|

|

Lecture notes, cheat sheets

Valuation and property management. Lecture notes: briefly, the most important

Directory / Lecture notes, cheat sheets Table of contents

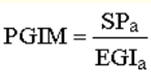

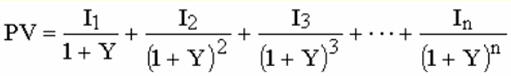

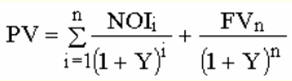

1. Real estate 1.1. Real estate as an investment object Real estate - land and all improvements permanently attached to it (buildings, structures, construction in progress). In Russia, the term "immovable and movable property" first appeared in the legislation during the reign of Peter I in the Decree of March 23, 1714 "On the order of inheritance in movable and immovable property." Land, land, houses, factories, factories, shops were recognized as real estate. Real estate also included minerals located in the ground, and various structures, both towering above the ground and built under it, for example: mines, bridges, dams. Economic reforms in Russia, the consolidation of property by property rights for individuals and legal entities, led to the need to divide property into movable and immovable (for more details, see Shevchuk D.A. Organization and financing of investments. - Rostov-on-Don: Phoenix, 2006; Shevchuk D.A. Fundamentals of banking - Rostov-on-Don: Phoenix, 2006; Shevchuk D.A. Banking operations - Rostov-on-Don: Phoenix, 2006). Since 1994, according to Art. 130 of the Civil Code of the Russian Federation, "immovable things (real estate, real estate) include land plots, subsoil plots, isolated water bodies and everything that is firmly connected with the land, i.e. objects that cannot be moved without disproportionate damage to their purpose, including forests, perennial plantings, buildings, structures". Real estate also includes air and sea vessels subject to state registration, inland navigation vessels, and space objects. Other property may also be classified as real estate. So, according to Art. 132 of the Civil Code of the Russian Federation, "an enterprise as a whole, as a property complex used for entrepreneurial activities, is recognized as real estate." Things that are not real estate, including money and securities, are recognized as movable property. The following features of real estate can be distinguished: - real estate cannot be moved without causing damage to the object; - real estate is firmly connected with the land, not only physically, but also legally; - durability of the investment object; - each specific property is unique in terms of physical characteristics and in terms of investment attractiveness; - real estate cannot be stolen, broken or lost under normal conditions; - the cost of real estate is high, and its division into property shares is difficult, and in other cases impossible; - Information about real estate transactions is often unavailable; - the loss of consumer properties or the transfer of value in the production process occurs gradually as it wears out; - the usefulness of real estate is determined by the ability to satisfy a specific human need for residential and industrial space; - the possibility of a positive or negative impact of new construction on the cost of adjacent land, buildings; - there is a tendency to increase the value of real estate over time; - there are specific risks inherent in real estate as an investment object: the risk of physical damage under the influence of natural and man-made factors, the risk of accumulation of external and functional wear and tear, financial risk associated with the conditions for revising the rent; - Strict government regulation of real estate transactions. 1.2. Property types There are three main types of real estate: land, housing and non-residential premises. The basic object of real estate is land. Along with the division into types, real estate is classified according to a number of criteria, which contributes to more successful research of the real estate market and facilitates the development and application of methods for evaluating various categories of real estate and managing them. There are the following forms of income from investing in real estate: - increase in the value of real estate due to changes in market prices, the acquisition of new and development of old facilities; - future periodic cash flows; - income from the resale of the object at the end of the holding period. The attractiveness of investing in real estate is explained by the following factors: - at the time of the acquisition of real estate, the investor receives a package of rights, while many investment objects do not entail ownership rights; - the safety of invested funds in general (under normal conditions, real estate cannot be lost or stolen) and inflation in particular (inflationary processes are accompanied by an increase in real estate prices and income from it); - the ability to receive income from real estate in monetary terms and other beneficial effects of living, the prestige of owning a certain object, etc. Investing in real estate has such positive features as the possibility of long-term use of the object and the preservation of capital. 1.3. Real estate market The real estate market is a set of relations around operations with real estate: buying and selling real estate, mortgages, renting out real estate, etc. The main segments of the real estate market: the land market, the housing market and the non-residential premises market. Separately, there is a profitable real estate market, which is segmented according to the functional purpose of the objects: - market of office objects; - market of commercial objects; - market of production and storage facilities; - market of hotel services; - the market of unfinished construction objects. Depending on the legal rights to real estate, which are the subject of a transaction between the seller and the buyer, the real estate market is divided into markets for sale and rental. In the sale and purchase market, in exchange for the corresponding equivalent, full ownership is transferred, including the right to dispose, while in the rental market, the object of the transaction is a partial set of rights, excluding the right to dispose. The following features of the real estate market can be distinguished: - locality; - low interchangeability of objects; - seasonal fluctuations; - the need for state registration of transactions. When financing real estate, three groups of costs are distinguished: - the cost