|

|

Lecture notes, cheat sheets

State and municipal finance. Lecture notes: briefly, the most important

Directory / Lecture notes, cheat sheets Table of contents

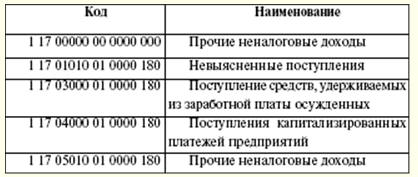

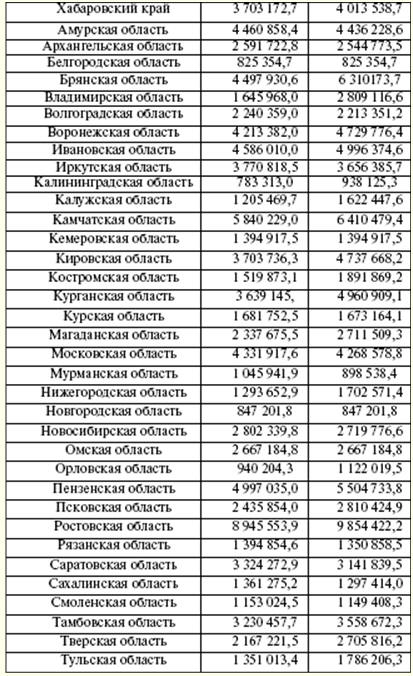

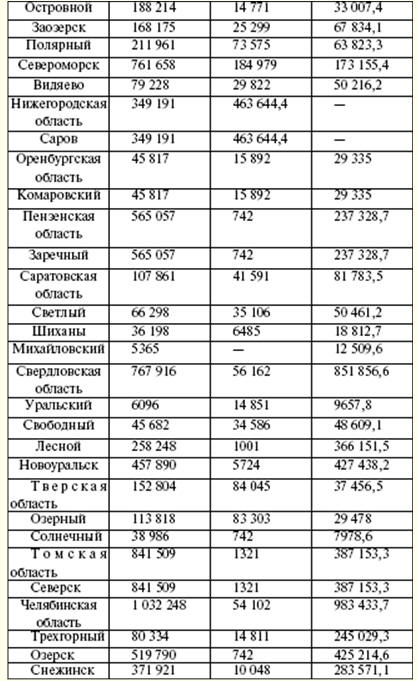

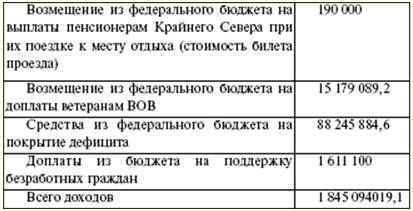

LECTURE No. 1. The essence and history of the emergence of state and municipal finance 1. The essence of finance Finance - this is a system of monetary relations generated and regulated by the state, associated with the redistribution of the value of the gross domestic product, as well as part of the national wealth. With the advent of the state came the financial system. Already under the slave system, the state performed a number of socio-economic functions (such as the maintenance of the army, the protection of public order, the construction of buildings, roads, etc.) and replenished its treasury through taxes in cash and in kind. The merger of the monetary form of tax and the functions of the state itself gave rise to the essence of public finance. State and municipal finance is a set of redistributive monetary relations regulated by the state for the formation and use of cash income necessary to fulfill important strategic tasks. Centralized monetary incomes (funds) include budgets of all levels (state, regional, local), as well as extra-budgetary funds (Federal and territorial compulsory medical insurance funds, Pension Fund, Social Insurance Fund). It is generally accepted that state and municipal finances perform four functions: 1) planning - achieving maximum balance and proportionality of financial resources; 2) organization - the need to determine the procedure for compiling, approving, executing the budget, choosing authorized credit institutions, delimiting the powers of executive and legislative authorities in the budget process; 3) stimulation; 4) control - the need to exercise control in the preparation, approval, execution of the budget. Finance and the financial system were formed at the time of the connection of the state and taxes. Tax taxes ceased to exist in kind and for some time now were collected only in monetary terms. 2. The history of the emergence of state and municipal finance The emergence of financial relations is associated with the process of separating the state treasury from the property of the monarch. Since then, the term "finance" has been used. In the Middle Ages, this term meant income. In European countries closer to the XVIII century. finances included the totality of income, expenses, state debt. Initially, finances were considered as monetary funds. Somewhat later, the concept of "finance" began to include local finance. Thanks to the development of the science of finance, the state began to approach the formation of finance more meaningfully. Finance was considered as a combination of tax collections, property, budgeting and spending on broader purposes. In world practice, there are two theories of the origin of finance: classical and neoclassical. The classical theory implies the dominance of the state over finances. Neoclassicists present a different vision of the financial system. They completely depart from the dominance of the state in all areas, including the allocation of finance as an independent category. The classical theory presents thoughts concerning the tax policy of the state. In this regard, Adam Smith became famous. His merit lies in the development of rules relating to the relationship of the taxpayer and the tax system. In modern tax relations, these rules are also reflected, for example, in the Tax Code of the Russian Federation. A. Smith's rules read: 1) taxes should not harm industry and human freedom; 2) taxes must be fair and equal; 3) taxes must have good reasons; 4) there should not be many cash desks and many tax collectors. Neoclassical theory received its dawn in the middle of the XNUMXth century. A new stage in the development of finance has appeared. The neoclassical approach is applied to the formation of national and international financial relations. The theory is based on four principles: 1) the economic strength of the state, and therefore the stability of its financial system, is largely determined by the economic power of the private sector, which is based on large organizations; 2) minimal government intervention in the private sector; 3) the main available sources of financial development of large corporations are profits and capital markets; 4) due to the internationalization of labor, capital and goods markets, the general course of development of the financial systems of different countries is the desire for integration. This term has been used in Russia since the XNUMXth century. and his interpretation was as follows: "Finance is everything that concerns the income, expenditure of the state" (V. I. Dal). 1802 was marked by the creation of ministries, including the Ministry of Finance. It was in charge of the system of control over income, foreign relations, customs affairs, taxes and fees, etc. The Ministry of Finance consisted of financial and economic collegiums. However, some financial and economic issues remained under the jurisdiction of other institutions: the Ministry of Commerce, the Ministry of Internal Affairs, the State Treasury. According to the functions and powers of the Ministry of Finance of the XVIII-XIX centuries. is the prototype of the modern financial body. The work of the "old" ministry consisted in resolving issues of state lending, determining the sources of income for the state treasury, managing the minting of metal coins and issuing paper money. In addition, the competence of this body included control over the withdrawal and receipt of taxes. The structure of the Ministry of Finance was revised by M. M. Speransky: Minister -> Departments -> Branches -> Tables The Ministry was headed by the Minister of Finance, under which a council and an office were formed. The Ministry itself consisted of departments, branches, tables. Subordination was envisaged in decision-making and in interactions with higher authorities: head clerks reported to department heads, and department heads reported to department directors, who in turn were directly subordinate to the minister. The emperor appointed a minister who was subordinate only to him. Thus, the principle of unity of command lay in the management of the ministries. The structure of the ministries was built according to the French analogy. The Ministry of Finance played an important role in reviewing the "annual" financial reports from other ministries. Further, these reports were promoted to the State Council and to the king himself, along with the developed proposals. When drawing up the budget, the Ministry of Finance had to consider the estimates of each ministry, which were submitted no later than November 15th. In the future, the estimates were reduced to a list of income and expenditure items. In this form, the budget was submitted for consideration to the State Council and then for approval by the sovereign. At present, the consideration and approval of the budget goes the same way: from the ministries to the president. In those days, the distribution of expenses and sources of income in the preparation of the budget were in the strictest confidence. At this stage in the development of budgetary relations, this process is fairly transparent and open. New rules for the compilation, execution and approval of the state painting were adopted in 1862. State paintings became subject to publication. The main principles for the compilation and spending of the treasury proclaimed budgetary unity, a single cash execution, i.e., expenses were made from the cash desks of the State Treasury, where all state revenues were accumulated. When there was a shortage, additional sources of income were sought. This could be an increase in taxes and taxes, the sale of state property and peasants. To address the issues of covering the budget deficit, an interdepartmental Financial Committee was created under the Ministry of Finance. In the structure of the Ministry there was a commission for repayment of debts. Her competence included the examination and resolution of issues to reduce the internal and external public debt. The Ministry of Finance consisted of six departments. These included: the Department of Mining and Salt Affairs, the Department