|

|

Lecture notes, cheat sheets

Accounting. Accounting theory (lecture notes)

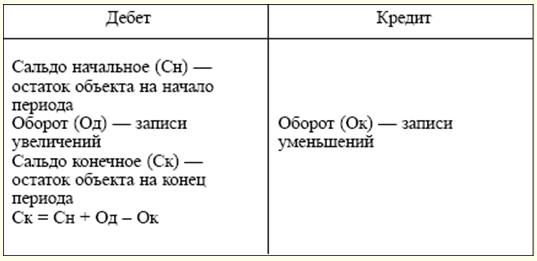

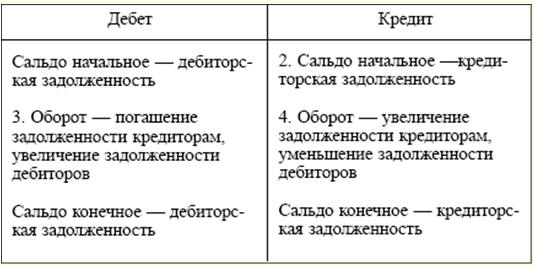

Directory / Lecture notes, cheat sheets Table of contents (expand) SECTION I. THEORY OF ACCOUNTING Topic 1. PRINCIPLES AND CONCEPTS OF ACCOUNTING IN A MARKET ECONOMY economic accounting is a system for monitoring, measuring and recording the processes of material production in order to control and manage them. To quantify the property of an organization, its obligations and business transactions in economic accounting, three types of meters are used: natural, labor and monetary. Natural meters serve to characterize the objects taken into account in physical terms. Depending on the physical properties of the object, various meters are used (meter, liter, kilogram, kilowatt-hour, etc.). Labor meters (hour, day, month) - a kind of natural meters. They are used in calculating the amount of labor costs. Universal meter - money. As a rule, natural and labor meters are reflected in the monetary meter. Thus, the monetary meter is used to reflect property, liabilities and business transactions in a single measurement, in Russian accounting - in rubles. There are three types of economic accounting: operational, statistical and accounting. Each of them has its own specifics, a certain range of observed phenomena, specific tasks and methods of observation. They complement each other and constitute a unified system of economic accounting in the Russian Federation. Operational accounting is used to register, monitor and control certain phenomena of the financial and economic activities of the organization. With its help, daily monitoring of the progress of production and its sale, the expenditure of the wage fund, the timely receipt of material values, etc. is carried out. Statistical accounting studies and generalizes mass phenomena and their patterns in the financial and economic activities of organizations (movement of commodity mass, inflationary processes, market dynamics). Statistical accounting data is used for economic analysis and forecasting for the current and future periods. Бухгалтерский учет is an ordered system for collecting, registering and summarizing in monetary terms information about the property, obligations of the organization through continuous, continuous documentation. Accounting has its own characteristics that distinguish it from other types of accounting, namely: ▪ is documented; ▪ continuous in time (from day to day) and continuous in scope (without gaps) of all changes occurring in the financial and economic activities of the organization; ▪ uses special, unique methods of data processing (accounts and double entry). Accounting is divided into accounting theory, financial and management accounting. Accounting theory is the theoretical, methodological and practical basis for organizing an accounting system. Financial accounting is a system for collecting accounting information that provides accounting and registration of business transactions, as well as the preparation of financial statements. Management accounting is designed to collect accounting information that is used within the organization. Its main goal is to provide information to managers at various levels responsible for achieving specific production results. The tasks of accounting are enshrined in legislation: ▪ generation of complete and reliable information about the organization’s activities and its property status, necessary for internal users of financial statements: managers, founders, participants and owners of the organization’s property, as well as external ones - investors, creditors, etc.; ▪ providing information to internal and external users of accounting statements to monitor compliance with legislation when the organization carries out business operations and their feasibility; the presence and movement of property and liabilities; use of material, labor and financial resources in accordance with approved norms, standards and estimates; ▪ timely prevention of negative phenomena in the financial and economic activities of organizations, identification and mobilization of internal reserves and forecasting of the organization's performance for the current period and for the future. Topic 2. REQUIREMENTS AND ASSUMPTIONS IN ACCOUNTING The emergence of new economic and legal relationships presupposes the orientation of accounting on the principles of accounting generally accepted in world practice. (Accounting Reform Program, approved by Decree of the Government of the Russian Federation No. 06.03.98 dated March 283, XNUMX.) The principle is the basis, the initial, basic position of accounting as a science, which predetermines all the statements arising from it. The principles of accounting are enshrined in the Accounting Regulation "Accounting Policy of the Organization" (PBU 1/98) (approved by order of the Ministry of Finance of Russia dated 09.12.98 No. 60n). According to this PBU, the principles are divided into basic and basic. Basic principles (assumptions) - these are the conditions that are created by the organization when setting up accounting (clause 6 PBU 1/98): ▪ 1. Property isolation. The property and obligations of an organization exist separately from the property and obligations of the owners of this organization and other organizations. 2. Business continuity. The Organization will continue in operation for the foreseeable future and has no intention of liquidating or substantially reducing operations. 3. The sequence of application of accounting policies. The accounting policy chosen by the organization will be consistently applied from one reporting period to another. 4. Temporal certainty of the facts of economic activity. The facts of economic activity refer to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds. Basic principles (requirements) are generally accepted accounting principles arising from the current legislation (clause 7 PBU 1/98): ▪ 1. Completeness. Completeness of reflection in accounting of all facts of economic activity. 2. Timeliness. All facts of economic activity must be reflected in the accounting in a timely manner. 3. Prudence (or caution). An organization should be more prepared to account for losses than for income. 4. Priority of content over form. Reflection in the accounting of the facts of economic activity, based not only on their legal form, but also on the economic content. 5. Consistency. Identity of accounting data of internal analytical information. 6. Rationality. Rational and economical accounting, based on the conditions of activity and the size of the organization. Topic 3. NORMATIVE REGULATION OF ACCOUNTING The first (legislative) level consists of laws and other legislative acts (decrees of the President of the Russian Federation, decrees of the Government of the Russian Federation), directly or indirectly regulating the establishment of accounting in an organization. A special place at this level is occupied by the Federal Law of November 21.11.1996, 129 No. XNUMX-FZ "On Accounting". This document establishes a unified legal and methodological basis for the organization and maintenance of accounting. A very important place at this level belongs to the Civil Code of the Russian Federation and the Tax Code of the Russian Federation. In the first part of the Civil Code, many issues of accounting work are legislatively fixed. The application of the Tax Code has significantly streamlined the basic rules and procedures related to the taxation of commercial organizations. The second level of regulatory regulation is the Accounting Regulations (PBU). These documents summarize the principles and basic rules of accounting, set out the basic concepts related to individual areas of accounting, as well as accounting techniques (without specifying the mechanism for their application to a particular type of activity). Disclosure of PBU norms should be carried out in third-level documents - methodological guidelines and recommendations for accounting. This group of documents includes guidelines for planning, accounting and costing of products; guidelines for the inventory of property and financial obligations; guidelines for filling out forms of financial statements, etc. The most important documents of this level are the new Chart of Accounts and Instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31.10.2000, 94 No. XNUMXn). To them one can add numerous instructions from the Ministry of Finance of Russia on issues that arise for the first time in the practice of economic activity. The fourth level in the regulatory system should be occupied by the working documents of the organization that form its accounting policy in methodological, technical and organizational