of maintaining the property in a functionally usable condition; - annual tax on property ownership; - high transaction costs in real estate transactions. Fluctuations in demand and supply in the real estate market are slow, because in the presence of demand, an increase in the number of properties occurs over a long time period, determined by the construction period of the building. In the case of an excess of real estate, prices remain low for several years (for more details, see Shevchuk D.A. Buying a house and land: step by step. - M .: AST: Astrel, 2008). The main factors affecting supply and demand: - economic: the level of income of the population and business, the availability of financial resources, the level of rental rates, the cost of construction and installation works and building materials, tariffs for utilities; - social: change in the number, population density, educational level; - administrative: tax rates and zonal restrictions; - ecological: susceptibility of the area where the property is located to droughts and floods, deterioration or improvement of the environmental situation. Real estate is a financial asset, as it is created by human labor and capital investments. The acquisition and development of real estate is accompanied by high costs and, accordingly, the need to attract borrowed funds, etc., often arises. Therefore, the real estate market is one of the sectors of the financial market. The financial market is a complex economic system that includes a set of institutions and procedures aimed at the interaction of sellers and buyers of all types of financial documents. The real estate market is one of the most significant components of the financial market. There is a close relationship between the financial market and the real estate market: the growth of investments in real estate revitalizes the real estate market, the fall curtails it. Economic instability holds back both Russian and foreign creditors and investors. State support is needed to intensify financing of investments in real estate. 1.4. Participants and sources of the real estate financing process Traditionally, participants in the real estate financing process are divided into the following categories: - federal and local authorities and administrations; - credit and financial institutions; - investors, etc. Federal and local authorities and administrations provide economic and legal relations between participants in the real estate financing process. The state ensures compliance with the norms and rules related to the functioning of the real estate market; regulates issues of zoning, urban development and registration of property rights to real estate; establishes benefits or imposes restrictions (legislative restrictions, taxation features) on investments in real estate. In addition, the state acts as the owner of many real estate objects. Financial institutions provide capital to investors who do not have sufficient funds. Investors are individuals and legal entities (residents and non-residents) who purchase real estate and maintain it in a functional condition. Investors can be divided into two types: 1) active - finance and engage in the construction, development or management of the facility; 2) passive - only finance the project without taking further part in it. Currently, development has developed in the real estate market - a special type of professional activity in managing an investment project in the field of real estate, one of the tasks of which is to reduce the risks associated with real estate development. The developer is the organizer, whose activities can be divided into three stages: 1) analysis of the possibility of implementing the project: the state and trends of changes in legislation, consumer preferences, financial and economic conditions, prospects for the development of the region are taken into account; 2) development of a project implementation plan: the area of the land plot required for the implementation of the project is determined, a location with the appropriate environment, communications is selected, and the project's effectiveness is assessed. Then the sources of financial resources are determined, a building permit is obtained, etc.; 3) implementation of an investment project: attracting financial resources, design and construction organizations, monitoring the progress of construction, renting or selling an object in whole or in parts. Sources of capital investment financing: state funds, local budget funds (municipal), own financial resources of enterprises and individuals, attracted funds, investors' funds. 1.5. Benefits of investing in real estate Investing in real estate that generates income is the most profitable. The attractiveness of acquiring income-generating real estate lies in the return on investment after repayment of operating expenses. However, in this case, the risk is higher due to the low liquidity of real estate and the length of the payback period for invested funds. Methods of investing in the real estate market can be direct and indirect. Direct - Acquisition of real estate at auction in accordance with a private contract, purchase with a leaseback. Indirect - purchase of securities of companies specializing in real estate investments, investments in mortgages secured by real estate. Investments in real estate, like investments in corporate securities, are long-term. Advantages of investing in real estate over securities: 1. Unlike corporate securities, such as stocks, which pay quarterly dividends, real estate ownership provides the investor with monthly cash, as monthly rent payments lead to monthly payments to the investor. 2. The cash flow of income from real estate ownership (the difference between cash receipts from rent and property maintenance costs plus capital investments) is less dynamic than the cash flow of highly leveraged corporations: - cash flow income of corporations depends on the volume of product sales, which are dependent on the daily decisions of consumers, and income streams from real estate are more stable because they are based on lease agreements; - sources of corporate cash income may change over time, and sources of income from real estate are more predictable, since buildings are immovable, assets are fixed both physically and legally. 