|

|

Lecture notes, cheat sheets

Theory of accounting. Lecture notes: briefly, the most important

Directory / Lecture notes, cheat sheets Table of contents

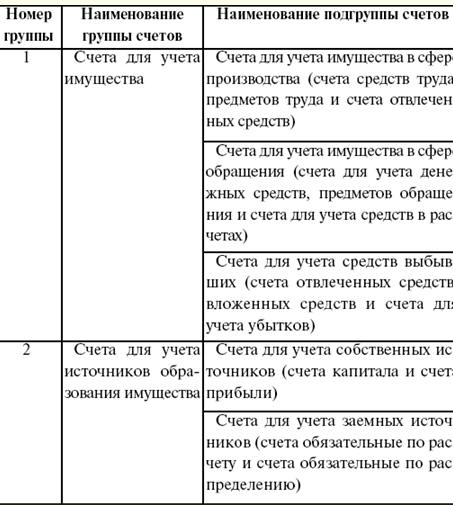

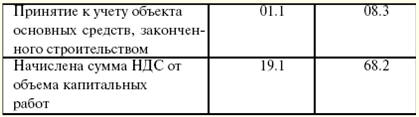

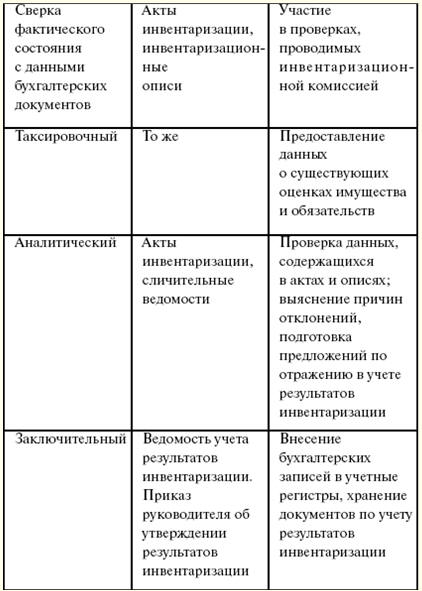

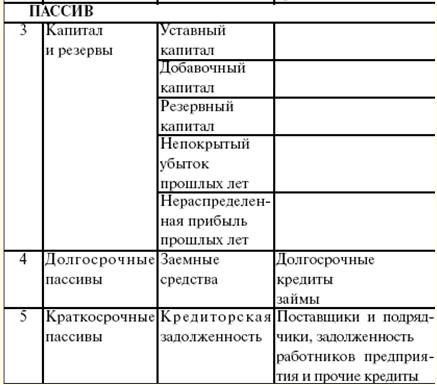

LECTURE No. 1. The theory of accounting, its essence and significance in the management system 1. The concept and types of accounting. Indicators used in accounting, functions, objects and tasks of accounting Бухгалтерский учет is an ordered system for collecting, registering and summarizing information in monetary terms about the property, obligations of organizations and their movement through continuous, continuous and documentary accounting of all business transactions. Observation represents a general idea of the ongoing economic phenomenon. Measurement gives a quantitative expression to the ongoing economic phenomenon. Register is carried out within the established system and facilitates the process of memorizing and studying the observed economic phenomena. Types of accounting: 1) Management Accounting is a type of such accounting in which the collection, processing and provision of accounting information for the needs of management at the enterprise takes place. The purpose of management accounting is the formation of an information system at the enterprise. The main task of management accounting is the preparation of reliable and complete information, which serves as a source for making the necessary management decisions at enterprises in the management process. The main part of such accounting is the accounting and analysis of costs (the cost of production). Management accounting is closely related to the analysis of ready-made information for the management of the organization (improvement of the technological process of production, optimal cost reduction, etc.). This information, as a rule, is used in the process of making managerial decisions in planning and forecasting at the enterprise (for financial accounting purposes). The organization's management accounting data is its commercial secret and should not be disclosed by its employees; 2) financial Accounting - this is accounting information about the costs and income of the enterprise, about receivables and payables, about the compilation of property, about funds, etc.; 3) tax accounting - this is a type of accounting in which information is summarized in order to determine the tax base for taxes based on the data of primary documents grouped in accordance with the procedure provided for by the Tax Code of the Russian Federation (TC RF). The purpose of tax accounting is to ensure the correctness and reliability of accounting for settlements between enterprises and government agencies. In the process of calculating indicators the activity of the enterprise is widely used measurement of its economic means with the help of meters. Accounting meter is a specific accounting unit that measures and calculates economic assets and operations in the enterprise. Business accounting primarily involves the quantitative measurement of accounting objects. For this purpose, accounting meters are used: natural, labor, monetary. natural meters serve to reflect in the accounting of economic means and processes in their kind, measure, mass. The use of natural meters depends on the characteristics of the objects taken into account, i.e., on their physical properties. Accounting objects can be measured in units of mass (kilograms, tons, etc.), by count (number of pieces, pairs, etc.). With the help of natural accounting, systematic monitoring of the state of movement of specific types of material assets (fixed assets, finished products, etc.) is carried out and control is exercised over their safety, as well as over the volume of the process of procurement, production and sale of products. Labor meters used to reflect in accounting the amount of working time spent, calculated in working days, hours, minutes. Labor meters, in combination with natural meters, are used to calculate the amount of wages, identify labor productivity, determine production standards, etc. money meter occupies a central place in accounting and is used to reflect a variety of economic phenomena and summarize them in a single monetary valuation. Only with the help of a monetary meter can one calculate the total value of the heterogeneous property of an enterprise (buildings, machine tools, materials, etc.). The monetary meter is expressed in rubles and kopecks. By means of them, the costs incurred (expenses) of the enterprise, previously expressed in labor and physical meters, are summarized. A monetary meter is necessary, in particular, for calculating the cost of production, determining the profit or loss of an organization, and reflecting the results of economic activity. Functions, objects and tasks of accounting Functions accounting: 1) controlling - ensures control over the safety, availability and movement of objects of labor, means of labor, funds, over the correctness and timeliness of settlements with the state and its services. With the help of accounting, three types of control are carried out: preliminary, current and subsequent; 2) information function - is one of the main functions, as it is a source of information for all departments of the enterprise and higher organizations. Information must be reliable, objective, timely and operational; 