of Miscellaneous Taxes and Duties, the Department of State Property, the Department of Manufactories, the Department of Internal Trade, and the State Treasury. The Department of Miscellaneous Taxes and Duties was in charge of the collection of direct and indirect taxes, and the conduct of censuses of the taxed population. The State Property Department managed state property and state peasants. Mining factories, salt business and the Mint were in charge of the Department of Mining and Salt Business, which included the Mining Institute and the Mining Scientific Committee. Control over the receipt and expenditure of all state funds was carried out by the state expedition of the accounts of the Senate, the Department for resolving old accounts of the former Revision College, and the account expedition of the Department of Water Communications. All structural bodies later merged into the General Directorate for the Audit of Public Accounts. The apparatus of the department consisted of the state controller and two departments (civil, military and maritime reporting). Financial control was of a formal nature and was limited to checking documents, reports and books in St. Petersburg; The Main Directorate did not have independent local bodies. This body partially became the prototype of the modern Accounts Chamber, which, under Russian law, has broad powers. Much worse was the case with monetary relations. Under the feudal system, lending was poorly developed. Almost all banks in the country issued loans only to landlords under serfs. In 1847, the State Commercial Bank was created for the merchant class. Accordingly, this bank issued loans exclusively to the merchants. The Assignation Bank was engaged in issuing banknotes and exchanging them for coins. Serfs were not eligible for loans. The only bank for the middle peasants was the land bank. All of these banks were under the Ministry of Finance. Later, the Council of State Credit Establishments was organized to control the turnover in the banking sector. This body was part of the ministry in question. The State Bank was formed on the basis of the Commercial and Loan Banks. Accordingly, all the balances of the abolished banks were transferred to the newly formed bank. The main activity of the bank is the storage of deposits at interest, the issuance of loans and loans secured by securities and precious metals, the purchase and sale of gold, accounting for bill transactions. Later, the State Bank issued securities. In 1882, the Peasant Land Bank was formed. The basis of his activity was mediation in acquiring land from the nobles and selling it to the kulak. As you know, the bank requested high interest. Not all sections of the peasantry could afford to buy land with a loan. In parallel, another bank was created, which served only nobles and landowners. This bank was called the Noble Land Bank. The main operation of the bank was the issuance of loans secured by land to the nobles. The collapse of the financial system in Russia began with the advent of E.F. Kankrin. Under his leadership in 1839-1843. the currency reform was carried out. As part of the Ministry of Finance, an expedition of state credit notes was established, the function of which was the issuance of credit notes. A little later it was disbanded. The fatal mistake of the minister was the unwillingness to develop lending to industry and the construction of railways. In addition, the formation of a middle class from peasants and philistines was hampered in every possible way. After the war, the state treasury became impoverished. There was a question about the construction of railways, which required huge funds. It was impossible to do this due to the budget. So the government gave the railroad companies large loans, guaranteeing the proceeds of the interest. The budget deficit was artificially covered by the issuance of credit notes and loans. The financial system suffered its final collapse during the war period (during the Crimean War). During the reign of Alexander II, shifts in the socio-economic development of the country were outlined. Industry and trade became important because they ensured the filling of the state budget. Significant moments in Russian history were the Peasant Reform of 1861 and the redemption operation. This entailed the expansion of the state apparatus and an increase in the role of the Ministry of Finance. The "Regulations on the redemption" (February 19, 1861) stated that the management of the redemption operations was entrusted to the St. Petersburg safe treasury. With the growth in the number of redemption cases, the Main Redemption Institution was formed in the structure of the ministry. Two departments were later separated within the Ministry of Finance: the Department of non-salary fees and the Department of salary fees. The creation of departments is associated with the imposition of certain goods with excise duties. In particular, this concerned the production of alcoholic beverages. The Department of Fixed Charges was in charge of excises (drinking, beet sugar) and duties (passport, judicial). At that time, excise taxes were considered the main sources of income for the state budget. The Salary Department was in charge of the system of direct collections and in-kind duties. Created at the beginning of the XNUMXth century. The Ministry of Trade and Industry took over some of the functions of the Ministry of Finance. Later, the role of the Ministry in managing the credit business and foreign loan operations was strengthened. Stolypin's agrarian policy intensified the activities of the Peasants' Bank, which was under the jurisdiction of the Ministry. He received the right to give loans to peasants on the security of allotment lands when moving to new lands. Local institutions of the Ministry of Finance On the ground, the main financial bodies were the Treasury (in the province) and county treasuries. Initially, the treasury was headed by the vice-governor, and then it was decided to appoint the chairman of the treasury. Thus, the functions of control over local finances were transferred to the head of the chamber. The local chambers resolved cases relating to bidding for contracts. This saved the money of the state treasury and made it possible for the development of domestic industry. Around 1811, 1815, 1833, 1850, 1857. audits were carried out, information about which was stored in the economic department of the Treasury. It also controlled state property and affairs related to state peasants. The system of treasury bodies was characterized by state administrative division. The county treasuries were managed by the Treasury department, and the control department carried out internal financial control: revision of the books and annual reports of the treasuries. In 1838, the local Ministry of State Property was formed, which dealt with the management of state property and state peasants. Therefore, the Treasury lost the authority to conduct these cases. County treasuries were subordinate to the Treasury Chamber of the province. The local treasury was responsible for issuing money and keeping fees. At the suggestion of local authorities, county treasuries issued passports and sold stamped paper. The executive body - the local Ministry of Finance included the following institutions: 1) customs districts; 2) customs guards; 3) mining boards; 4) salt offices; 5) manufacturing committee; 6) commercial advice. LECTURE No. 2. The budget system of the Russian Federation The budget system is a set of budgets of different levels, interconnected. The structure of the budget system is based on the form of government. There are two forms of organization of the budget system in terms of public finances. 