aspects. The regulatory system is designed to ensure the formation of complete and reliable information about the financial and economic activities of the organization. Topic 4. SUBJECT OF ACCOUNTING The subject of accounting is the economic activity of the organization. To characterize the phenomena that are subject to accounting, there is the concept of "accounting object". An object is understood as any phenomenon that can be objectively expressed in valuation and is necessary for management needs. In the theory of accounting, three groups of objects are distinguished: assets, liabilities, business transactions. The assets of the organization (property) include: ▪ 1) non-current assets: ▪ fixed assets are means of labor used in carrying out the financial and economic activities of the organization for a period exceeding 12 months: buildings, structures, transport, equipment, computer equipment, etc.; ▪ profitable investments in material assets - expenses of the organization in the form of investments in buildings, equipment and other assets that have a material structure, provided by the organization for temporary use in order to generate income; ▪ intangible assets - long-term costs of an organization to acquire exclusive rights to the results of intellectual activity arising from patents, certificates and other documents of protection. This category also includes organizational expenses arising when creating a business entity in the form of a contribution to the authorized capital, and the value of the business reputation of the acquired organizations; ▪ investments in non-current assets - long-term investments of the organization in the acquisition (construction) of fixed assets, creation and acquisition of intangible assets; ▪ long-term financial investments - investments of an organization in securities of joint-stock companies, state and private debt securities, authorized (share) capitals of other organizations; ▪ 2) current assets: ▪ production inventories - a set of means of labor involved in the process of production, performance of work, provision of services: raw materials, supplies, fuel, spare parts; ▪ goods - assets acquired or received from other persons and intended for sale; ▪ finished products - products that have been completely processed, accepted by technical control and, in accordance with the approved acceptance procedure, delivered to the warehouse; ▪ cash - cash in hand, free cash in settlement, currency and other bank accounts; ▪ short-term financial investments - investments of the organization in bonds, bills, etc.; ▪ accounts receivable (funds in settlements) - funds of an organization that are temporarily at the disposal of other organizations and individuals. The liabilities of the organization include: ▪ 1) own capital: ▪ authorized capital - the totality of contributions of founders to property in monetary terms when creating an organization to ensure its activities, in the amounts determined by the constituent documents; ▪ reserve capital - part of retained earnings reserved for purposes specified by law (to cover losses, repay dividends on preferred securities in cases where other funds are not available); ▪ additional capital - an internal source that is formed due to changes in the value of assets; ▪ retained earnings - profit remaining at the disposal of the organization from the beginning of its activities, minus payments and withdrawals in accordance with the law; ▪ targeted financing - funds intended to finance certain targeted activities (funds received from other organizations, subsidies from government bodies, etc.); ▪ 2) obligations of the organization (raised capital): ▪ long-term liabilities - loans and borrowings, the repayment period of which occurs no earlier than in 12 months; ▪ short-term liabilities - loans and borrowings that mature in less than 12 months. It also highlights current accounts payable that arise in the process of the financial and economic activities of the organization. Topic 5. METHOD OF ACCOUNTING An accounting method is a set of methods and techniques for reflecting the financial and economic activities of an organization, which include specific methods for monitoring accounting objects, their measurement, grouping and generalization. The main elements of the method are techniques related to: ▪ with the organization of accounting supervision, i.e., obtaining primary information about all business transactions occurring in the organization. Documentation and inventory are used for this purpose; ▪ organization of accounting measurements. These are estimation and calculation; ▪ grouping of accounting objects. Accounting and double entry are used here; ▪ generalization of accounting data. For this purpose, a balance sheet summary of information and a set of indicators are used. 5.1. Documentation An accounting document is a written evidence that confirms the fact of a business transaction, the right to perform it, or establishes the liability of employees for the values entrusted to them. The financial and economic activities of organizations are accompanied by the implementation of numerous and varied operations. In turn, each business transaction must be formalized by accounting documents that contain primary information about the business transactions performed or the right to perform them. Any completed transaction must be documented. It is a properly drawn up document that gives the operation legal force. Documents must be accurate and completed in a timely manner. Documents are closely related to concepts such as documentation (primary accounting), unification, standardization and workflow. Documentation is a way of registering property, obligations and business transactions with accounting documents. No operation can be reflected in the accounting without confirmation of its relevant documents. The correct and timely registration of all business transactions with documents is the initial stage of accounting. Unification of documents is the development of standard forms of documents for their use in the execution of homogeneous operations in various organizations, regardless of the form of ownership and departmental affiliation. Unified forms of primary documentation are approved by resolutions of the State Statistics Committee of Russia. Standardization is the establishment of the same (standard) sizes of forms of the same type of documents, which allow more efficient use of paper when printing documents, reduce its waste. In addition, standardization facilitates the accounting processing of documents, including with the help of a computer, and the storage of documents in an archive. Document flow is the path that a document takes from the moment it is drawn up to being archived. In each organization, the document flow is developed by the chief accountant and approved by the head of the organization. Lack of workflow or its fuzzy organization leads to neglect of accounting and various abuses. 5.2. Inventory To ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of property and liabilities, during which their presence, condition and assessment are checked and documented. The procedure for conducting an inventory (the number of inventories in the reporting year; their dates; the list of property and liabilities checked during each of them, etc.) is determined by the head of the organization, with the exception of the following cases when an inventory is required: ▪ when transferring property for rent, redemption, sale, as well as during the transformation of a state or municipal unitary enterprise; ▪ before preparing annual financial statements; ▪ when facts of theft, abuse or damage to property are revealed; ▪ in case of a natural disaster, fire or other emergency situations caused by extreme conditions; ▪ during reorganization or liquidation of an organization. By completeness of coverage, inventories are divided into continuous and selective, by the nature of the conduct - into mandatory and optional (see also 15.6). 5.3. accounting accounts An accounting account is a special way of grouping, current reflection and control of changes in individual homogeneous accounting objects. The score is a two-sided table: the left side is Debit, right - Credit. These terms began to be used during the emergence of accounting in Western European countries. At that time, accounting covered only trade and credit transactions, and these words were used to denote the settlement relationships between merchants and bankers. Subsequently, they turned into accounting terms. Depending on the content, accounting accounts are divided into: ▪ active - designed to record property by availability, composition and location; ▪ passive - reflect the accounting of property by sources of its formation. Active account