3) ensuring the safety of property. The performance of this function depends on the current accounting system, on the availability of specialization, warehouses, which are equipped with organizational equipment; 4) feedback function - accounting generates and transmits feedback information; 5) analytical function - with the help of it, the existing shortcomings are revealed, outline and analyze ways to improve the activities of the organization and its main services. The objects of accounting are: 1) property of the enterprise - fixed assets, intangible assets, etc.; 2) obligations of the enterprise - settlements, transactions, etc.; 3) business transactions - transactions related to the activities of the enterprise. The main tasks of accounting: 1) timely and correct performance of the necessary calculations and obligations; 2) operational control over the correctness and reliability of information in accounting documents; 3) timely reflection of accounting data in accounting registers. 2. Historical overview of the most important stages in the development of accounting Jean-Baptiste Demarchet (1874-1946) is an outstanding French scientist who created the well-known and popular coat of arms of accountants, which depicts three objects (the sun, scales and the Bernoulli curve) and the motto "Science - conscience - independence"). Each item means something different: 1) sun - illumination of the economic activity of the enterprise by accounting; 2) scales - the importance of balance, its balance; 3) Bernoulli curve - infinity of accounting. Approximately from the second half of the XK century. in various countries, scientific directions began to form, schools that are designed to comprehend and use the accounting craft. Italian school. This school was dominated by the legal interpretation of accounting. Representatives of this school are F. Villa, F. Marchi, G. Cerboni, G. Rossi and others. They were inclined to believe that the accountant takes into account and controls the activities of the storekeeper, cashier, as well as the rights and obligations of financially responsible persons (at that time they were called agents), the rights and obligations of legal entities and individuals with whom the organization makes settlements (at that time they were called correspondents), and not the values of the organization. Therefore, it was found that the accountant reflects not the cash on hand, not the materials in the warehouse, etc., but the responsibility of the cashier, storekeeper, etc. Each account was personalized, that is, there was always some responsible person behind it . At the same time, the double entry was determined by the rule of E. Degrange, which sounds like this: "The one who gives out is credited, the one who receives is debited." Already in the twentieth century. The question of the implementation of a special branch of jurisprudence - accounting law has been repeatedly raised, since an accountant is in some way a judge who applies state law in the course of his work. "Accounting is the algebra of law," said the outstanding scientist P. Garnier. French school. Here the economic interpretation of accounting played a significant role. Prominent representatives of this school are J. Courcelles-Senel, E. Leauté, A. Guillebeau, J. B. Dumarchais and others. They saw the main goal primarily in calculating the efficiency of the organization's economic activities, and not in direct control over the safety of the organization's values, as many of their Italian accountants colleagues did. With the help of the established methodology, it reflects the movement of fixed capital, all resources, values of the organization, and not their rights and obligations in jurisprudence. It is from this that another explanation for the emergence of a double entry follows: there is no inflow of funds without their expenditure - this is how the representatives of this school assumed. This assumption was supported by the representative of the school, J. Proudhon, who argued that accounting was a political economy. He had his own opinion: most economists are very bad accountants, who know nothing, and also who do not understand in the receipt and expenditure of funds and in keeping books. German school. This school attached great importance to procedural issues, the structure of counting forms, the sequence of accounting records. The main representatives of this school were F. Gyugli, I.F. Sher, G. Niklish, and others. This school provides for a smooth transition to accounting from balance to accounting, and not vice versa, as was typical for the Italian and French schools. These schools, as mentioned above, argued that the debit and credit of any accounting account are "qualitatively homogeneous fields", the German school, in turn, argue that the value of the debit and credit of the accounting account varies depending on the account itself, whether it is passive or active. American school. This school assumed that accounting is a tool for managing people, and that people, in turn, manage an organization. From the side of psychology, accounting information is the only incentive for administrators, who are obliged to respond well to this incentive. If this does not happen, then the information has no value for accounting. The main achievement of American scientists (G. Emerson, C. Harrison, C. Clark, W. Paton, etc.) was and is the design and implementation of methodological techniques, namely "standard-cost", "direct-costing" and " responsibility centers. At the same time, after some time, such a branch of accounting as management accounting was formed. It can be concluded that each of these schools brought to the science of "Accounting" their specific ideas. In the accounting life of our country in about the first half of the nineteenth century. included wonderful ideas that are being discussed and improved to this day. LECTURE No. 2. Subject, method and principles of accounting 1. Subject and method of accounting The subject accounting is the economic activity of an enterprise or individual, which is carried out with the help of economic means: 1) fixed assets; 2) intangible assets; 3) working capital; 4) cash; 5) funds in settlements; 6) abstract means. Fixed assets - these are funds that participate in the economic activity of the enterprise for a long time, retain their shape and are partially included in the cost of production (in the form of depreciation). Intangible assets - These are patents, trade secrets, licenses, trademarks, etc. Current assets are used in the production process for a short time (approximately one production cycle). At the same time, they change their essential form, and, as a rule, they are included in the cost of production with their entire cost. Working capital includes raw materials, materials, purchased semi-finished products, electricity, fuel, packaging. Cash - this is money in the cash desk of the enterprise, on settlement and special accounts in banks. Funds in settlements is a receivable. Abstract funds - these are the amounts that are paid in the form of taxes and fees, are formed at the expense of own funds, as well as with the help of borrowed sources. Accounting method - these are the techniques, elements by which accounting is carried out. Elements and methods of accounting: 1) accounts; 2) double entry; 3) documentation; 4) inventory; 5) evaluation and calculation; 6) balance sheet; 7) reporting. Account is a tool for accounting, grouping, coding economic assets and operations. There are active, passive and active-passive accounts in relation to the balance sheet. Correspondence of invoices is a relationship between accounts. double entry - this is a record of business transactions on the debit of one and the credit of another account. Encoding business transactions using double entry is called accounting entry. Double entry reflects dual changes in the composition of the property of the enterprise and has the following significant meanings: it gives accounting a systemic character, provides a relationship between accounts, gives an idea of the movement of economic assets, sources of their formation (information value), allows you to eliminate errors in accounts. Documentation - this is a continuous and continuous reflection of the economic activity of the enterprise in accounting documents. Each document is a written evidence of the fact of a business transaction. Documents have a name, and obligatory details give them legal force. Inventory - this is a check of the actual availability of inventory, cash, financial obligations on a certain date. Evaluation - determination of value in monetary terms. Calculation is the definition of production costs. It includes cost items. Balance sheet - this is a way of generalizing economic funds, grouping their sources for a certain date. The left side is the asset of the balance sheet, the right side is the liability. The totals of the asset and liability of the balance sheet must correspond to each other, since there can be no more economic assets than their sources. Reporting- this is a reflection of all economic activities of the enterprise in documents for the reporting period (month, quarter, half year or year). 2. Accounting principles Accounting is based on the following principles: 1) principle of monetary measurement - in accounting reports, information must always be expressed in a single monetary unit (in the currency of the country where the enterprise is located); 2) principle of mandatory documentation - a continuous, continuous, documented and reliable reflection of the objects that are taken into account, which arise from various operations simultaneously taking place in the organization. These operations, in turn, reflect the constantly renewed circulation of all means of organization and the continuous change of their forms; 3) the principle of duplicity or double entry - is concluded according to the sources of formation and on the basis of placement with the fulfillment of equality in both groups of accounting; 4) the principle of organizational autonomy - in order to preserve the objectivity of accounting, accounting accounts that reflect all business transactions of the organization are kept separately from accounts that are intended directly for accounting for persons associated with this organization. The separation of the accounting accounts of the organization and its owners (legal entities) is considered the principle of the autonomy of the organization; 5) operating principle - any created organization must exist (function) and be a permanent production; 6) cost principle - assets are accounted for at the acquisition price, i.e. at cost. It is the main basis for accounting for an asset in accounting for the entire time of its existence. Based on these rules, own assets are also listed in the balance sheet at the primary price (acquisition price), and regardless of the period of their stay at the