund are distributed among the subjects of the Russian Federation in accordance with the methodology approved by the Government of the Russian Federation. The total volume of the Federal Compensation Fund is approved during the third reading of the law on the federal budget. Subventions are credited to the budget of the subject of the Russian Federation and are spent in accordance with the adopted regulatory legal acts of the Government of the Russian Federation. And the subventions provided for the fulfillment of certain expenditure obligations of municipalities are spent in accordance with the regulatory legal acts of the Government of the Russian Federation, the regulatory legal acts of the constituent entities of the Russian Federation. Subventions to municipalities are transported through a regional compensation fund specially created as part of the subject. Subventions from the Federal Compensation Fund are distributed among all constituent entities of the Russian Federation in proportion to the population, consumers of budgetary services, persons entitled to receive transfers to the population, and other indicators, taking into account objective conditions that affect the cost of providing budgetary services. Until August 1 of the current financial year, the Ministry of Finance of the Russian Federation sends the methodology for distributing subventions from the Federal Compensation Fund to the executive bodies of state power of the constituent entities of the Russian Federation. Until October 1 of the current financial year, the data are reconciled (together with the executive bodies of state power of the subjects). After this date, changes to the initial data for calculating the distribution of subventions from the Federal Compensation Fund for the next financial year are not allowed. In 2007, it is planned to allocate subventions from the Compensation Fund for the following purposes: 1) distribution of subventions to the budgets of the constituent entities to increase the monetary allowance for employees and wages for employees of the territorial divisions of the State Fire Service, maintained at the expense of the budgets of the constituent entities of the Russian Federation. In total, 4 thousand rubles were allocated; 2) distribution of subventions to the budgets of the constituent entities of the Russian Federation for the implementation of powers in the field of organization, regulation and protection of aquatic biological resources for 2007. The total amount of subventions allocated to the constituent entities is 46 thousand rubles; 3) distribution of subventions to the budgets of subjects of the Russian Federation to provide subventions to the budgets of closed administrative-territorial formations, subventions for the resettlement of citizens and the development of social and engineering infrastructure to the budgets of closed administrative-territorial formations for 2007 (Table 8). Table 8 Distribution of financial resources for ZATOs