On active accounts, the balance can be only in debit or absent. Passive account

On passive accounts, the balance can be only in credit or absent. In addition to active and passive accounts, active-passive accounts are used in accounting practice. They have features of both accounts. Active-passive accounts are used, as a rule, to account for any calculations. Active-passive accounts can have both debit and credit balances. A special group of off-balance accounts is designed to record values that do not belong to the organization or require special control. Such objects may include fixed assets held by the organization on the terms of the current lease; inventory items in safekeeping; strict reporting forms, etc. The structure of off-balance accounts does not differ from the structure of balance accounts. Active-passive account

5.4. double entry By its economic nature, any business transaction is necessarily characterized by duality and reciprocity. To preserve these properties and control the records of business transactions on accounts in accounting, the double entry method is used. A double entry is a record, as a result of which each business transaction is reflected in the accounting accounts twice: on the debit of one account and the credit of another account interconnected with it. Related to the double entry method are concepts such as "correspondence of accounts" and "accounting entry". Correspondence of accounts is the relationship between accounts that occurs with the double entry method. Accounting entry is the registration of correspondence of accounts, when an entry is simultaneously made on the debit and credit of accounts for the amount of the business transaction. Accounting entries can be simple or complex. A simple accounting entry is the interaction of two accounts. Complex accounting entry - the interaction of three or more accounts. 5.5. Evaluation Valuation is a monetary expression of the value of an object in accounting, that is, the amount in which an object is recognized in accounting and reporting. An assessment of the obligations, income and expenses of the organization, as well as the means of production and inventories is singled out. Accounts receivable, as a rule, are estimated on the basis of the conditions established by the agreement between the organization and the debtor. The same principles apply to the assessment of the organization's income. Accounts payable are assessed based on the conditions of occurrence. Expenses are recognized in accounting in actual amounts. The acquired property is valued depending on the source of the acquisition. Valuation of property purchased for a fee is carried out by summing up the actual costs incurred for its purchase; property received free of charge - at market value on the date of posting; property produced by the organization itself - at the cost of its manufacture. The composition of actually incurred costs includes, in particular, the costs of acquiring the object itself; commissions (cost of services) paid to supply, foreign trade and other organizations; customs duties and other payments; transportation, storage and delivery costs carried out by third parties. The use of other valuation methods, including by way of reservation, is allowed in cases provided for by the legislation of the Russian Federation, as well as by the regulations of the Ministry of Finance of Russia and bodies that are granted the right to regulate accounting by federal laws. 5.6. Calculation Calculation is the result of calculating in monetary terms the value of individual accounting objects and at the same time a method of their evaluation. The subject of calculation is understood as the object of accounting, the cost of which is necessary for the management needs of the organization and is of interest to other users of accounting information. All processes of the organization's activities are subject to calculation. In the process of acquiring the means of production, the cost of individual objects of non-current assets is determined. In the process of procurement of inventories, their cost and the cost of the procurement process as a whole are revealed. In the production process, the production cost of various types of products is determined using costing. In the sales process, the total cost of goods sold and the proceeds from it are calculated. Thus, costing qualifies as an element of the accounting method and acts as a necessary addition to the assessment. 5.7. Financial statements The composition, procedure for registration and presentation of financial statements is regulated by PBU 4/99 "Accounting statements of organizations" (approved by order of the Ministry of Finance of Russia dated 06.07.1999 No. 43n). Financial statements are a system of indicators reflecting the property and financial position of an organization at the reporting date, as well as the financial results of its activities for a certain period. The financial statements of the organization should include performance indicators of all its branches, representative offices and other divisions. The financial statements include: ▪ balance sheet (form No. 1); ▪ profit and loss statement (form No. 2); ▪ explanations to the balance sheet and profit and loss statement; ▪ auditor's report (if, by law, reporting is subject to mandatory audit). Organizations must prepare financial statements for the month, quarter and year on an accrual basis from the beginning of the year. At the same time, monthly and quarterly reporting are intermediate. The reporting year for organizations is the period from January 1 to December 31 inclusive. For newly created organizations, the first reporting year is the period from the date of their state registration to December 31, inclusive, and for organizations established after October 1, to December 31 of the next year, inclusive. For the preparation of financial statements, the reporting date is the last calendar day of the reporting period, inclusive. The annual reporting includes: ▪ balance sheet (form No. 1); ▪ profit and loss statement (form No. 2); ▪ explanations to the balance sheet and profit and loss statement; ▪ the final part of the auditor's report. Small business entities have the right not to submit explanations to the balance sheet and income statement as part of the annual report. Quarterly financial statements include: ▪ balance sheet (form No. 1); ▪ profit and loss statement (form No. 2). (See also 27.1 "Requirements for the preparation of financial statements", 27.2 "Composition and content of financial statements, 27.4 "Meaning and functions of the income statement", 27.5 "Consolidated financial statements".) 