3. Corporate rates of return are generally lower than real estate. This is due to the fact that the intensive operation of real estate assets is comparable to most business areas. To recover the costs of fixed capital invested in real estate, a higher level of return is required, since the expected income to be received by the investor must exceed the costs of operating the property. The rate of return should be higher than when investing in financial assets, which should correspond to the higher risks of investing in real estate. 4. Investments in real estate are characterized by a greater degree of safety, security and the ability to control the investor than investments in shares. The sources and amount of investment in real estate are influenced by: - expected return on investment; - bank interest rate; - tax policy in general and in the investment sphere in particular; - inflation rates; - the degree of risk of investment in real estate. Reasons for the attractiveness of investing in real estate in terms of inflation: - rapid depreciation of money with insufficient reliability of their safety in credit institutions; - frequent discrepancy between the bank rate and the level of inflation; - limited more profitable areas of investment; - residual affordability and ease of investment in housing; - investing in real estate that generates income can, under these conditions, increase the rent, thereby preserving the invested funds. On the other hand, in conditions of inflation, there are circumstances that encourage investment in other areas: real incomes are falling, it is difficult for an investor to predict the ratio between costs and expected benefits, it is more difficult to get a long-term loan at an acceptable interest rate, which leads to a lack of financial resources for potential buyers. At the current stage of development of the Russian economy with high inflation rates, investment activity is subject to significant risks, which leads to a decrease in investment activity in the real estate market. The limited investment resources led to the process of curtailing construction in almost all sectors of the economy (for more details, see Shevchuk D.A. Real estate appraisal and property management. - Rostov-on-Don: Phoenix, 2007). And yet the real estate market is attractive to potential investors for the following reasons: - investments in real estate are characterized by a significant degree of safety, security and the ability to control the investor; - at the time of the acquisition of real estate, the investor receives a package of rights, while most other investment objects do not entail the right of ownership; - investing in real estate allows you to save money from inflation; - the real estate market, which has a large size, is little mastered; - investments in real estate are accompanied by an acceptable profitability of operations in this market. Today in Russia, investment activity in the real estate market is reduced. Even the housing market, which is the most active segment of the real estate market, was not provided with appropriate credit and financial mechanisms that would support the effective demand of the population and make it possible to improve the living conditions of the population on a massive scale. The balance of interests of all participants in the real estate financing process is a necessary component of the normal functioning of the real estate market. 1.6. Mortgage credit lending Under the "mortgage" understand the pledge of real estate as a way to secure obligations. The presence of a mortgage lending system is an integral part of any developed system of private law. The role of mortgages especially increases when the state of the economy is unsatisfactory, since a well-thought-out and effective mortgage system, on the one hand, helps to reduce inflation by drawing on temporarily free funds of citizens and enterprises, and on the other hand, helps to solve social and economic problems. The emergence of mortgages. The first mention of the mortgage refers to the VI century. BC e. In Greece, a mortgage meant the debtor's liability to the creditor for certain land holdings. On the border of the land area owned by the debtor, when registering the obligation, a pillar was placed, called "mortgage". The first acts on pledge that have come down to us in Russia date back to the period of the XNUMXth-XNUMXth centuries, and the legislative norms first appeared at the very end of the XNUMXth or the beginning of the XNUMXth century. in the Pskov Judicial Charter, in which, along with the oldest method of collection - personal - there is a collection of property. At the end of XIX - beginning of XX centuries. the process of lending secured by land plots, which the borrower was going to acquire, was actively going on. This process developed with the assistance of peasant land banks, which were created in almost all provinces of Russia and contributed to the allocation of land to impoverished peasants. From 1922 to 1961 In Russia, the Civil Code of the RSFSR, Art. 85 of which defined a pledge as a right of claim, which allows the creditor, in the event of the debtor's failure to fulfill the obligation, to receive priority satisfaction over other creditors at the expense of the value of the pledged property (without division into movable and immovable). As such, due to various economic and legal obstacles, the institution of mortgage has not yet gained significant popularity in Russia, so it is regulated by a relatively small number of regulations. In 1992, the Law of the Russian Federation "On Pledge" was adopted, which fixed the possibility of mortgages as a way to secure obligations. The Civil Code of the Russian Federation (Part I) clarified certain provisions on pledge (Articles 334-358). In Art. 340 it is stipulated that the mortgage of a building or structure is allowed only with simultaneous mortgage under the same agreement of the land plot on which this building or structure is located, or of a part of this plot that functionally provides the pledged object, or of the right to lease this plot or its corresponding part belonging to the pledgor. And in the case of a mortgage of a land plot, the right of pledge does not extend to the buildings and structures of the pledgor located or being built on this plot, unless otherwise stipulated in the contract. Registration of real estate - the most important function of the state, without proper implementation of which a stable turnover of real estate is impossible, is regulated