1. Simple (unitary). Countries with this form represent a single centralized state, consisting of dependent administrative-territorial units (Japan, England, Switzerland, France, etc.). Unitary states have a two-tier budget system: the state budget and local budgets. Thus, the budget system of Japan consists of the state budget, the budgets of 47 prefectures and 3255 municipalities. The French budget system contains the central budget and the budgets of 95 departments, as well as about 38 communes. The state budget is an accumulator of a part of the national income redistributed through the financial system. Large tax revenues are assigned to the state budget, which make it possible to incur expenses for the implementation of socio-economic tasks. In 1960-1970. in Western countries there was a consolidation of municipal administrative units. As a result, the importance of local budgets has increased. For example, in the UK, a reform of local governments was carried out. During the reform there was a division into counties and districts. In addition, smaller administrative divisions such as rural districts and parishes were abolished. The positive aspects of the reform of local self-government bodies were the reduction in the number of local budgets and the increase in their volume. Thus, interbudgetary relations between the state treasury and the budgets of municipal units have become more focused. Local self-government bodies were able to independently regulate many social issues in the area. Local budgets act as "conductors" of the government's financial, economic, and social policy. Although formally local budgets are considered independent of the center, in reality, significant funds are allocated from the general budget in the form of subsidies and targeted subsidies to finance the current expenses of local authorities. In Japan, the relationship between the state budget and local budgets is carried out at the level of subsidizing for the intended purpose (for example, for the construction of hydroelectric power plants). 2. Complex (federal, confederate, imperial). The complex form of the device represents a union of states or territorial entities independent of each other (USA, Canada, Germany, allied states, Russia, etc.). In federal states, there is a three-tier budget system: the budget of the central government, the budgets of the members of the federation, and local budgets. A feature of the federal structure of finance is the independence of each level of the budget and the variety of relationships between these levels. For example, the US budget system includes: 1) the federal budget; 2) the budgets of fifty states; 3) more than 80 budgets of local administrative units: a) 3000 districts; b) 19 municipalities; c) 17 cities and townships; d) 15 school districts; e) 29 special districts. The budget system of Germany consists of: 1) the federal budget; 2) the budgets of 16 lands, including the budgets of the Hanseatic cities; 3) community budgets, including the budgets of associations of communities and districts, etc. The federal budget is the financial basis of the government and plays the leading role. Expenses and incomes of local budgets under a federal structure are not included in the budgets of the members of the federation, and the expenses and incomes of the members of the federation are not included in the federal budget. The federal budget includes basic taxes. US personal income tax and corporate income tax revenues are 60%. The most important expenses are assigned to the federal budget: military, economic, some social, administrative. In the federal budget of Germany there is an item of expenditure related to the country's participation in the EU. The incomes of the budgets of the members of the federation are taxes, proceeds from their property and funds raised through the issuance of loans. The lion's share of revenues to the budgets of the lands are the so-called direct taxes: income tax, inheritance tax, corporate income tax, property tax. The main sources of revenue in the budget of the provinces, for example Canada, are excises, income tax, corporate income tax, payments to social insurance funds. The expenditure of the budgets of the members of the federation is carried out depending on their functions in economic and social activities, the provision of financial assistance to agriculture and individual industries, the maintenance of the administrative apparatus (judicial bodies, police). All levels of the budget chain are closely interconnected. Each state differs in the ways of interaction between the links of the budget system. In the United States, funds from the federal budget go to state and local budgets in the form of subventions. There are the following forms of financial links: blocks and income sharing programs. Blocks include federal subsidies provided to states and local governments. The authorities of the territories have the right to use them in a certain socio-economic sphere (for example, health care, employment, housing construction, etc.). In Germany, funds from the federal budget are transferred to the budgets of the states in the form of subsidies. In turn, the authorities of the lands transfer the corresponding amounts to the communities. In accordance with the Budget Code of the Russian Federation, the budget system of the Russian Federation consists of the budgets of the following levels: 1) the federal budget and the budgets of state off-budget funds; 2) the budgets of the constituent entities of the Russian Federation and the budgets of territorial state extra-budgetary funds; 3) local budgets of municipal districts, urban districts, intra-city municipal formations of federal cities of Moscow and St. Petersburg; 4) budgets of urban and rural settlements. At each level there is a process of development, adoption, execution, control of financial resources of budgets. The federal budget and the budgets of state off-budget funds are developed and approved in the form of federal laws. The budgets of the constituent entities of the Russian Federation and the budgets of territorial state non-budgetary funds are developed and approved in the form of laws of the constituent entities of the Russian Federation. Local budgets are developed and approved in the form of legal acts of representative bodies of local self-government. For all levels, the annual budget is prepared for one financial year, which corresponds to the calendar year. The totality of all budgets in the respective territory constitutes the consolidated budget. The consolidated budget of the Russian Federation includes: 1) the federal budget; 2) a set of budgets of other levels of the budget system of the Russian Federation. The consolidated budget does not include the budgets of state and territorial off-budget funds. Intergovernmental transfers are also not included in this system. The use of the consolidated budget is closely related to the process of budget planning and forecasting. Its quantitative characteristics serve to confirm the reality and validity of the indicators of the federal, regional and local budgets. Summary of budgets - this is a settlement document that reflects the connection (consolidation) of all indicators characterizing the combined budgets. In order to avoid mistakes in the process of consolidation, certain rules are observed for summing up the main budget indicators: income, expenses, deficit (surplus). When determining the final indicators for the set of budgets: 1) it is forbidden to balance budget deficits with surpluses of other budgets (i.e. mutually reduce the deficits of some and surpluses of other budgets as part of the consolidated budget); 2) double counting of transfers is unacceptable, since they are part of the income of one budget and at the same time as an expense in the composition of a higher budget. For the effective functioning of the budget system in Russia, the following principles must be observed (Article 28 of the RF BC): 1) the unity of the budget system of the Russian Federation. This principle implies the unity of the budget legislation of the Russian Federation, forms of budget documentation and reporting, a single procedure for establishing and fulfilling expenditure obligations, generating income and implementing budget expenditures, etc.; 2) differentiation of incomes and expenses between the levels of the budget system of the Russian Federation. The principle of delimitation of revenues and expenditures between budgets means the distribution and assignment of certain types of powers to different levels of government. This principle is primarily associated with the performance of the functions assigned to the authorities; 3) independence of budgets. The principle of independence of the budget includes the right of the authorities to independently form and execute the adopted budget. In addition, state and municipal authorities are responsible for the efficient use of budgetary funds. Regional and municipal authorities have the right to establish taxes and fees as tax revenues to the respective budgets. The independence of the