5.8. Balance sheet The procedure for compiling and the requirements for the balance sheet are fixed by PBU 4/99 and Order of the Ministry of Finance of Russia dated July 22.07.03, 67 No. XNUMXn "On Forms of Accounting Statements of Organizations". The balance sheet is a summary of the closing balances of all accounts. In a generalized form, it is a two-sided table: the left side is called Asset, the right side is called Passive. In the Asset of the balance, information is collected on the value of the assets (property) of the organization, in the Passive - on the sources of formation of this property. The total of the Asset is equal to the total of the Passive. (This equality is usually called the general balance equation.) The result of the balance sheet is otherwise called the balance sheet currency. In the current balance sheet, there are two sections in the Asset and three in the Liabilities. Each section consists of articles. Each article has a serial number and contains information about one or more accounting objects. There are several types of balance: ▪ reporting balance - as of the reporting date; ▪ opening balance - information on the funds and sources of the organization at the beginning of its activities; ▪ liquidation balance sheet - compiled upon liquidation of an organization; ▪ separation balance sheet - compiled when dividing an organization; ▪ unification balance sheet - compiled during a merger of organizations. (See also 27.3 Meaning and Functions of the Balance Sheet.) Topic 6. CLASSIFICATION OF ACCOUNTS The classification of accounting accounts is their grouping on the basis of the homogeneity of the economic content of the indicators of property, liabilities and business transactions reflected in them. Accounting accounts can be classified: ▪ 1) due to balance (active, passive, active-passive, off-balance sheet) (see 5.3 "Accounts"); ▪ 2) according to the purpose and procedure for keeping records: ▪ tangible, or property - used to control and account for fixed assets, intangible assets, material assets: 01 “Fixed assets”, 07 “Equipment for installation”, 10 “Materials”, etc. Strictly active accounts; ▪ cash - intended for accounting for transactions with cash: 50 “Cash”, 51 “Settlement accounts”. Active accounts; ▪ stock funds - intended to account for stable and long-term sources of funds: 80 “Authorized capital”, 82 “Reserve capital”, 83 “Additional capital”. Strictly passive accounts; ▪ contractual (regulatory) - intended to regulate the assessment of an object. Opened in addition to the main property accounts to adjust the valuation of an object: 02 “Depreciation of fixed assets”, 05 “Depreciation of intangible assets”; ▪ collection and distribution - used to account for expenses that, at the time of their occurrence, cannot be immediately attributed to specific manufactured or sold products. At the end of the month, these expenses are attributed to a specific type of product in accordance with the accepted methodology (25 “General production expenses”, 26 “General business expenses”). These accounts do not have a balance and are not reflected in the company’s balance sheet; ▪ costing - intended to reflect production costs, which are taken into account when preparing costing calculations to determine the actual cost of specific types of products (works, services): 20 “Main production”, 23 “Auxiliary production”, 44 “Sales expenses”. Strictly active accounts; ▪ loan, or credit, - intended for accounting for bank loans: 66 “Short-term loans and borrowings”, 67 “Long-term loans and borrowings”. Strictly passive accounts; ▪ budgetary and distribution - intended for dividing expenses between reporting (budget) periods: 96 “Reserves for future expenses”, 97 “Future expenses”, 98 “Future income”; ▪ operational-resultative - designed to collect information about the organization’s income and expenses and determine the financial result: 90 “Sales”, 91 “Other income and expenses”, 99 “Profits and losses”. Active-passive accounts; ▪ 3) according to the level of detail of indicators: ▪ synthetic (first order accounts) - contain generalized indicators of property, liabilities and transactions for economically homogeneous groups. Accounting is carried out only in monetary terms and gives a general description of the object; ▪ sub-accounts (second-order accounts) - are intermediate between synthetic and analytical accounts. Designed for additional grouping of analytical accounts within a given synthetic account. Consequently, several analytical accounts make up one sub-account, and several sub-accounts make up one synthetic account; ▪ analytical (third-order accounts) - detail the content of synthetic accounts for individual types of property and transactions. Accounting is organized both in monetary and in natural and labor measures. Topic 7. GENERAL PRINCIPLES OF ACCOUNTING FOR BUSINESS PROCESSES Organizations perform a variety of business transactions that make up the content of the main business processes. It is economic processes that are for the organization the objects that make up economic activity. There are three main business processes in an organization: ▪ procurement of inventory items; ▪ production of products (performance of work, provision of services); ▪ sale of products (performance of work, provision of services). Basic principles of accounting for the process of procurement of inventory items. This process is a complex of business operations to provide the organization with raw materials, supplies, fuel, energy and other items and means of labor necessary for the production of products (performance of work, provision of services). During this process, both durable and disposable property is acquired. When purchasing inventories, the organization pays the supplier their cost at purchase prices, and also bears additional costs associated with the supply (for transportation and unloading, for delivery from the railway station, from the airport or from the pier to the warehouse of the organization). All of these costs are referred to as "Procurement and Delivery Costs". Thus, the actual cost of acquiring (procurement) stocks consists of the cost at acquisition (procurement) prices and the costs of procurement and delivery of these valuables to the organization. The main accounting accounts used in the procurement process: 10 "Materials", 51 "Settlement accounts", 60 "Settlements with suppliers and contractors". The buyer, having received from the supplier an invoice for the materials shipped to him, accepts it (gives consent to payment) or refuses to accept it. Based on the acceptance of the account in the accounting of the organization, an accounting entry is made on the debit of account 10 and the credit of account 60 for the cost of materials at purchase prices. Example 1