enterprise, they are not revalued, and newly created products are valued at the prevailing cost of costs at the time of their release; 7) accounting period principle: accounting is carried out according to accounting periods, which are considered to be calendar periods; 8) the principle of conservatism (caution) - Undoubtedly, the leaders of the enterprise always want to present the affairs of production in the best possible way. But this is not always consistent with reality. The preliminary receipt of income during the reporting period cannot be counted against the income already owned by the enterprise if the final execution of the operation falls outside the reporting period. They are better attributed to deferred income. If the company has incurred expenses, and the finality of the operation is not documented (perhaps these costs will be returned), then they should be included in deferred expenses so as not to distort the true profit figures. This means that when making a profit or making expenses, you need to have strong evidence of their legitimacy. It follows that the principle of conservatism has two sides: a) income is recognized only when there is reasonable certainty; b) an expense is recognized as soon as a reasonable opportunity arises; 9) implementation principle - determines the amount of revenue to be recognized from a particular sale in that period. Since the goods can be sold at a price above and below its cost, in installments and before payment, the amount of sale should be adjusted for the estimated amount of bad debts; 10) linkage principle - indicates the following: if an event affects both income and expenses, then the impact on each of them should be recognized in one accounting period. Production costs are included in the cost of production of the reporting period to which they relate, regardless of the time of payment, and profit is determined as the difference between sales proceeds and production costs. It follows from the foregoing that production costs should be included in the cost price in the period in which the sales proceeds are determined; 11) sequence principle - enterprises can independently choose the method of accounting, but subject to the condition that it be followed for a sufficiently long time (at least a year), until there are sufficiently good reasons for changing it. Otherwise, a situation of incommensurability of indicators will arise; 12) materiality principle - establishes that minor events may be ignored, but all important information must be fully disclosed. LECTURE No. 3. Accounting policy of the organization. Founders and shareholders 1. The general concept of the accounting policy of the organization Accounting policy of the organization (UPO) is a set of accounting methods (primary observation, cost measurements, grouping of results, generalization of facts). The accounting policy of the organization states: 1) chart of accounts; 2) non-standard forms of primary documentation (if any); 3) the procedure for conducting an inventory; 4) methods for assessing assets and liabilities; 5) document flow rules; 6) information processing technology; 7) the procedure for monitoring business transactions. The main requirements of the accounting policy are: 1) completeness of reflection of facts; 2) discretion in acquisitions and investments; 3) priority of content over form; 4) consistency of synthetic and analytical accounting; 5) rationality of accounting. Accounting information and its meaning. The nature of information, the process of its collection, processing and use is an internal affair of each organization. Since the adoption of the new chart of accounts, accounting has been improved. At the same time, accounting approaches the system of international practice. Information should be understandable, reflect the essence of the issue without ambiguous perception and excessive detail. Another qualitative feature is relevance (relevance), i.e., the impact of information on the economic decisions of an enterprise. Information is the basis for forecasting and provides the basic functions of management (management). Operational planning at the enterprise. Operational financial planning, in contrast to the preparation of a financial plan, includes the development and compilation of two documents: 1) payment calendar; 2) the cash plan of the enterprise. The payment calendar allows you to compare income and expenses for a certain period of time (for a month, for a decade, for five days, in contrast to the financial plan, which is compiled for a year, broken down by quarters). The basis for compiling the payment calendar are: 1) data on the balance of income and expenses of the enterprise; 2) planned data on the production and sale of products; 3) logistics plans; 4) plans for the placement of borrowed funds and liabilities. The payment calendar consists of two sections: 1) gross income and cash receipts; 2) gross expenses and deductions of funds. В profitable part of the payment calendar, the main source is the proceeds from the sale of products (the amount of proceeds is determined based on the schedule for the shipment of products and the work delivered). Income includes income from rent and bank loans. В expendable parts reflect all types of payments provided for the payment period. These are payments to suppliers in accordance with the concluded contracts and all expenses related to remuneration of labor based on the stipulated wage fund, planned, but adjusted for the percentage of the implementation of the production program. In the payment calendar, labor costs are posted in the appropriate periods, according to the salary payment schedule: 1) expenses related to deductions to off-budget funds; 2) all types of payments to the budget strictly in accordance with the terms of their payment; 3) repayment of loans in strict accordance with the terms for which they were issued; 4) payment of interest for the use of loans. Enterprise cash plan can be made for a month or for shorter periods. It reflects the sources of receipt of funds to the cash desk of the enterprise and the costs and payments of cash from the cash desk. A reference section is compiled for these expenses, in which the payroll fund is calculated and the terms for paying wages are indicated. 