lower budgets is manifested in the independence of the formation of expenditures. In the case when subventions and subsidies for targeted expenses are received from a higher budget, an obligation arises to "spend them on the needs prescribed by the center"; 4) equality of budgetary rights of subjects of the Russian Federation, municipalities. The principle of equality of budgetary rights of subjects of the Russian Federation, municipalities means determining the budgetary powers of government bodies, determining the volume, forms and procedure for providing interbudgetary transfers in accordance with uniform principles and requirements. This principle is also stated in the Constitution of the Russian Federation. The principle of equality of budgetary rights is not always implemented in reality. This is due to the uneven distribution of transfer funds between regions and municipalities; 5) completeness of reflection of incomes and expenditures of budgets, budgets of state non-budgetary funds. The principle of completeness of reflection of incomes and expenses of budgets, budgets of state extra-budgetary funds means that all incomes and expenses of budgets, budgets of state extra-budgetary funds and other mandatory revenues determined by the tax and budget legislation of the Russian Federation, laws on state extra-budgetary funds, are subject to reflection in budgets, budgets of state off-budget funds without fail and in full; 6) budget balance. The principle means that the volume of budgeted expenditures corresponds to the total volume of income; 7) efficiency and economy of the use of budgetary funds. The principle of efficiency and economy in the use of budgetary funds means that when drawing up and executing budgets, authorized bodies and recipients of budgetary funds should proceed from the need to achieve the desired results using the smallest amount of funds or to achieve the best result using the amount of funds determined by the budget. One of the ways to save budget funds is a procurement campaign or tenders; 8) general (aggregate) coverage of budget expenditures. The principle of general (aggregate) coverage of expenditures means that all budget expenditures must be covered by the total amount of budget revenues and receipts from sources of financing its deficit; 9) publicity. The principle of publicity means the availability of information on the course of development, approval, and execution of the budget. Secret articles can only be approved as part of the federal budget; 10) reliability of the budget. The principle of budget reliability means the reliability of indicators for the forecast of the socio-economic development of the relevant territory and the realistic calculation of budget revenues and expenditures; 11) targeting and targeted nature of budgetary funds. The principle of targeting implies the use of budgetary funds for their intended purpose. Target financial resources are allocated for specific budget recipients. Violation of this principle entails violation of the budget legislation. LECTURE No. 3. Fundamentals of budget policy The achievement of strategic goals in the development of the state is based on the basis of financial policy. The implementation of financial policy takes place through the preparation of a financial plan for the medium (long-term) perspective, the budget and the most efficient use of these funds for the state to perform its functions. The subjects of the implementation of the budget policy are the authorities that have the authority to form and use financial resources. The financial policy of the state should focus not only on the domestic economy of the country, but also on the requirements of financial law. The priority objectives of the financial policy are: 1) formation of legislation adapted to reality; 2) reduction of the tax burden with a simultaneous increase in the efficiency of the functioning of the tax system; 3) formation of adequate planning and forecasting of the development of the financial system; 4) achieving maximum balance of budgets at all levels; 5) effective return on the functioning of the customs system; 6) creation of conditions for stimulating revenues to the budgets of various levels, etc. Financial policy consists of such structural links as budget policy, customs policy, monetary policy. Changes are taking place in the field of customs policy related to Russia's accession to the WTO. According to the rules of this organization, in the territories where these rules apply, import duties will not apply. Currently, a whole system of customs fees and duties, as well as their benefits, operates on the territory of the Russian Federation. The Customs Code of the Russian Federation provides for special customs regimes. Monetary policy is formed by the Government of the Russian Federation and the Central Bank. Its main tasks: 1) the stability of the inflation rate. This refers to the achievement of a level at which economic growth is noted; 2) application of the latest technologies in payment transactions; 3) control of the money supply; 4) maintaining the position of a floating exchange rate. Within the framework of tax policy, the primary task is to reduce the tax burden. As a result, there are changes in tax legislation. Issues related to the taxation of small and medium-sized businesses have shifted towards improvement. For such business entities, special tax regimes have been developed and implemented. These include a taxation system in the form of a single tax on imputed income and a simplified taxation system. Income tax rates have been reduced. At the same time, a large share of tax deductions goes to the budget of the subject. In turn, regional authorities have the legislative right to reduce this rate (17%). All this creates the prerequisites for the legalization of profits of enterprises. A scheme has been developed for the application of tax incentives for income tax, unified social tax, value added tax. A regressive scale for the UST has been introduced, i.e., with an increase in the tax base, the tax rate decreases. Special benefits are also provided for special zones. Three types of free economic zones are prescribed in the legislation: recreational, technical and innovative, scientific and technical. For them, the state provided for exemption from a number of taxes and benefits for UST, income tax. The current budget policy of Russia is in line with the strategic goals of the economic development of the Russian Federation, improving the quality of life and ensuring the safety of its citizens. National projects are becoming increasingly important. A basis is being created for solving urgent problems, such as improving the quality of education, providing citizens with affordable and comfortable housing, improving the health of the population, creating decent living conditions in the countryside and developing agro-industrial production. Some federal and regional programs to address the above areas are listed when considering interbudgetary transfers. Some national projects receive the necessary funding. However, there are some inconsistencies here as well. So, at first, funds for the payment of the unified social tax and the payment of district coefficients were not taken into account due to the introduction of additional payments to certain categories of teachers and medical workers. As a result, amendments to the federal budget are again required in the process of its execution, which is not welcome. With regard to social financing, the wages of certain categories of employees of public sector organizations, the monetary allowance of military personnel and law enforcement officers, pensions and a number of benefits in connection with motherhood and raising children have been significantly increased. The results of the reform of the system of benefits in kind have been positive. This reform made it possible to increase the effectiveness of social support for the population. Budgetary funds for these purposes are provided in the required volumes. A new federal law on public procurement came into force, which more clearly regulates the procedures for conducting tenders, creating conditions for expanding the range of suppliers and more efficient use of budgetary funds. This will allow more economical spending of budgetary funds. Since 2006, the volume of state investment expenditures has been increased in the federal budget and the