In the debit of account 10, in addition to the purchase cost of materials, additional costs associated with their delivery, unloading, and stacking are taken into account. Summing up the cost of materials at purchase prices and additional costs, we calculate the actual cost of purchased inventory items (example 1). Thus, despite the fact that the purchase price of materials is 756 rubles, the actual cost of the acquired object was 000 rubles. The tasks of accounting for the process of procurement (acquisition) of resources: ▪ documentation and timely recording of the receipt of materials, fixed assets, and intangible assets; ▪ reliable calculation of the initial cost of fixed assets, intangible assets, the actual cost of purchased materials; ▪ timely repayment of debts to suppliers and contractors. Basic principles of accounting for the production process. This process is the process of workers influencing objects of labor with means of labor to obtain finished products. Human labor, objects and means of labor take part in the sphere of production. As a result, the organization generates the corresponding costs: wages to employees; the cost of items spent on the manufacture of products, etc. In addition, the organization has overhead costs (maintenance of machinery and equipment, the cost of repairing fixed assets for production purposes, etc.) and general business expenses (administrative and managerial, expenses for payment for information and audit services, etc.). All these costs add up to the cost of manufactured products, work performed or services rendered. To account for production costs and calculate the cost of manufactured products, the main account 20 "Main production" is used. The debit of this account collects all costs that, in accordance with applicable law, are included in the cost of products (works, services) (example 2). According to the debit of account 20, there may be a balance that shows the balance of work in progress at the beginning or end of the reporting period. The credit of the account reflects the production cost of finished processing of products, work performed or services rendered (example 3). Example 2

Example 3

The tasks of accounting for the production process:

Fundamentals of accounting for the implementation process. The scope of sales is a set of business operations related to the marketing and sale of products (performance of work, provision of services), fixed assets and other assets, as well as the determination of financial results (profit or loss). When accounting for transactions related to the sale and determination of the financial result, the following accounts are used: 43 "Finished products", 90 "Sales", 91 "Other income and expenses", 99 "Profits and losses". The organization may also incur additional sales costs: packaging, transport, commission fees, advertising costs, etc. These costs are called commercial (non-production) and are accounted separately on account 44 "Sale costs". The main accounting account on which the organization keeps records of the process of selling finished products (performance of work, provision of services) is account 90 "Sales". On this account, the financial result from the sale of products (performance of work, provision of services) is revealed as the difference between the cost of the sale and the full cost. The peculiarity of account 90 is that on it the same business transactions are expressed in two estimates: at cost (expenses) and at sales prices (income). Comparison of these two estimates and allows you to identify the financial result.