4) distribution of subventions to the budgets of subjects to provide subventions to the budgets of science cities of the Russian Federation for the development and support of social, engineering and innovation infrastructure for 2007; 5) distribution of subventions to the budgets of subjects for financial support of the powers transferred to the executive and administrative bodies of municipalities to compile (change, supplement) lists of candidates for jurors of federal courts of general jurisdiction in the Russian Federation for 2007. In total, it is planned to provide subventions in the amount of 143 thousand rubles .; 6) distribution of subventions to the budgets of the constituent entities of the Russian Federation for the implementation of local development programs and employment for mining towns and villages for 2007. The amount of subsidies is 2 thousand rubles; 7) distribution of subventions to the budgets of the subjects for the implementation of the powers to pay compensation to the disabled for insurance premiums under the contract of compulsory insurance of civil liability of vehicle owners. Total subsidies - 476 thousand rubles; 8) distribution of subventions to the budgets of the constituent entities for the exercise of powers to implement the state policy of employment of the population, including the costs of exercising these powers by the bodies of the employment service of the constituent entities of the Russian Federation. It is planned to allocate 34 thousand rubles for these purposes; 9) distribution of subventions to the budgets of the constituent entities of the Russian Federation to encourage the best teachers for 2007. Total financial resources - 1 thousand rubles; 10) distribution of subventions to the budgets of subjects for the exercise of powers to pay state lump-sum benefits and monthly monetary compensations to citizens in the event of post-vaccination complications. In 2007, 5400 thousand rubles will be allocated; 11) distribution of subventions to the budgets of subjects for the implementation of certain powers of the Russian Federation in the field of water relations. The amount of subventions allocated in the amount of 1 thousand rubles; 12) distribution of subventions to the budgets of subjects for payment of housing and communal services to certain categories of citizens. The figure is 81 thousand rubles; 13) distribution of subventions to the budgets of subjects for the exercise of powers to provide housing for certain categories of citizens (according to the Law "On Veterans"). The total amount of subventions is 5 thousand rubles; 14) distribution of subventions to the budgets of the subjects to provide social support measures for persons awarded the badge "Honorary Donor of the USSR", "Honorary Donor of Russia". It is planned to allocate 3 thousand rubles for these purposes; 15) distribution of subventions to the budgets of the subjects for the implementation of expenses to ensure equal accessibility of public transport services on the territory of the subject for certain categories of citizens. The total amount of subventions is 4 thousand rubles; 16) distribution of subventions to the budgets of the subjects for the exercise of powers related to the transportation between the subjects of the Russian Federation (including within the territories of the states - members of the Commonwealth of Independent States) of minors who have arbitrarily left their families, orphanages. The total amount of subventions is 34 thousand rubles; 17) distribution of subventions to the budgets of subjects for the implementation of powers in the field of forestry. The amount of subventions allocated in the amount of 7 thousand rubles; 18) distribution of subventions to the budgets of subjects for the implementation of federal state registration of acts of civil status. The total amount of subventions is 4 thousand rubles; 19) distribution of subventions to the budgets of subjects for the implementation of powers in the field of protection and use of wildlife objects classified as hunting objects. The volume of subventions in 2007 is 30 thousand rubles; 655,5) distribution of subventions to the budgets of the constituent entities to increase the monetary allowance for employees and wages for employees of police units, maintained at the expense of the budgets of the constituent entities of the Russian Federation and local budgets. The amount is RUB 20 thousand. Regional transfers Regional intergovernmental transfers are provided in the form of: 1) financial assistance to local budgets. This type of interbudgetary transfers exists in the form of subsidies from regional funds for financial support of settlements and subsidies from regional funds for financial support of municipal districts (urban districts), as well as subsidies; 2) subventions to local budgets from regional budget compensation funds, including autonomous regions; 3) funds transferred to the federal budget in connection with the repayment and servicing of the state debt of a constituent entity of the Russian Federation to federal government bodies; 4) budget credits to local budgets. When receiving funds from the budget of the subject, all the rules enshrined in the legislation on taxes and fees are observed. Budget loans from the budgets of subjects are provided on the basis of the absence of overdue debts of municipal bodies to the budget. Another condition that must be fulfilled is the use of the loan only by local authorities and for its intended purpose. Granting credit to legal entities is not allowed. If local governments fail to comply with the conditions for providing interbudgetary transfers from the budget of a constituent entity of the Russian Federation, the body executing the budget of a constituent entity of the Russian Federation has the right to suspend the provision of interbudgetary transfers. Subventions are still an exception to this list. The regional fund for financial support of settlements is formed as part of the budget of the subject in order to equalize, based on the number of residents, the financial capabilities of local self-government bodies of settlements to exercise their powers to resolve issues of local importance. The