Investment Fund has been created. The reform of federal relations between the budgets of different levels was continued. There are already positive developments: the federal budget and the budgets of the constituent entities of the Russian Federation for 2005 were executed for the first time under the conditions of the legislatively established delimitation of expenditure obligations and revenue sources. Due to this, the balance of regional budgets has increased. Every year the transparency of the system of financial support of the constituent entities of the Russian Federation is growing. However, the mechanisms used in distributing subsidies (calculation of budget sufficiency, equalization of lagging regions) are not sufficiently focused on stimulating the growth of their own tax potential. With the provision of subventions from the federal budget, the circle of own powers of the state authorities of the subjects has been expanded. State authorities of the constituent entities of the Russian Federation received the right, in cases established by law, to participate in the exercise of the powers of the Russian Federation with the implementation of expenses at the expense of the budgets of the constituent entities of the Russian Federation. Similar decisions have been made with respect to local self-government bodies. A positive development in 2006 was the formation of their own budgets for the newly formed municipalities. According to the new legislation on local self-government, the subjects independently determine the transition to a new model of interbudgetary relations. More than half of the subjects have already adopted their regulations on the formation and distribution of financial resources. The reduction in the base rate of the unified social tax ensured a significant reduction in the tax burden (primarily for the manufacturing industries). Since 2006, a new methodology for forming the country’s budget has been adopted. Russia has significant experience in planning economic and other activities. Suffice it to remember the five-year period. In the post-Soviet period, the authorities abandoned this type of management. Taking into account the accumulated experience, we are returning to three-year planning. With the help of this, budget policy will be determined more qualitatively. However, the stopping ("braking") force of the planning process was the adoption of a long-term financial plan for 2006-2008. after the start of the planning period. This objectively hinders the introduction of a results-based medium-term budgeting model. Another positive moment in 2006 was the transfer of the entire system of budgets to cash execution services in the bodies of the Federal Treasury. At present, the budget policy is being formed based on the need to improve the quality of life of the population, create conditions for ensuring positive structural changes in the economy and the social sphere, address the problems of macroeconomic balance, increase the efficiency and transparency of public finance management. Another important point is the gradual reduction of inflation rates. The suppression of inflationary growth rates should be based on the elimination of the causes of inflation. To implement the tasks set, the Government of the Russian Federation is responsible for the following strategic areas: 1) an important point is to ensure the balance of the budget system of the Russian Federation in the long run. This is especially true of obligations in the field of pension and state social insurance. With the entry into force of the new mixed pension accumulation system, it became necessary to draw up new rules for deductions from the federal budget to the Pension Fund. A sore point is the dependence of budget revenues on fluctuations in world oil prices. Therefore, the budget spending strategy should be based not on current assessments of the price situation in the commodity markets, but on the basis of long-term trends; 2) the main direction in the field of budget policy should be the continued accumulation of budget revenues in the Stabilization Fund. The funds of the Stabilization Fund in excess of the base amount should be used to replace sources of external financing of the budget deficit, as well as to early repay the state external debt. As practice shows, the formation of such a fund gives a sense of stability. However, according to the President of the Russian Federation, there should be a clear separation between the funds that are reserved in the Stabilization Fund in order to reduce the risks of falling oil prices (the reserve part), and the resources formed in excess of this amount (the “future generations fund”). It is proposed to set the volume of the reserve part as a percentage of GDP; 3) a more efficient return of budget expenditures is needed. Expenses of budgets of all levels should be focused on the end result. At the same time, the obligations imposed on the authorities should be comparable with the financial resources allocated for this; 4) increasing the role of medium-term financial planning. Already in 2007, the federal budget for the medium term (2008-2010) was approved. Reports on the results of the use of budgetary appropriations should be taken into account when drawing up and reviewing draft budgets; 5) further expansion of the independence and responsibility of the main managers of budgetary funds by developing and implementing methods and procedures for assessing the quality of financial management at the departmental level, developing internal audit, strengthening financial discipline; 6) ensuring transparency and efficiency of procurement for state and municipal needs. Currently, the formation of a regulatory framework for the implementation of the provisions of the Federal Law of July 21.07.2005, 94 No. XNUMX-FZ "On placing orders for the supply of goods, performance of work, provision of services for state and municipal needs" is being completed. Particular attention should be paid to determining the list of goods, works, services, the purchase of which should be carried out at auctions, as well as to the specifics of the purchase of products for defense and security needs. A positive moment in this area is the conclusion of long-term contracts for the supply of products for state and municipal needs. It is planned to expand the practice of holding joint tenders by state and municipal customers. This will make it possible to more effectively promote the adoption of joint decisions regarding the conduct of tenders for federal needs; 7) improvement of state property management. Obtaining one-time income should not be the only goal of privatization of state and municipal property. First of all, it should contribute to structural changes in the relevant sectors of the economy, allowing us to expect a positive economic, social and budgetary effect. As soon as possible, it is necessary to legally resolve the issue of reducing the redemption price of land plots under objects that are in private ownership. The shortcomings of the existing system of denationalization of property include the delay in privatization procedures. It is necessary to reconsider their sequence. The results will be the acceleration of privatization procedures and the growth of revenues to the budget system; 8) effective participation of Russia in the initiatives of the world community to alleviate the debt burden of the poorest countries. At the GXNUMX summit, it was decided to write off the debt of African countries; 9) reorganization and increase in the capitalization of specialized state investment institutions in order to support the export of goods and import of technology, long-term financing of large investment projects. For this, a lot of work has been done to create legislation on industrial-production, technology-innovative and tourist-recreational special economic zones. In order to expand private investment, mechanisms for using the funds of the Investment Fund and venture funds are widely used. In accordance with the Budget Message to the Federal Assembly dated May 30.05.2006, 2007 "On Budget Policy in 2006," tax policy in 2007-XNUMX. and for the medium term should be formed based on the need to stimulate positive structural changes in the economy, consistently reduce the total tax burden, and qualitatively improve tax administration. Legislation on production sharing agreements is in place. The state