by the Federal Law of July 21.07.1997, XNUMX "On State Registration of Rights to Real Estate and Transactions with It". The actual implementation of the bank's rights under the mortgage is possible within the framework of the Law "On Enforcement Proceedings". Separate special rules, which, nevertheless, should be taken into account when concluding mortgage agreements, are scattered under the relevant laws. In 1998, the Federal Law "On Mortgage (Pledge of Real Estate)" was adopted, according to which, under an agreement on pledge of real estate (mortgage agreement), one party - the pledgee, who is a creditor under an obligation secured by a mortgage, has the right to receive satisfaction of his monetary claims to the debtor under this obligation from the value of the pledged real estate of the other party - the mortgagor, predominantly over other creditors of the mortgagor, with exceptions established by law. The pledgor may be the debtor under an obligation secured by a mortgage, or a person not participating in this obligation (a third party). The property on which a mortgage has been established remains with the pledgor in his possession and use (Article 1). A mortgage may also be established as security for an obligation under a loan agreement, under a loan agreement or other obligation, including an obligation based on the sale, purchase, lease, contract, other agreement, or damage, unless otherwise provided by federal law. 2) The mortgage agreement is concluded in compliance with the general rules of the Civil Code of the Russian Federation on the conclusion of agreements, as well as the provisions of the said Federal Law. A mortgage is subject to state registration by justice institutions in the Unified State Register of Rights to Real Estate at the location of the property that is the subject of the mortgage and ensures the payment of the principal amount of the debt to the mortgagee or under a loan agreement or other obligation secured by a mortgage (for more details, see the book Shevchuk D.A. Mortgage: just about the complex. - M.: GrossMedia: ROSBUH, 2008). With the introduction of the Law "On Pledge of Real Estate", a "mortgage" appeared as a freely tradable security on the market. A mortgage bond is a registered security certifying the owner's right to receive performance on a monetary obligation secured by a mortgage on the property specified in the mortgage agreement, without presenting other evidence of the existence of this obligation, and the very right of pledge to the property specified in the mortgage agreement. After the state registration of a mortgage by the body carrying out this registration, the mortgage bond is issued to the original mortgagee and transferred by means of an endorsement. The mortgage simplifies the transfer of mortgage rights by the bank - it is transferred by making another endorsement with subsequent state registration. Another positive characteristic of a mortgage is that the mortgage itself can be pledged. 1.6.1. Mortgage as a way to secure obligations Often, the term "mortgage" means mortgage lending, but "mortgage" has an independent meaning - a pledge of real estate as a way to secure obligations. According to Art. 5 of the Law "On Mortgage (Pledge of Real Estate)" under a mortgage agreement, real estate specified in Art. 130 of the Civil Code of the Russian Federation, the rights to which are registered in the manner established for state registration of rights to real estate, including: - land plots, with the exception of land plots specified in Art. 63 of this Federal Law; - enterprises, buildings, structures and other real estate used in entrepreneurial activities; - residential buildings, apartments and parts of residential buildings and apartments, consisting of one or more isolated rooms; - dachas, garden houses, garages and other consumer buildings; - air and sea vessels, inland navigation vessels and space objects. If we are talking about housing mortgages, then the subject of collateral must meet the following requirements: have a kitchen and a bathroom separate from other apartments or houses (i.e., communal apartments are not accepted as collateral); be connected to electric, steam or gas heating systems that provide heat to the entire area of \u2008b\uXNUMXbthe dwelling; be provided with hot and cold water supply in the bathroom and kitchen; have plumbing equipment, doors, windows and a roof in good condition (for apartments on the top floors). The building in which the subject of pledge is located must meet the following requirements: not be in an emergency condition; not to be registered for a major overhaul; have a cement, stone or brick foundation; have metal or reinforced concrete floors; the number of storeys of the building should not be less than three floors (for more details, see Shevchuk D.A. An apartment on credit without problems. - M .: AST: Astrel, XNUMX). The mortgage agreement must specify the subject of the mortgage, the results of the assessment of its value, the essence and term of performance of the agreement secured by the mortgage, as well as the right by virtue of which the property that is the subject of the mortgage belongs to the pledgor. The subject of the mortgage is determined in the contract with an indication of its name, location and a description sufficient for identification purposes. The appraisal of the subject of mortgage is determined in accordance with the Law "On appraisal activities in the Russian Federation" by agreement between the mortgagor and the mortgagee. The mortgage agreement must be notarized and subject to state registration, from the moment of which it comes into force. Mortgage is subject to state registration by institutions of justice in the Unified State Register of Rights to Real Estate at the location of the property that is the subject of mortgage, in the manner prescribed by the Federal Law on State Registration. rights to real estate and transactions with it. A loan agreement secured by a mortgage can be concluded after the registration of the mortgage agreement, and the right of pledge arises from the moment the loan agreement is concluded, and the borrower does not risk anything if the loan agreement is not concluded. Due to the fact that the legislation allows multiple subsequent pledge of property already encumbered with a mortgage, an appropriate prohibitive condition should be included in each mortgage