The calculated financial result from the sale of products (performance of work, provision of services) is subject to mandatory write-off at the end of the month to account 99 "Profit and Loss". Thus, the balance on account 90 "Sales" does not remain. A similar principle of operation is used when making accounting entries on account 91 "Other income and expenses". The tasks of accounting for the implementation process:

Topic 8. TYPICAL CHANGES IN THE BALANCE SHEET UNDER THE INFLUENCE OF COMPLETE BUSINESS OPERATIONS Business transactions arising in the course of the organization's activities do not violate the equality of the results of the Asset and Liabilities, while the amounts in the context of individual articles and sections of the balance sheet may change. This is explained by the fact that each operation affects two balance sheet items. At the same time, they can be in the Asset or the Passive, or both in the Asset and the Passive. Depending on the nature of the change in items, business transactions can be divided into four groups: ▪ Type 1 of business transactions shows changes in Asset items with a constant balance sheet currency. Example 1 Receipt of money from the current account to the cashier: ▪ Debit accounts 50 "Cash register" Credit accounts 51 "Settlement Accounts". Transfer of materials for production needs: ▪ Debit accounts 20 "Primary production" Credit accounts 10 "Materials". ▪ Type 2 is characterized by changes in Liability items with a constant balance sheet currency. Example 2 Part of retained earnings is used to replenish the reserve capital: ▪ Debit accounts 84 "Retained earnings (uncovered loss)" Credit accounts 82 "Reserve capital". Personal income tax charged: ▪ Debit accounts 70 "Settlements with personnel for payroll" Credit accounts 68 "Calculations on taxes and fees". ▪ Type 3 causes changes in the Asset and Liability items, while the balance sheet currency increases. Example 3 Calculation of wages for workers of the main production: ▪ Debit accounts 20 Credit accounts 70. Short-term bank loan received: ▪ Debit accounts 51 Credit accounts 66 "Calculations on short-term credits and loans". ▪ 4th type causes changes in the Asset and Liability items, while the balance sheet currency decreases. Example 4 Wages paid to workers: ▪ Debit accounts 70 Credit accounts 50. Short-term bank loan returned: ▪ Debit accounts 66 Credit accounts 51. Topic 9. ACCOUNTING REGISTERS AND FORMS OF ACCOUNTING REPORTS Under the accounting technique is understood the registration of accounting information, carried out manually or with the help of technical means. For this purpose, accounting registers are used. Registers are designed to systematize and accumulate information contained in primary documents for reflection in accounting accounts and financial statements. The correctness of the reflection of business transactions in the accounting registers is ensured by the persons who compiled and signed them. The content of internal reporting registers is a trade secret. Accounting registers reflect all business transactions. Registers can be kept in special books, on separate cards, in the form of typescripts. Forms of registers are developed and recommended by the Ministry of Finance of Russia; bodies to which federal legislation grants the right to regulate accounting; executive authorities, as well as the organizations themselves, subject to the general methodological principles of accounting. Accounting registers are tables of a special form designed to register business transactions. They differ in: ▪ Classification of accounting registers by appearance. ▪ Accounting books - bound accounting tables with special graphics. They are used for accounting in accounting at production sites (workshops, warehouses, teams). All pages are numbered, the number of pages and the signature of the chief accountant are indicated at the end of the book. The most common: General Ledger and Inventory Ledger. ▪ Cards - separate sheets of paper or cardboard of a small standard size, lined up for accounting needs. Must be kept in a file cabinet. Cards are distributed into sections, and special signs are attached to them. Each card file is assigned to an accountant who is responsible for the safety of the cards and the accuracy of the entries made. ▪ Free sheets (statements, order journals, typographs) - unlike cards, they are stored in registration folders. Classification by nature of recording. ▪ Chronological registers - used to register all documents in the order they were received, but without distributing them among accounts. Chronological recording is made in special registration journals or registers (Cash Book, Register of Incoming Goods, inventory of cards for accounting of fixed assets). Its purpose is to ensure control over the safety of documents received by the accounting department and the correctness of the recording. Chronological registration is used for making inquiries. ▪ Systematic registers - maintained for grouping accounting records into synthetic and analytical accounts (The general ledger is maintained by the accounting department using a memorial order form of accounting for grouping transactions into synthetic accounts). ▪ Combined registers - combine chronological and synthetic records (most order journals, the "Main Journal" book). Classification by volume of information. Synthetic registers - open for maintaining synthetic accounts (without explanatory text, indicating only the date, numbering and posting). A short text is rarely given (register of accounting documents). Analytical registers - serve to reflect the indicators of analytical accounts and control the presence and movement of each type of value. Classification by structure. One-way registers - various cards for accounting for material values, settlements, they combine separate columns of debit and credit entries. Accounting is kept on one sheet in monetary, natural or both meters simultaneously. One-way register form. Bilateral registers - used in bookkeeping. The account is opened on a expanded page, the left one is Debit, the right one is Credit. Used only for manual accounting. Double-sided register form. ▪ Multigraph registers - reflect additional indicators within the analytical account. In particular, accounting for the movement of materials is reflected for the organization as a whole, as well as in the context of materially responsible persons, departments and cost items. ▪ Linear registers are a type of polygraph registers. Here, each analytical account is reflected on only one line, which makes it possible to divide the synthetic account into an unlimited number of analytical ones. ▪ Chess registers - used to simultaneously reflect the amounts in the debit of one account and the credit of another. Each amount is written at the intersection of a row and a column. Topic 10. CORRECTION OF ERRORS IN DOCUMENTS AND ACCOUNTING REGISTERS When maintaining documents and registers of blots, erasures are not allowed both in the digital and in the text part. When storing accounting registers, they must be protected from unauthorized correction. To correct erroneous entries in accounting, several methods are used. Corrective method - consists in crossing out the text or amount and writing the correct text or amount over the crossed out one. Strikethrough is done with one line so that it is possible to read the strikethrough. The entire amount is crossed out completely, even if only one figure is erroneously recorded. The correction must be specified and confirmed: in the document - by the signatures of the persons who endorsed the document; in accounting registers - by the signature of the person who made the correction. In the margins opposite the line of the corrected entry, a typical clause is given: "Believe the corrected". The corrective method is used to correct errors as a result of incorrect calculation of totals, as well as in cases of recording in the wrong accounting register that is indicated in the transaction. This method is used if errors are found in the registers of the journal-order form of accounting before putting down the results, as well as in the accounting registers of the memorial-order form before the presentation of the balance sheet. After the totals have been transferred to the General Ledger, no corrections are allowed. In this case, the accounting department draws up a certificate for the amount of the error, the data of which is entered in the General Ledger as a separate line. These certificates are stored in the relevant registers. Method of additional posting - is used when the amount recorded in the registers is less than the actual one: ▪ if the correspondence of accounts is indicated correctly, but in a smaller amount; ▪ if the actual cost of production is higher than the standard (planned) one. Postings are made for the missing amount. Example 1 On the basis of an extract from the current account, 1000 rubles were received by the cashier. Prepared accounting entry: Debit accounts 50 "Cash register" Credit accounts 51 "Settlement accounts" in the amount of 100 rubles. So additional wiring is needed: Debit accounts 50 "Cash register" Credit accounts 51 "Settlement accounts" in the amount of 900 rubles. The "red side" method (or negative entry) is used to correct erroneous entries if they are made for a large amount, or when making an incorrect posting. The correction is that the incorrect entry or entry is overwritten in red (or highlighted: "circle"), then the entry is made in normal color. When calculating the totals, the "red" amount is subtracted. Example 2 Consider the same case as in the previous example, but with this version of the wiring: Debit accounts 51 "Settlement accounts" Credit accounts 50 "Cashier" in the amount of 1000 rubles. The fix is to write the wiring: Debit accounts 51 "Settlement accounts" Credit accounts 50 "Cashier" in the amount of 1000 rubles. in red ink, and then the correct wiring is written: Debit accounts 50 "Cash register" Credit accounts 51 "Settlement accounts" in the amount of 1000 rubles. Topic 11. FORMS OF ACCOUNTING To register information in accounting in different combinations, books, cards, magazines, etc. are used, entries in which are made in different sequences. As a result, various forms of accounting are formed. The form of accounting is understood as a set of accounting registers that predetermine the relationship between synthetic and analytical accounting, the methodology and technique for registering transactions, the technology and organization of the accounting process. The following are the most common forms of accounting. "magazine main". This is one of the book and card forms of accounting, conducted in organizations with a small volume of production, in individual institutions and some financial bodies. A characteristic feature of this form is that the registers for chronological and systematic records are combined in one register - the "Magazine Main". Journal entries are written directly from primary documents or from consolidated documents. When registering, each posting is assigned a number and one line is assigned. Synthetic account balances are transferred to the journal at the beginning of the month. Then transactions are recorded, turnovers are displayed and the balance is calculated. Thus, the accounts are closed after the balance is recorded on the 1st day of the next month. Analytical accounting is kept in books or on cards. According to the analytical accounting, a turnover sheet is compiled, which is checked against the synthetic accounting data.