procedure for the formation of a regional fund for the financial support of settlements and the distribution of subsidies from this fund, including the procedure for calculating and establishing additional standards for deductions from personal income tax to local budgets that replace these subsidies, is approved by the law of the constituent entity of the Russian Federation in accordance with the requirements of the Budget Code of the Russian Federation. The volume of the regional fund for financial support of settlements is approved by the law of the constituent entity of the Russian Federation on the budget of the constituent entity of the Russian Federation for the next financial year. All urban settlements (including urban districts) and rural settlements of a constituent entity of the Russian Federation are entitled to receive subsidies from the regional fund for financial support of settlements. At the same time, the amount of this subsidy is determined for each settlement of the subject based on the number of inhabitants of the settlement per inhabitant. The peculiarity of regional interbudgetary transfers is as follows. When compiling and approving the budget of a constituent entity of the Russian Federation, subsidies from the regional fund for financial support of settlements can be completely or partially replaced by additional standards for deductions to the budgets of settlements from personal income tax. The ratio is calculated as the ratio of the estimated amount of subsidies (part of the estimated amount of subsidies) to a settlement from the regional fund for financial support of settlements to the amount of personal income tax predicted in accordance with a unified methodology to be credited to the consolidated budget of the subject: where H is an additional standard for deductions to the budgets of settlements; V subsidies - the estimated amount of subsidies; Personal income tax forecast - the amount of personal income tax to be credited to the consolidated budget of the subject. If the funds received as a result of the calculation of the additional standard exceed the established amount of the estimated subsidy, they are not subject to withdrawal to the higher budget. In the future, with the subsequent distribution of financial assistance to local budgets, these funds are not taken into account. If the funds received as a result of calculating the additional standard are lower than the estimated subsidy, they are not subject to recovery from the financial support fund for settlements. In the future, with the subsequent distribution of financial assistance to local budgets, these funds are not taken into account. Local self-government bodies may be vested with the powers of state authorities of the constituent entities to calculate and provide subsidies to settlements at the expense of the budgets of the constituent entities of the Russian Federation. When granting subsidies to settlements, a financial support fund for settlements is not created. The subsidies due to settlements are included in the regional compensation fund and are distributed among the budgets of municipal districts. The distribution is based on the number of inhabitants of the territory and is calculated per inhabitant. Subventions received by the budget of the municipal district for the exercise of powers to calculate and provide subsidies to settlements at the expense of the budgets of the constituent entities of the Russian Federation are sent to the district fund for financial support of settlements. The distribution of subsidies is considered when approving the budget of the subject for the next financial year. In addition to the financial support fund for settlements, a regional fund for financial support of municipal districts (urban districts) is formed as part of the subject's budget. The main purpose of the foundation - equalization of the budgetary security of municipal districts (urban districts). The procedure for the formation of the fund is approved by the regulatory legal acts of the subjects in accordance with the legislation of the Russian Federation. The volume of the regional fund for financial support of municipal districts (urban districts) is approved by the law of the constituent entity of the Russian Federation on the budget of the constituent entity of the Russian Federation for the next financial year. Subsidies from the fund are provided to municipal districts (urban districts), the level of estimated budgetary security of which does not exceed the level established as a criterion for equalizing the estimated budgetary security. How is the level of budget security determined? In accordance with the Budget Code of the Russian Federation, the level of estimated budgetary security of municipal districts (urban districts) is defined as the ratio of tax revenues per inhabitant and a similar indicator on average for municipal districts and urban districts of a given subject of the Russian Federation per inhabitant. When determining the indicators, the following factors should be taken into account: the level of development and structure of the economy, the tax base, the structure of the population, socio-economic, climatic, geographical and other factors that affect the cost of providing public services. When redistributing financial resources through the financial support fund for municipal districts, the equality of municipalities should be taken into account. The level of estimated budgetary security of a municipal district (urban district), taking into account subsidies, cannot exceed the level of estimated budgetary security, taking into account the corresponding subsidies, of another municipal district (urban district), which before the distribution of these subsidies had a higher level of estimated budgetary security. When compiling and approving the budget of a constituent entity of the Russian Federation, subsidies from the fund can be replaced by additional standards for deductions to the budgets of municipal districts (urban districts) from personal income tax (PIT). The ratio is calculated as the ratio of the estimated amount of subsidies to a municipal district (urban district) to the projected volume of tax revenues from