agreement (for more details, see Shevchuk D.A. Loans to individuals. - M .: AST: Astrel, 2008). The mortgage secures the payment to the mortgagee of the principal amount of the debt under the loan agreement or other obligation secured by the mortgage in full or in the part provided for by the mortgage agreement. A mortgage established to secure the execution of a loan agreement subject to the payment of interest also ensures the payment to the creditor of the interest due to him for the use of the loan and the payment to the pledgee of the amounts due to him: - in compensation for losses and/or as a penalty (fine, penalty fee) due to non-fulfillment, delay in fulfillment or other improper fulfillment of an obligation secured by a mortgage; - in the form of interest for the illegal use of other people's funds provided for by a mortgage-secured obligation or by the Federal Law, Art. 393 of the Civil Code of the Russian Federation (it is difficult to collect interest from an individual for using other people's funds, since in a lawsuit it is necessary to prove that the citizen had the opportunity to pay off the debt, but did not return the funds he had and used them differently, but there are no such practical developments yet) ; - in reimbursement of legal costs and other expenses caused by foreclosure on the pledged property; - in reimbursement of expenses for the sale of mortgaged property. Unless otherwise provided by the agreement, the mortgage secures the pledgee's claims to the extent that they exist by the time they are satisfied at the expense of the pledged property. The alienation of the pledged property by the owner is possible only with the consent of the bank. The Bank may foreclose on the pledged property in order to satisfy its claims at the expense of this property, caused by non-fulfillment or improper fulfillment of the obligation secured by mortgage, in particular, non-payment or late payment of the amount of the debt in full or in part. For example, in case of violation of the terms for making periodic payments more than three times within 12 months. Recovery is usually made by court order. The rules of the Law "On Mortgage (Pledge of Real Estate)" apply to the pledge of unfinished real estate if it is being built on a land plot allocated for construction in accordance with the procedure established by law. Allocation of pledge of real estate in a separate category, called "mortgage", due to the peculiarities of real estate. The advantages of real estate as an object of collateral in relation to other objects of collateral are as follows: - the value of the mortgaged property may increase in proportion to the rate of inflation; - the real danger of losing property (especially housing in case of housing mortgage lending) is a good incentive for the debtor to fulfill his obligations; - the possibility of using it as collateral if the loan is long-term and significant in amount, since the property is durable and its value is high; - an increase in the value of real estate can be predicted with sufficient certainty, which is impossible when using, for example, consumer goods as collateral. A long-term loan can be granted on security with the transfer to the pledgee of the pledged property: precious metals and products made from them, secured by highly reliable securities, the price of which is particularly stable. However, in world practice, the vast majority of long-term loans are secured by real estate. Mortgage may become the most priority way of ensuring the fulfillment of obligations in Russia as well. 1.6.2. Features of mortgage lending A mortgage loan is a loan secured by certain real estate. Mortgage lending is the provision of a loan secured by real estate. Creation of an effective system of mortgage lending is possible on the basis of the development of primary and secondary mortgage capital markets. The primary mortgage capital market consists of lenders who provide loan capital and investor borrowers who buy real estate for investment or commercial use. The secondary market covers the process of buying and selling mortgage bonds issued in the primary market. The main task of the secondary mortgage capital market is to provide primary lenders with the opportunity to sell the primary mortgage, and use the proceeds to provide another loan on the local market. The advantage of mortgage lending is that if the borrower does not repay the loan, the lender has the right to dispose of the property at its discretion. Due to the fact that real estate is durable and its price is quite stable, the lender has low fears of loan default and there are grounds for long-term diversion of financial resources. Obtaining a mortgage loan is associated with the need to fulfill obligations under a loan agreement. Therefore, before obtaining such a loan, a potential borrower needs to analyze: - is there enough money to make a down payment for an apartment and to cover the costs associated with the transaction for the sale of an apartment (notarization of the contract, fee for registering the contract in the State Register), conclusion of insurance contracts; - whether there will be funds to maintain the necessary standard of living after making periodic payments under the loan agreement; - whether a drop in income is expected during the loan period, is there a prospect to quickly find another job in the event of termination of the existing one, with payment not lower than the previous one; - whether there is a continuous work experience for the last 2 years and what are the reasons for dismissal and breaks in work, and whether current obligations related to housing are fulfilled in a timely manner: payment for utilities, telephone, electricity (checked by the bank); - whether there are assets in the form of movable or immovable property (cars, garage, cottage, other apartment) that can be used as additional security. The main problem of mortgage lending is the lack of long-term financial resources. One of the sources of long-term funds are the deposits of private investors. But at present, the population's confidence in banks in general and in commercial ones, especially, has been undermined. The financial and economic crisis of 1998 led to a significant decrease in the real incomes of the population, the depreciation of savings, and an outflow of private deposits to the Savings Bank. Another problem is the assessment of the solvency of a potential borrower, based on his real income. Due to the excessive tax burden, the share of the shadow sector in the economy is large, so the official income of potential borrowers is not high, which makes it difficult for commercial banks to make decisions on loans. A well-thought-out state tax policy in mortgage lending to the population will make it possible to bring real incomes out of the "shadow". But tax laws cannot change quickly. The valuation of the subject of mortgage is carried out in accordance with the Law "On valuation activities in the Russian Federation" by agreement between the mortgagor and the mortgagee. This chapter briefly outlines the basics of assessing the market value of real estate. 