2. Accounting for equity, formation of authorized capital, settlements with founders and shareholders on contributions to the authorized capital The formation of the authorized capital is carried out in order to create an organization and its organizational and legal form. Organizations are divided into commercial and non-commercial. Commercial companies pursue profit making as their primary activity. Under normal conditions, any commercial organization will be able to start carrying out its activities and implement the tasks assigned to it, if its founders have contributed enough funds to the authorized capital. Authorized capital is the main source of formation of own funds and funds of the organization and represents the amount of funds invested initially in the organization by its owners or participants in business entities. Therefore, a business company is the collective property of several individuals or legal entities - the founders of this company. The statutory fund of unitary organizations reflects the amount of funds contributed by the state or municipal body at the time the enterprise was put into operation to carry out its activities. The statutory fund of joint-stock companies determines the minimum amount of property of this company, which guarantees the interests of its creditors. Each founder must fully contribute to the authorized capital within the period specified in the constituent documents. In this case, the value of the contribution of each founder must be not less than the nominal value of his share. After the registration of a joint-stock company, the debt of the founders to the company is formed for the amount of the registered authorized capital. To account for settlements on contributions to the authorized capital, account 75 "Settlements with founders" is used, it is active-passive, it serves, on the one hand, for accounting for settlements with founders on contributions to the authorized capital (subaccount 1), and on the other hand, for accounting calculations on accrued income to the founders sub-account 2). The following entry is made for the amount of the registered authorized capital: Debit of account 75 "Settlements with founders", Credit of account 80 "Authorized capital". The balance is only debit, reflects the amount of debt on contributions to the authorized capital at the beginning of the month. The loan turnover shows the amount of repaid receivables deposited in the form of cash or material assets. Making deposits: Debit of account 51 "Settlement account", Credit of account 75 "Settlements with founders". Crediting funds of a foreign founder at the rate: Debit of account 52 "Currency account", Credit of account 75 "Settlements with founders". Settlements for the authorized capital with the founders are carried out in the order journal No. 8. The founders can be both Russian and foreign citizens. The amount of profit remaining after payment of tax is called undistributed. It, as a rule, passes to the disposal of the owners of the enterprise and is spent at their disposal. Retained earnings are recorded on account 84 "Retained earnings". Analytical accounting for this account is carried out in such a way as to ensure the formation of information on the areas of use of the remaining funds. LECTURE No. 4. Accounts and double entry 1. Types of accounts, their structure In the production process, a large number of business transactions are carried out every day that require current reflection, for which special accounting forms are used, which are built on the principle of economic homogeneity. Accounting account - the main unit of information storage, which, after summarizing all accounting information, is necessary for making management decisions. accounting accounts - this is a method of current interconnected reflection and grouping of property according to composition and location, according to the sources of its formation, as well as business operations on qualitatively homogeneous grounds, expressed in monetary, natural and labor meters. For each type of property, liabilities and transactions, separate accounts are opened with their name and digital number (cipher), which correspond to each balance sheet item, for example, 01 "Fixed assets", 04 "Intangible assets", 10 "Materials", 20 "Main production ", 50 "Cashier", 51 "Settlement accounts" 52 "Currency accounts", 75 "Settlements with founders", 99 "Profit and losses", 80 "Authorized capital", etc. Each account is a two-sided table: the left side of the account is a debit (from Latin "must"), the right side is a credit (from Latin "believes"). For some accounts, a debit means an increase, a credit means a