provides guarantees in the study and development of mineral deposits. A decision was made to introduce a zero tax rate on the extraction of minerals for newly commissioned oil fields located in Eastern Siberia and on the continental shelf of the Russian Federation, as well as to establish reducing coefficients to the rate of this tax on depleted fields. It is planned to enshrine on a permanent basis in the Tax Code of the Russian Federation the formula used today for calculating this tax, depending on the world oil price. In order to stimulate innovation, there was a need to reduce the period for attributing the costs of research and development work, including those that did not give a positive result, to income tax-reducing expenses from two years to one year. Reforming the system of excise collection should be focused on stimulating the consumption of higher quality goods. The issue of differentiating excise duty rates for gasoline depending on its quality has already been worked out, benefits have been established. The procedure for paying excises on cigarettes consists in calculating the ad valorem component of the excise rate from the retail price of cigarettes. The ad valorem rate is a combination of natural and interest rates. In the coming years, indexation of excise rates for petroleum products will not be carried out. An innovation in the legislation on taxes and fees will be the unification of two local taxes: land and property. Instead, a single local property tax will be created. Perhaps this will lead to a more or less effective procedure for mass real estate appraisal. This project is under development. This type of tax is planned to be launched in 2009. The Government of the Russian Federation during the formation of the long-term financial plan of the Russian Federation for 2007-2009. and the draft federal budget for 2007 should provide funds for the implementation of the decisions taken to increase wages in the public sector, the salaries of military personnel and law enforcement officers. Particular attention should be paid to solving the problem of raising the living standards of pensioners. In particular, it is necessary to ensure the implementation of the earlier decision to bring the size of social pensions to a level not lower than the subsistence minimum for a pensioner. In the Message of the President of the Russian Federation to the Federal Assembly of the Russian Federation, tasks were set for a qualitative improvement in the system of support for motherhood and childhood in order to significantly increase the birth rate. The funds necessary for their implementation should be taken into account when forming the federal budget for 2007 and subsequent years. In particular, the law "On maternity capital" was adopted, which came into force in 2007. The law provides for the payment of 250 thousand rubles. women who gave birth or adopted a second or subsequent children, starting from January 1, 2007. According to the document, a man also has the right to receive money if he is the sole adopter of the second, third or subsequent children. It is also agreed that these funds will be provided only after the child is three years old, or after three years have passed from the date of his adoption. Money from maternity capital in full or in part can be directed to education, and any child in the family, the purchase of housing, as well as the formation of the funded part of the mother's labor pension. At the same time, this amount will be reviewed annually, taking into account the rate of inflation growth. In 2007-2008 bets were made on the allocation of funds for the implementation of priority national projects. When planning work for 2007, funds from the budgets of all levels, state off-budget funds and other sources allocated for the implementation of project activities are already taken into account. In addition, greater transparency in the spending of budgetary funds is ensured. The priority in financial management remains the coordinated implementation of education and health projects and the adoption of measures for the structural modernization of relevant industries. Joint implementation is carried out at all levels of government. In the field of education, first of all, support will be provided to those regions that are introducing a new wage system in general education institutions. Regarding the support of the category of teachers, programs to encourage the best teachers are of great importance. The question of real lending to education is raised. In the agro-industrial sector, the tasks of stimulating the introduction of modern technologies, further developing lending, agricultural insurance, and improving the standard of living in rural areas are relevant. The implementation of this project is based mainly on the formation of target programs for rural development. Of great importance are subsidies from the regional budget for agricultural producers in terms of leasing payments, bank loans. Many subjects receive transfers to reimburse the amounts spent. The development of leasing should stimulate the use of the most economical agricultural machinery and equipment in operation. LECTURE No. 4. The federal budget of the Russian Federation is the main financial plan of the country The budget plays an important economic, social, political role in the reproduction process. The state influences the redistribution of national income between industries. Through the budget, the state can influence weaker, non-monetary sectors (such as agriculture, culture, education, health care, etc.). Federal budget - the form of formation and spending, based on the financial year, of funds intended for the fulfillment of expenditure obligations of the Russian Federation. Like any other economic category, the budget performs certain functions: the formation of a budget fund, its use, control over the use of funds for their intended purpose. The first function is associated with the formation of income, consisting of tax and non-tax revenues. The main source of income is the income of economic entities received as a result of the redistribution of the national product. The structure of budget revenues is not constant and depends on the economic development of the country in a certain period. Another function is related to the targeted use of budgetary funds. Finally, the third function involves the creation of a control associated with both the first and the second function. Targeted use of budgetary funds is subject to control. There is a special reporting form for this. In accordance with the RF Budget Code, the budget has its own structure. The main constituent elements are budget revenues and expenditures. Income and expenses, in turn, are subject to grouping. The budget classification of the Russian Federation is a grouping of revenues, expenditures and sources of financing budget deficits at all levels. The budget classification of the Russian Federation includes: 1) classification of budget revenues of the Russian Federation; 2) functional classification of RF budget expenditures; 3) economic classification of RF budget expenditures; 4) classification of sources of internal financing of budget deficits of the Russian Federation; 5) classification of sources of external financing of the federal budget deficit; 6) classification of types of state internal debts of the Russian Federation, constituent entities of the Russian Federation, municipalities; 7) classification of types of the state external debt of the Russian Federation and state external assets of the Russian Federation; 8) departmental classification of federal budget expenditures. In accordance with Chapter 4 of the RF BC, the classification of RF budget revenues is a grouping of budget revenues at all levels of the RF budget system. The classification of budget revenues of the Russian Federation includes the code of the administrator of budget revenues, groups, subgroups, articles, sub-items, elements, programs (subprograms) and codes of economic income classification. The economic classification of income is a grouping of general government transactions by economic content. There is a distinction between income on own and regulatory. Own fixed on a permanent basis (these are taxes, non-taxes, gratuitous transfers). Regulatory income - payments for which the standards for deductions (Table 1) to lower budgets are established. Table 1 Standards