2. Real estate appraisal 2.1. Factors affecting the value of real estate There are four factors that affect the value of real estate. 1. Demand - the quantity of a given product or service that finds solvent buyers on the market. The biggest potential demand is in the housing market. 2. Utility - the ability of property to satisfy some human needs. Utility stimulates the desire to acquire a certain thing. The usefulness of housing is the comfort of living. For an investor operating in the real estate market, a land plot without restrictions on use and development will have the greatest utility. 3. Scarcity - limited supply. As a rule, with an increase in the supply of a certain product, prices for this product begin to fall, with a decrease in supply, they rise. 4. The possibility of alienability of objects is the possibility of transferring property rights, which allows real estate to pass from hand to hand (from seller to buyer), that is, to be a commodity. Previously, land in Russia was a single state property, so land was not considered a commodity. Thus, value is not a characteristic inherent in real estate in itself: the presence of value depends on the desire of people, it is necessary to have purchasing power, utility and relative scarcity. 2.2. Main types of real estate value Several types of value correspond to different purposes of real estate valuation. The market value of the appraised object is the most probable price at which the appraised object can be alienated on the open market in a competitive environment, when the parties to the transaction act reasonably, having all the necessary information, and any extraordinary circumstances are not reflected in the value of the transaction price. To determine the market value, it is impossible to accept the sales prices of similar objects without additional analysis, since the transaction price does not characterize the motives of the seller and the buyer, the absence or presence of any external influences. The market value of real estate can only be determined if the following conditions of an equilibrium transaction are present: - the market is competitive and provides a sufficient choice of property for the interaction of a large number of buyers and sellers; - the buyer and the seller are free, independent of each other, well informed about the subject of the transaction and act only in order to maximize their own interests - to increase income or better satisfy needs; - exposition period of the object of evaluation. The investment value is the highest price that an investor can pay for a property, given the expected return (utility, convenience) of this investment project. Investment and market values coincide only when the expectations of a particular investor are typical for this market (for more details, see Shevchuk D.A. Organization and financing of investments. - Rostov-on-Don: Phoenix, 2006; Shevchuk D.A. Fundamentals of banking affairs. - Rostov-on-Don: Phoenix, 2006; Shevchuk D.A. Banking operations. - Rostov-on-Don: Phoenix, 2006). The liquidation value of the appraisal object is the value of the appraisal object if the appraisal object must be alienated within a period less than the usual exposition period for similar objects. It is usually calculated when the object is forced to be sold. Due to the limitation of the sale period, which is not enough to familiarize all potential buyers with the object put on the market, the liquidation value may be significantly lower than the market value. It is determined, as a rule, during the liquidation of the enterprise by decision of the owner or a judicial authority. Represents the amount of cash that could actually be received from the sale of an entity's assets, regardless of their carrying value. Utilization value of the appraised object - the value of the appraised object, equal to the market value of the materials it includes, taking into account the costs of disposing of the appraised object. The value of the appraisal object for taxation purposes is the value of the appraisal object, determined for the calculation of the tax base and calculated in accordance with the provisions of regulatory legal acts (including the inventory value). It can be based on the market value, on the cost of reproducing the object, or calculated according to the normative methodology without the involvement of specialist experts. The special value of the object of appraisal is the value, for the determination of which the appraisal agreement or the regulatory legal act stipulates conditions that are not included in the concept of market or other value specified in the appraisal standards that are mandatory for appraisal activity subjects. The following types of value can be distinguished: the cost of an operating enterprise - the cost of a single property complex, determined in accordance with the results of the functioning of the established production. At the same time, the assessment of the value of individual objects of the enterprise consists in determining the contribution that these objects make as integral components of the operating enterprise; insurance cost - the cost of full compensation for damage to property in the event of an insured event. It is calculated in accordance with the methods used by insurance companies and government agencies to calculate the amount for which destructible elements of an object can be insured. The costs of restoring the elements of the object that are at risk of destruction and destruction are taken into account. 