personal income tax to be credited to the budgets of all levels of the budget system of the Russian Federation for the territory of the corresponding municipal district (urban district). Funds received by a municipal district (urban district) under an additional standard of deductions from personal income tax in excess of the amount of the estimated subsidy are not subject to withdrawal to the budget of a constituent entity of the Russian Federation. Losses of the budget of a municipal district (urban district) in connection with the receipt of funds under an additional standard of deductions from personal income tax in an amount lower than the estimated subsidy are not subject to compensation from the budget of a constituent entity of the Russian Federation. There are other means of financial assistance to local budgets from the budget of the subject of the Russian Federation. These are subsidies. They are provided to local budgets as equity financing for social and economic infrastructure development programs. As part of the budget of a constituent entity of the Russian Federation, a fund for municipal development of a constituent entity of the Russian Federation may be formed. The right to choose the priority of programs is given to regional authorities. In order to provide subsidies to local budgets for equity financing of priority socially significant expenditures of local budgets, a regional fund for co-financing social expenditures may be formed as part of the budget of a constituent entity of the Russian Federation. In addition to the two funds listed above, a regional budget compensation fund for the budget of a constituent entity of the Russian Federation is formed as part of the budgets of the subjects. It is formed in order to financially ensure the execution of certain state powers by local governments at the expense of subventions from the Federal Compensation Fund, own income and sources of financing the budget deficit of the subject. Subventions from the Regional Compensation Fund, which are financed by subventions from the Federal Compensation Fund, are spent in accordance with the procedure established by the Government of the Russian Federation. Local transfers There is a consideration of such forms of interbudgetary transfers provided from local budgets as: 1) financial assistance from the budgets of municipal districts to the budgets of settlements; 2) subventions transferred to regional funds for financial support of settlements and regional funds for financial support of municipal districts (urban districts); 3) subventions transferred from the budgets of settlements to the budgets of municipal districts for resolving issues of local importance of an inter-municipal nature; 4) funds transferred to the federal budget or to the budget of a constituent entity of the Russian Federation in connection with the repayment of municipal debt to federal state authorities or state authorities; 5) other gratuitous and irrevocable transfers. The procedure for providing financial assistance from the budgets of municipal districts to the budgets of settlements Financial assistance from the budget of a municipal district to the budgets of settlements that are part of a given municipal district may be provided in the form of grants from the district fund for financial support of settlements and other grants and subsidies. In order to further equalize the financial capabilities of local self-government bodies of settlements in relation to subsidies from the regional fund for financial support of settlements in exercising their powers on issues of local importance, regional funds for financial support of settlements may be formed as part of the budgets of municipal districts. Subsidies from the regional fund for financial support of settlements are provided to settlements, the estimated budgetary security of which does not exceed the level established as a criterion for equalizing the estimated budgetary security of settlements. The estimated budgetary security of settlements is determined by the ratio of tax revenues per inhabitant that can be received by the budget of the settlement based on the tax base (tax potential), and a similar indicator on average for the settlements of a given municipal district, taking into account differences in the structure of the population, socio-economic, climatic, geographic and other objective factors and conditions affecting the cost of providing municipal services per capita. The procedure for providing subventions from local budgets to the budget of a constituent entity of the Russian Federation It may be envisaged to transfer subventions to the budget of a constituent entity of the Russian Federation from the budgets of settlements or municipal districts (urban districts) in which, in the reporting year, the estimated tax revenues of local budgets exceeded the level established by the law of the constituent entity of the Russian Federation. Subventions from the budgets of settlements, transferred to the budget of the subject, are credited to the regional fund for financial support of settlements. Author: Novikova M.V. << Back: Municipal level budget >> Forward: Features of the budget of the Union State

▪ Correctional psychology. Crib ▪ Psychology of Personality. Crib

The existence of an entropy rule for quantum entanglement has been proven

09.05.2024 Mini air conditioner Sony Reon Pocket 5

09.05.2024 Energy from space for Starship

08.05.2024

▪ Gastronomic preferences of cats ▪ Ford cars will learn to track free parking lots

▪ section of the site Electricity for beginners. Article selection ▪ article Zeus the Thunderer. Popular expression ▪ article Why is there no life on the moon? Detailed answer ▪ Dracaena article. Legends, cultivation, methods of application

Home page | Library | Articles | Website map | Site Reviews www.diagram.com.ua |

Arabic

Arabic Bengali

Bengali Chinese

Chinese English

English French

French German

German Hebrew

Hebrew Hindi

Hindi Italian

Italian Japanese

Japanese Korean

Korean Malay

Malay Polish

Polish Portuguese

Portuguese Spanish

Spanish Turkish

Turkish Ukrainian

Ukrainian Vietnamese

Vietnamese

See other articles Section

See other articles Section