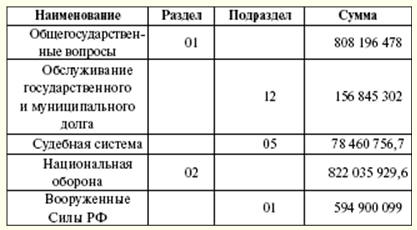

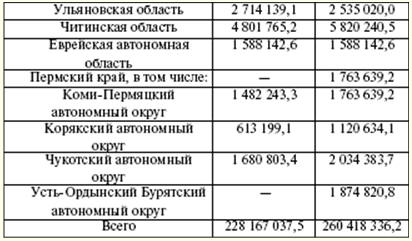

The functional classification of expenditures of the budgets of the Russian Federation is a grouping of expenditures of budgets of all levels. It reflects the direction of budgetary funds for the implementation of the main functions of the state and the solution of issues of local importance. The first level of the functional classification of budget expenditures of the Russian Federation is the sections that determine the expenditure of budgetary funds for the performance of state functions. The second level of functional classification of expenditures of budgets of the Russian Federation - subsections that specify the direction of budgetary funds to perform the functions of the state in the context of sections. The classification of target items of expenditures of the federal budget forms the third level of the functional classification of expenditures of the budgets of the Russian Federation and reflects the financing of federal budget expenditures in specific areas of activity of the main managers of federal budget funds within the subsections of the functional classification of expenditures of the budgets of the Russian Federation. The classification of types of budget expenditures forms the fourth level of the functional classification of expenditures of the budgets of the Russian Federation and details the directions of financing budget expenditures by target items (Table 2). Table 2 Distribution of expenditures by functional classification for 2007 (thousand rubles)

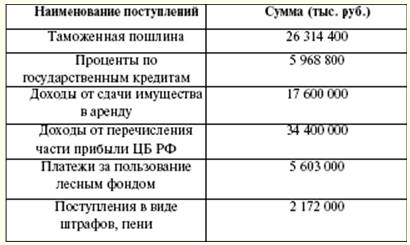

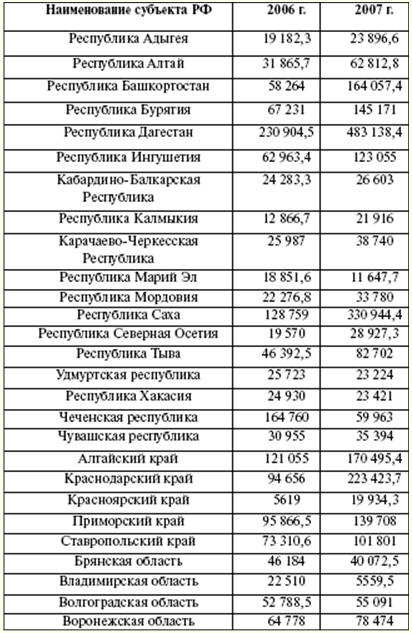

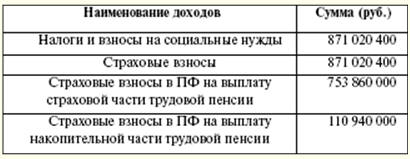

The economic classification of expenditures of budgets of the Russian Federation is a grouping of expenditures of budgets of all levels of the budgetary system of the Russian Federation according to their economic content. The classification of sources of financing budget deficits of the Russian Federation is a grouping of borrowed funds attracted by the Russian Federation, constituent entities of the Russian Federation and municipalities to cover the deficits of the corresponding budgets. The departmental classification of federal budget expenditures is a grouping of expenditures that reflects the distribution of budgetary funds among the main administrators of the federal budget funds. The type of expenditure is supported by the source of financial coverage. If a new type of expenditure appears, the sources and procedure for financing new types of budget expenditures should be determined, including if it is necessary to transfer financial resources for new types of expenditures to budgets of other levels. The structure of budget expenditures includes capital and current expenditures. Capital spending is intended to invest in newly created legal organizations and support existing ones. The form of support is budget credits. Capital expenditures are determined by the economic budgetary classification of expenditures. Current spending is associated with the provision of subsidies and subventions to lower budgets. In addition to the provided budget loans, there are other forms of spending budget funds (appropriations, transfers, payment under a government contract, inter-budget transfers, etc.). The practice of creating reserve funds as part of the budget is widespread. The size of the fund should not exceed 3% of the total cost. The purpose of creating such funds is to use a reserve stock for unforeseen expenses (losses from natural disasters, restoration work from accidents that have occurred). Thus, the Reserve Fund of the President of the Russian Federation is formed as part of the federal budget. Its volume should not be more than 1% of the established amount of expenses. Only the President of the Russian Federation has the right to dispose of the funds of this fund. However, spending the funds of the fund for personal purposes, for elections and other events is prohibited. This fund is created for emergency expenses. The total amount of income in 2007 amounted to 6 rubles. The structure of the revenue part consists of tax and non-tax revenues. The list of tax revenues depends on the legally fixed taxes and fees (Table 964). At the same time, there is a distribution of the share of tax sources between the budgets of different levels. This year, income tax, value added tax, excises, mineral extraction tax, unified social tax, water tax, collection for the use of aquatic biological resources are determined. The first place in terms of revenues to the budget is occupied by the value added tax, the fee for the use of natural resources, and the tax on the extraction of minerals. Customs payments have a large share of income. Establishment of new types of taxes, their cancellation or change is possible only by making appropriate changes to the tax legislation of the Russian Federation. The federal legislative authorities may establish new types of non-tax revenues, cancel or change the existing ones after the federal executive authorities submit their opinion and only by amending the Budget Code of the Russian Federation. Table 3 Tax receipts to the federal budget in 2007