A simple form is maintained using property registers. Eight unified statements are used as accounting registers: ▪ B1 (accounting for fixed assets and depreciation charges); ▪ B2 (accounting for inventories, goods, finished products and VAT paid by value); ▪ B3 (accounting for production costs); ▪ B4 (accounting for cash and funds); ▪ B5 (accounting for settlements and other operations); ▪ B6 (sales accounting); ▪ B7 (accounting for settlements with suppliers); ▪ B8 (accounting for wages). Accounting for operations is completed after a month by calculating the totals for turnover. The results are entered in the chess sheet - B9. The memorial order form of accounting got its name from the memorial order, which completes the processing of primary documents. With this form of accounting, a memorial order is drawn up for each business transaction (or group of transactions combined in a consolidated document). A characteristic feature of this form is that the documents received by the accounting department are accumulated and recorded in the accumulative statements. A memorial order is drawn up for each group of documents. All documents related to this posting, both primary and summary, are attached to it. The order indicates the number, summary of the operation, debit, credit, amount. Synthetic accounting is conducted in two registers: ▪ registration journal; ▪ General ledger. The journal is used to record transactions in chronological order. Then memorial warrants are recorded in the General Ledger, which has a two-sided form. Analytical accounting is carried out mainly in cards, entries in analytical accounting registers are made directly from primary or summary documents attached to the order. The journal-order form got its name from the main register - the journal-order. With this form of accounting, two main registers are used: ▪ To facilitate the work of summarizing and grouping data, special development tables are used. Order magazines are free sheets built according to the chess principle. Entries are made on the basis of receipt of documents. Order journals are built on a credit basis. They can be used for one account (journal-order No. 1 - "Cashier", journal-order No. 2 - "Settlement account") or for several accounts (journal-order No. 10 - "Costs of production"). In addition to order journals, statements are opened. They are used when the required analytical indicators are difficult to obtain directly from order journals. Cash transactions, transactions on settlement and currency accounts are recorded both in debit and credit. The totals of the order journals at the end of the month are transferred to the general ledger.