decrease, while for others, on the contrary, a debit means a decrease, and a credit means an increase. Depending on the content, accounting accounts are divided into active, passive and active-passive. Accounts are active on: 1) economic content - these are those accounts that are intended for accounting for property by availability, composition and location; 2) balance - when accounts (items) are located in the active part of the balance; 3) balance (balance) - if the accounts have a debit balance. Accounts are considered passive for: 1) economic content - when the accounts reflect the accounting of property according to the sources of its formation; 2) balance - if the accounts (items) are located in the passive part of the balance; 3) balances are those accounts that have a credit balance. In addition to active and passive accounts, active-passive accounts are used in accounting practice, which can have a debit or credit balance at the same time. If one balance is displayed on an active-passive account, then it is effective and shows the final result from opposite operations. For example, on account 99 "Profit and Loss" both profits and losses are reflected, but at the end of the month the final financial result is displayed - profit if the balance is credit) or loss (if the balance is debit). In some cases, in active-passive accounts, the effective balance cannot be withdrawn; this happens when the effective balance distorts the accounting figures. For example, account 76 "Settlements with different debtors and creditors" could replace two accounts: "Settlements with debtors" - an active account and "Settlements with creditors" - a passive account. The need to take into account these calculations on one account is explained by the constant change in mutual settlements, the debtor can become a creditor and vice versa, and it is not advisable to split this account into two separate ones. Business transactions of current accounting are recorded on the accounts as they accumulate. Each operation can be recorded separately, but if there are many homogeneous operations, then on the basis of primary documents it is legitimate to bring them into accumulative or group statements. This will reduce the number of entries in the accounts. The structure of active and passive accounts and the procedure for recording transactions in them are regulated by the following rules: 1) for active accounts. At the beginning of the reporting period, accounts are opened that have balances (initial debit balance - SND). Data for entry on accounts is taken from the active part of the balance sheet and recorded on the debit of accounts. This order means: open accounts and record the opening balance. The increase and receipt are reflected in the debit, and the decrease, expenditure and disposal - in the credit of the accounts. At the end of the reporting period, the totals of turnovers for all accounts are summed up: first for debit, and then for credit. In the results of the turnover on the debit of accounts, the amount of the initial balance is not included; this includes only the amounts for operations of the reporting period. The final debit balance (SKD) on active accounts for the reporting period is determined as follows: the total debit turnover is added to the initial debit balance (SND) and the total turnover on the loan is subtracted (Ok). The ending balance can be either debit or zero: Сcd = Cnd + Aboutд + Aboutк. Thus, for active accounts, debit means increase and credit means decrease; 2) for passive accounts accounts are opened on which the initial balance is recorded on the loan. It is taken from the passive part of the balance in the context of articles for which there are balances. Increases, receipts and receipts are reflected in the credit, and decreases, expenses and disposals are reflected in the debit. At the end of the reporting period, the totals of turnovers are summed up for each account, first for the credit, and then for the debit. The results of the loan turnover do not include the initial balance, but only the amounts of transactions that occur in the reporting period are taken into account. The ending balance (Skp) is defined as follows: to the initial balance (Snk) they add the turnover on the loan (OK) and subtract the turnover on the debit (Od). The ending balance can be either credit or zero: Сkn = Cnk + Aboutк - ABOUTд. Therefore, for passive accounts, a debit means a decrease, and a credit means an increase. Understanding the economic content of active and passive accounts is very important for mastering the methods of reflecting business transactions on accounting accounts and monitoring their execution. Grouping the assets of an economic entity by source of education. Assets of an economic entity is the capital of this entity. The capital is own and attracted. Own capital is divided into two types: 1) created in the course of economic activity (additional, reserve, enterprise funds, retained earnings, reserves of future expenses and payments, targeted financing and receipts). Extra capital is formed due to the additional contribution of funds by the owners in excess of the registered authorized capital, changes in the value of assets, due to their gratuitous receipt. Reserve fund (capital) is formed from the profit of the enterprise and is used to cover losses resulting from emergencies, to pay income and dividends in case of insufficient profit. Enterprise funds: accumulation funds and consumption funds are created from the profit of the enterprise for incentives (bonuses to employees) and for social program activities. Reserves for future expenses and payments are created in order to evenly include in the expenses of the reporting period the costs of vacation pay, the repair of fixed assets, and the payment of bonuses for length of service. Targeted funding and receipts - these are funds from the state and other organizations used to cover targeted expenses; 2) created for the purpose of investing the owners of the enterprise (authorized capital). Raised capital is also divided into two types: 1) long-term (credits, loans); 2) short-term (accounts payable, deferred income). 