2.3. Basic principles of real estate valuation The basic principles of real estate valuation can be divided into 4 categories. The best and most efficient use (NNEI) principle is based on determining the value of real estate if the property is used in the best, most efficient way, even if the current use of the property is different. The most probable and profitable use of the property at the time of valuation provides the highest current value of the property. Condition of the building (the need for major repairs is taken into account by the buyer when discussing the amount of the transaction; cosmetic repairs do not significantly affect the value of the property). Thus, a variety of different real estate transactions correspond to several types of value. Depending on the needs of real estate market participants, the value of different types of value of the same object can differ significantly. The most common appraisal of the market value of real estate. The value of real estate objects is influenced by a significant number of economic factors. The principles of real estate appraisal make it possible to take into account the most significant of them. There are several limitations for the NNEI version of the property being assessed: - maximum efficiency; - financial justification; - physical feasibility; - compliance with the law. The maximum efficiency is determined by discounting the future returns of the alternative use cases, taking into account the risk of the investment. Financial feasibility is understood as the justification for the expediency of financing an investment project, which reflects the ability of this project to provide income sufficient to reimburse investors' expenses and receive the expected return on invested capital. The justification for the technological and physical feasibility of the NNEI option is based on an analysis of the ratio of quality, costs and project implementation time, the likelihood of natural disasters, the availability of transport, and the ability to connect to public amenities. To establish the compliance of the use case with the legislation, it is necessary to analyze building and environmental standards: limiting the number of storeys, a ban on construction in a given place, zoning, prospects for the development of the city and the region, negative moods of the local population, fire safety, etc. The NNEI principle is important in the analysis of a land plot. If the current use of the land differs from the best and most efficient, the value of the vacant land may exceed the value of the existing improvements on it, and a decision may be made to demolish them in order to use the site in an optimal way. For example, it is desirable to give a plot with an individual house in a commercial development area for such development. If the current use of the land plot is different from the best use case, but the value of the buildings and structures on it exceeds its value, then the current use will continue until the value of the land, under the condition of its best use, does not exceed the value of the property in the current use. The results of the analysis of the best and most efficient use are taken into account when determining the value of real estate, when choosing a construction and reconstruction option, and when analyzing investment projects. The contribution principle is based on measuring the value of each element that it contributes to the total value of the object. The influence of both the presence of a contribution (element) and its absence on the change in the value of the property is taken into account. When analyzing investment projects and assessing the value of real estate, it is necessary to take into account the possibility of making improvements that will increase the value of the object. At the same time, the income received as a result of additional improvements should exceed the amount of invested funds aimed at creating these improvements. The principle of marginal productivity is that successive improvements will be accompanied by an increase in the value of the object, exceeding the cost of their creation, until the point of maximum productivity is reached, after which the costs of creating additional improvements will not be fully offset by the increase in the cost of the object. For example, updating the interior of a cafe will attract additional visitors, which will increase the income from the facility. The subsequent even higher-quality expensive repair of this premises, which is in good condition, may not affect the growth of income. Therefore, the cost of the second repair will not be compensated. Thus, the principle of marginal productivity is based on the ratio of the costs of additional improvements to the growth in the value of the object and the increase in income from it as a result of the measures taken. An increase in the volume of investments in the development of production will be accompanied by an increase in profit growth only up to a certain point, after which the profit growth rate will begin to decline. The principle of balance is based on the fact that the more harmonious and balanced the elements of the object, the higher its value in the market. For example: a residential building with a good layout, with a well-thought-out communication system, has a higher cost than an object whose elements are less balanced; the cost of a restaurant with a spacious hall will be higher than the cost of a similar restaurant, in which a narrow elongated room is equipped to receive visitors. In accordance with the principle of balance, one should also take into account the number of hotels, restaurants, trade enterprises in the same area. The balance of the elements of the object is determined on the basis of market requirements. An imbalance in the timing and volume of investment with the timing of construction can lead to a "freeze" of funds or, if there is a shortage, to a "freeze" in construction. Lack of improvements or congestion of land can lead to a decrease in its value. The principle of utility is based on the fact that a real estate object, along with greater utility for the user, also has a greater value in the market. Thus, the sales prices of apartments in brick houses are higher than in panel ones, since they have higher sound and heat insulation, and the walls "breathe". The utility of real estate for income generation is expressed as a stream of income. Income can be received as a result of using the object as a store, warehouse, parking lot, etc. The principle of substitution stated that an informed buyer in an open