The main ledger opens for a year. One or two sheets are assigned to each account. Based on the General Ledger and other registers, reporting forms are filled out. The automated (electronic) form arose with the use of computer technology for data processing. Special programs for accounting and financial calculations have been developed that allow you to form certain indicators and make calculations. The use of an electronic form of accounting allows without printing:

The choice of the form of accounting is reflected in the order on the choice of accounting policy. Topic 12. RIGHTS AND OBLIGATIONS OF THE CHIEF ACCOUNTANT Accounting in the organization is carried out by the accounting department headed by the chief accountant. If the organization does not have an accounting service, the head has the right to entrust accounting and reporting to a specialized organization or relevant authorities (on a contractual basis). Work in accounting is divided, as a rule, into main groups, for example: ▪ settlement - deals with issues related to accounts 69 "Settlements for social insurance and security", 70 "Settlements with personnel for wages", 71 "Settlements with accountable persons", 73 "Settlements with personnel for other transactions", 76 "Settlements with different debtors and creditors”, etc.; ▪ material - accounts 10 “Materials”, 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, etc.; ▪ production-costing, or cost, - accounts 20 “Main production”, 21 “Semi-finished products of own production”, 23 “Auxiliary production”, 25 “General production expenses”, etc. The chief accountant is appointed (dismissed) by the head of the organization and reports directly to him. In his work, he must be guided by the legislation of the Russian Federation and regulatory legal documents, as well as be responsible for compliance with the accounting principles contained therein. The Chief Accountant is responsible for: ▪ for the formation of accounting policies; ▪ ensuring control and recording of business transactions in the accounts; ▪ provision of operational information; ▪ preparation of financial statements in a timely manner; ▪ conducting economic analysis jointly with other services. The chief accountant, together with the head of the organization, signs documents that serve for the receipt and issuance of inventory items and cash, as well as settlement documents. These documents without the signature of the chief accountant are considered invalid and are not accepted for execution. The chief accountant does not have the right to accept for execution and execution documents on operations that are contrary to the law and violate financial and contractual discipline. The chief accountant informs the head in writing about such documents. Appointment and relocation of financially responsible persons is coordinated with the chief accountant. Their list, as well as the list of persons entitled to sign primary documents, is approved by the head of the organization, also in agreement with the chief accountant. The requirements of the chief accountant for documenting business transactions and providing documents to the accounting service are mandatory for all employees of the organization. The chief accountant cannot be assigned duties directly related to liability. He is not allowed to receive cash and inventory items by checks and other documents. In small organizations, the duties of a cashier can be performed by the chief accountant by written order of the head of the organization. When the chief accountant is dismissed from office, the cases are handed over to the newly appointed chief accountant (in the absence of the latter, to the employee appointed by order of the head). At the same time, the state of financial statements and the reliability of data are checked. After verification, an act is drawn up, which is approved by the head of the organization. Topic 13. ACCOUNTING POLICY The accounting policy of an organization is defined as a set of accounting methods used by it: primary observation, cost measurement, current grouping of facts of financial and economic activity and the final generalization of its results. The procedure for the formation of an accounting policy is regulated by PBU 1/98 "Accounting policy of an organization" (approved by order of the Ministry of Finance of Russia dated 09.12.1998 No. 60n). ▪ Accounting methods include: ▪ methods of grouping and assessing facts of economic activity; ▪ options for repaying the value of assets; ▪ organization of document flow; ▪ inventory; ▪ methods of using accounts and accounting registers; ▪ methods of information processing. The choice of an organization's accounting policy is determined by its specifics, including commercial, features of the management organization, current and long-term goals. ▪ The organization’s accounting policies are influenced by: ▪ tax conditions; ▪ benefits; ▪ form of ownership; ▪ personnel qualifications, etc. A special place in the accounting policy is occupied by methodological and organizational aspects. Methodological aspects include: ▪ options for calculating depreciation for fixed assets and intangible assets; ▪ the procedure for recording transactions for the purchase of materials in the accounts; ▪ method for estimating inventories; ▪ options for accounting for production costs; ▪ the procedure for writing off general production and general business expenses; ▪ list of created reserves. Organizational aspects include: ▪ choice of accounting form; ▪ organization of the work of the accounting service; ▪ system of internal production accounting, reporting and control; ▪ procedure for conducting an inventory of property and liabilities; ▪ application of the working chart of accounts; ▪ technology for processing accounting information; ▪ volume, timing and addresses for providing information; ▪ system of relationships with audit services. When developing the accounting policy of the organization, it must be remembered that after approval by the order of the head, it becomes legally binding. Therefore, the accounting policy should include methodological and organizational aspects, which should be supported by regulations. Authors: Erofeeva V.A., Timofeeva O.V. << Back: Accepted abbreviations >> Forward: Accounting in the industrial sector (Cash accounting. Accounting for inventories. Accounting for long-term investments. Accounting for fixed assets. Accounting for intangible assets. Accounting for labor and its payment. Accounting for production costs and calculating the cost of production. Accounting for financial investments. Accounting for settlements. Settlements for loans and borrowings . Accounting for finished products and their sales. Accounting for financial results. Capital accounting. Organizational reporting)

▪ The existence of an entropy rule for quantum entanglement has been proven

09.05.2024 Mini air conditioner Sony Reon Pocket 5

09.05.2024 Energy from space for Starship

08.05.2024

▪ ▪ website section LEDs. Article selection ▪ article Infrared photodiodes. Directory ▪ article Snyt ordinary. Legends, cultivation, methods of application ▪ article Hearing aid. Encyclopedia of radio electronics and electrical engineering

Home page | Library | Articles | Website map | Site Reviews www.diagram.com.ua |

Arabic

Arabic Bengali

Bengali Chinese

Chinese English

English French

French German

German Hebrew

Hebrew Hindi

Hindi Italian

Italian Japanese

Japanese Korean

Korean Malay

Malay Polish

Polish Portuguese

Portuguese Spanish

Spanish Turkish

Turkish Ukrainian

Ukrainian Vietnamese

Vietnamese

See other articles Section

See other articles Section