2. Double entry, its purpose Any business transaction is necessarily characterized by duality and reciprocity. To preserve these properties and control the records of business transactions on accounts in accounting, the double entry method is used. double entry is a record, as a result of which each business transaction is reflected in the accounting accounts twice: in the debit of one account and simultaneously in the credit of another account interconnected with it for the same amount. Double entry method determines the existence of such concepts as correspondence of accounts and accounting entries. Correspondence of invoices - this is the relationship between accounts that occurs with the double entry method, for example, between accounts 50 "Cashier" and 51 "Settlement accounts", or 70 "Settlements with personnel for remuneration" and 50 "Cashier", or 10 "Materials" and 60 " Settlements with suppliers and contractors", etc. Accounting entry there is nothing more than the registration of correspondence accounts, when an entry is made simultaneously on the debit and credit of accounts for the amount of the business transaction subject to registration. Double entry is reflected differently depending on the form of accounting. With a memorial form, each operation is recorded in different registers twice: on the debit and on the credit of the account. This record is also called split. With a journal-order form of accounting, a combined entry is used. In this case, the registers are constructed in such a way that, recording the operation once, they reflect it both in debit and in credit of the corresponding accounts. As a result of this, savings in accounting labor are achieved (instead of two entries of the amount, one) and the correspondence of accounts is clearly visible. In the practice of accounting, in addition to simple ones, there are also complex postings, which are of two kinds. In the first case, when one account is debited and several accounts are credited at the same time. In this case, the amount of credited accounts is equal to the amount of debited accounts. Accounts of synthetic and analytical accounting, their relationship In accounting, three types of accounts are used to obtain various information. According to their level of detail, they are divided into synthetic, analytical and sub-accounts. Synthetic accounts contain generalized indicators about the property, liabilities and operations of the organization for economically homogeneous groups, expressed in monetary terms. Synthetic accounts include: 01 "Fixed assets"; 10 "Materials"; 50 "Cashier"; 51 "Settlement accounts"; 43 "Finished products"; 41 "Goods"; 70 "Calculations with personnel for payment of the pile"; 80 "Authorized capital", etc. Analytical accounts detail the content of synthetic accounts, reflecting data on certain types of property, liabilities and operations, expressed in natural, monetary and labor meters. In particular, on account 41 "Goods" you should know not only the total number of goods, but also specifically the presence and location of each type of product or group of goods, and on account 60 "Settlements with suppliers and contractors" - not only the total debt, but also the specific debt for each supplier separately. Sub-accounts (synthetic account of the II order), being intermediate accounts between synthetic and analytical, are intended for additional grouping of analytical accounts within this synthetic account. They are accounted for in physical and monetary terms. Several analytical accounts make up one sub-account, and several sub-accounts make up one synthetic account. In accordance with the Federal Law of November 21, 1996 No. 129-FZ "On Accounting", synthetic and analytical accounting is used in accounting. Synthetic accounting - accounting of generalized accounting data on the types of property, liabilities and business transactions for certain economic characteristics, which is maintained on synthetic accounting accounts. Analytical accounting - accounting, which is maintained in personal and other analytical accounts of accounting, grouping detailed information about property, liabilities and business transactions within each synthetic account. Synthetic and analytical accounting are organized so that their indicators control each other and eventually coincide, which is why records are kept in parallel; entries in the accounts of analytical accounting are made on the basis of the same documents as entries in the accounts of synthetic accounting, but with greater detail. There is an inextricable relationship between synthetic and analytical accounts. It is expressed in the following equalities: 1) the opening balance for all analytical accounts opened on this synthetic account is equal to the opening