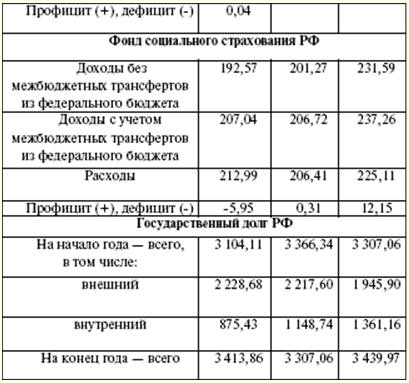

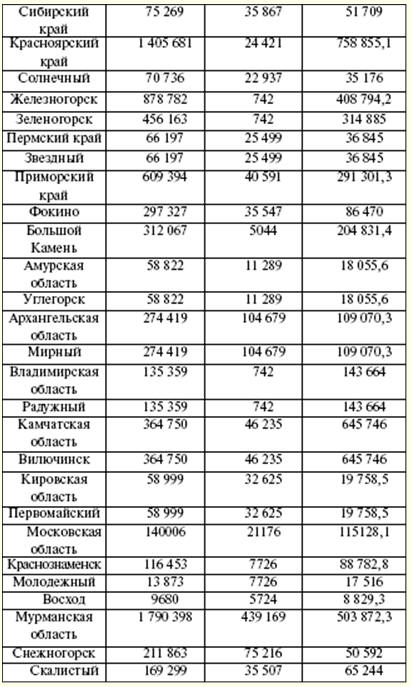

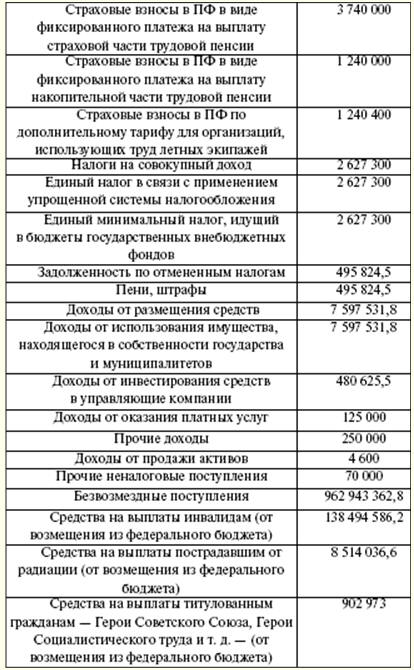

Non-tax revenues of the federal budget (Table 4) are formed from: 1) income from the use of state-owned property, income from paid services provided by budgetary institutions; 2) remaining after taxes and other obligatory payments and fees for the issuance of licenses to carry out activities related to the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products, part of the profits of unitary enterprises established by the Russian Federation; 3) customs duties and customs fees; 4) fees for the use of water bodies; 5) fees for the use of aquatic biological resources; 6) payments for negative impact on the environment; 7) the profit of the Bank of Russia remaining after the payment of taxes and other obligatory payments (according to the standards established by federal laws); 8) income from foreign economic activity; 9) other income. Table 4 Non-tax revenues to the budget in 2007

The income of the federal target budget funds is taken into account in the income of the federal budget. Receipts are made at established rates and are distributed among the federal target and territorial target budget funds. In the course of consideration of income and expenditure items, a deficit may appear. In such cases, the sources of financing the budget deficit are approved. Funding sources are approved by the legislature in law for the next financial year. Credits from the Bank of Russia, as well as the acquisition by the Bank of Russia of debt obligations of the Russian Federation, subjects of the Russian Federation, municipalities during their initial placement cannot be sources of financing the budget deficit. The sources of financing the federal budget deficit are: 1) internal sources: a) loans received by the Russian Federation from credit institutions in the currency of the Russian Federation; b) government loans carried out by issuing securities on behalf of the Russian Federation. State borrowings of the Russian Federation are loans and credits attracted from individuals and legal entities, foreign states, international financial organizations, for which debt obligations of the Russian Federation arise as a borrower or a guarantor of repayment of loans by other borrowers; c) budget loans received from the budgets of other levels of the budget system of the Russian Federation; d) proceeds from the sale of state-owned property; e) the amount of excess of revenues over expenditures on state stocks and reserves; f) change in the balances of funds on the accounts for the accounting of federal budget funds; 2) external sources: a) government loans made in foreign currency by issuing securities on behalf of the Russian Federation; b) loans from foreign governments, banks and firms, international financial organizations, provided in foreign currency, attracted by the Russian Federation. The drafting of budgets is preceded by the development of forecasts for the socio-economic development of the Russian Federation, constituent entities of the Russian Federation, municipalities and sectors of the economy, as well as the preparation of consolidated financial balances, on the basis of which the executive authorities develop draft budgets. The whole process begins with the Budget Message of the President of the Russian Federation, which is sent to the Federal Assembly no later than March of the previous year. The Government of the Russian Federation is engaged in the design of budgets, and at the local level - the executive bodies of local authorities. The draft budget is prepared by the Ministry of Finance. For the formation of the draft budget, the Message of the President of the Russian Federation, the forecast of socio-economic development, the forecast of the consolidated financial balance, and the plan for the development of the economic sector in the given territory are used. In addition, the calculations use information on the current tax legislation, the estimated amount of financial assistance from the budgets of other levels of the budget system of the Russian Federation, the types and amounts of expenditures from one level of the budget system to another, and the standards of financial costs for the provision of state or municipal services. Budgeting depends on the calculation of important indicators of GDP per capita, inflation. The development plan for the state or municipal sector of the economy includes: 1) a list and a summary plan of the financial and economic activities of federal state-owned enterprises; 2) a list and a summary plan of the financial and economic activities of state or municipal unitary enterprises; 3) a program for the privatization of state or municipal property and the acquisition of property into state or municipal property; 4) information on the maximum staffing of state or municipal employees and military personnel for the main administrators of budgetary funds. Simultaneously with the draft budget for the next financial year, the following are drawn up: 1) forecast of the consolidated budget of the relevant territory for the financial year; 2) targeted investment program for the financial year; 3) a development plan for the state or municipal sector of the economy; 4) the structure of the state or municipal debt and the program of internal and external borrowings; 5) assessment of budget losses from the provided tax benefits; 6) assessment of the expected execution of the budget for the current financial year. In addition, the Ministry of Finance of the Russian Federation is developing indicative budget indicators for the medium term, a draft federal law on the budget. At the same time, a medium-term forecast of socio-economic development and a forecast of the Consolidated Financial Balance are being prepared. The formation of the federal budget begins with the selection by the Government of the Russian Federation of a plan-forecast of the functioning of the Russian economy for the next financial year. Based on the chosen plan-forecast, the federal budget expenditures are distributed (Table 5). Table 5 Parameters of the budget system of the Russian Federation (billion rubles)