balance of the synthetic account: ΣCon = Cns; 2) the turnover on all analytical accounts opened on this synthetic account must be equal to the turnover of the synthetic account: ΣOa = ORc 3) the ending balance of all analytical accounts opened on this synthetic account is equal to the ending balance of the synthetic account: ΣCka = Cka The relationship between accounts and balance in accounting is manifested as follows. On the basis of these balance sheet items, active and passive accounts are opened, the names of which basically coincide with the balance sheet items. Thus, the asset article "Intangible assets" corresponds to account 04 "Intangible assets"; the liability article of the balance sheet "Additional capital" - account 83 "Additional capital", etc. Sometimes several accounts are presented in the balance sheet as one article. For example, the balance sheet item "Stocks" includes several groups of accounts (10, 11, 15, 16, 20, 21, 41, 43, etc.). At the same time, there are accounts that are reflected in the balance sheet under two items. For example, account 76 "Settlements with various debtors and creditors" in the asset balance is included in the article "Other debtors", and in the liability - in the article "Other creditors". The sums of the balances for the corresponding balance sheet items are the initial balances of the opened synthetic accounts. The total amount of debit balances of synthetic accounts corresponds to the total amount of credit balances, since these totals are something other than the totals of the asset and liability of the balance sheet. Based on the final balances of synthetic accounts, a new balance is drawn up for the first day of the next reporting period (month, quarter and year). It should be noted that there is a difference between the accounting accounts and the balance sheet, which consists in the fact that the accounting accounts reflect current business transactions and total data for reporting periods in natural, monetary and labor indicators, and the balance sheet reflects only total data at the beginning and end. reporting period in monetary terms. In the current accounting, accounts are presented that are not in the balance sheet, since they are closed before the balance sheet is drawn up - this is account 26 "General expenses", 25 "General production expenses", 44 "Sales expenses", 90 "Sales", 91 "Other income and expenses", etc. Not reflected in the balance sheet and off-balance accounts. 3. Classification of accounts Classification of accounts by economic content Grouping accounts by economic content answers one main question: "What is taken into account on this account?". Classification of accounts by economic content is presented in the following table.

Summarizing current accounting data One of the ways to summarize current accounting data are turnover sheets. In practice, the turnover sheet for synthetic accounts is called the turnover balance. The turnover sheet has a number of disadvantages: 1) there is no way to trace where the values came from and where they are directed, i.e. their movement; 2) it is impossible to establish how the property of the enterprise and the sources of its formation increase or decrease. Analytical accounting uses two main forms turnover sheets: 1) quantitative-sum; 2) contract or sum. Recording business transactions with a strict sequence is called chronological record. Determining the type of wiring: 1) if it is clear from the content of the document that there is a fact of receiving funds from the outside (the founder has contributed, a loan has been received from the bank, funds have been temporarily borrowed from creditors, materials have been received from suppliers, works or services have been accepted, debts have arisen on funds or the budget with mandatory deductions) , means the first type of posting: the debit of the active account and the credit of the passive account are involved; 2) if it is clear from the content of the document that there is a fact of the return of previously received funds, regardless of whom, or a payment was made on debts (the founder left, the loan was returned to the bank, borrowed funds were returned to creditors, taxes were transferred, etc.), - this is the second type postings - the credit of the active account and the debit of the passive account are involved; 3) if it is clear from the content of the document that there is a fact of moving any funds from one accountable person or storage location to another (from warehouse to warehouse, to production or to the buyer, from the cash register to the account or vice versa, and similar operations), this is the third type of posting : debit of the active account and credit of the active account; 4) if it is clear from the content of the document that there is a fact of transfer of funds from one owner to another or transfer from one fund to another (profit is distributed to the reserve, for the development of production and other purposes, the transfer of a share of one founder to another, the transfer of urgent loans to overdue, etc. .), is the fourth type of posting: debit of the passive account and credit of the passive account. Rule: Active group - investment rule (funds are invested). Passive group - preparation for investment (sources of funds, funds, reserves, income). Active-passive group - calculations can be both profitable and expenditure, i.e. active and passive meaning. Classification of accounting accounts by structure