market would not pay more for a property than for an object of similar utility, profitability, or the cost of building a similar object in an acceptable time frame. If there are several properties on the market of the same utility for the consumer, then the objects with the lowest price will be in the greatest demand. The buyer has options to choose from, and therefore the cost of a particular object will be affected by the availability of analogues or the value of the cost of their creation within an acceptable timeframe. The choice of the investor will be influenced by the value of objects of similar yield offered on the market, which are an alternative investment opportunity. For example, instead of three cheap car parks in a sparsely populated area, an entrepreneur can purchase one expensive car park in a central city for a similar return on investment. The expectation principle is based on the fact that the value of real estate is influenced by the expected future benefits of owning an object. The expectations associated with income-generating properties are expressed in the expected return on investment from income streams from the use and future resale of the property. The expectation of future benefits is expressed in monetary terms, while the adjustment to the current value of the object can be either positive or negative. The economic downturn, lack of policing and the prevailing negative public opinion may lead potential buyers to refuse to purchase real estate in the area. The expected construction of a metro station increases the value of adjacent residential buildings without physically changing them. So, this principle is based on the attractiveness of the future benefits of owning a property: the more positive expectations, the higher the value of real estate. The principle of external influence is based on taking into account changes in the value of real estate caused by the influence of changing environmental factors. The main external factors affecting the value of real estate: - economic: the level of income of the population and business, proximity to the centers of industrial and business activity, the availability of financial resources, the level of rental rates, the cost of construction and installation works and building materials, tariffs for utilities; - political: state and tendencies of changes in legislation; - social: changes in the number, population density, educational level; - administrative: tax rates and zonal restrictions; - environmental: exposure of the real estate area to droughts and floods, deterioration or improvement of the environmental situation. The principle of change is based on taking into account changes corresponding to life cycles, which are inherent both in specific objects and real estate markets, and in cities, and in society as a whole. There are four cycles of life: 1) growth - a period of increasing incomes of the population and income from real estate, the rapid development of the industry, the city; 2) stability - a period of equilibrium, which is characterized by the absence of a visible change in the level of income or losses; 3) decline - a period of social instability and a decrease in demand for real estate, a decline in production; 4) renewal - a period of renewal and revival of market demand, the formation of a region, etc. The cycle in which an individual property, area or society as a whole is located must be taken into account by the appraiser in the assessment process. The principle of competition is based on the fact that market prices are set at a certain level, taking into account competition. The principle of supply and demand is based on determining the value of an object by the ratio of supply and demand in the real estate market. Demand and supply are influenced by such factors as the level of income, changes in the size and tastes of the population, the amount of taxes, the availability of financial resources, the size of the loan rate, etc. The principle of conformity is based on the fact that the property reaches its maximum value in the environment of compatible harmonizing objects with a compatible land use. The use of the land must meet the existing standards of the area in which the property is located. New construction should be in the prevailing style. The homogeneity of objects in the area maintains their value at a certain level. For example, the presence of old individual houses next to expensive residential buildings will lead to a decrease in the price of luxury real estate. In general, the application of the principles of real estate valuation makes it possible to take into account the most significant factors affecting its value, and helps to bring the results as close as possible to the real economic reality. 2.4. Types of real estate appraisal Real estate appraisal can be mass and individual. Mass real estate valuation is the valuation of a large number of real estate objects on a specific date using standard methods and statistical analysis. This unifies the procedure for evaluating a large number of objects. During the mass assessment, at the final stage, the model used for calculations is checked and the quality of the results obtained is controlled. At the same time, the results obtained using the mass valuation model are compared with real sales prices and the deviations of the valuation level for each group of similar objects are evaluated. An individual real estate appraisal is an appraisal of a specific property on a specific date. It is necessary to protect the results of the assessment in courts, to determine the value of special-purpose objects, etc. An individual appraisal is carried out in several stages, united in the concept of "appraisal process", at the final stage of which the results obtained using different approaches to real estate appraisal are harmonized. The mass assessment is approximate, and the individual assessment is exact, obtained as a result of a thorough analysis of real data on analogues of the object of assessment. Further in the training manual, the mechanisms of individual real estate valuation will be considered. The real estate appraisal process consists of stages performed sequentially by a specialist appraiser to determine its value. At the stage "Identification of the problem" the statement of the problem that needs to be solved is carried out: - the object of assessment is described on the basis of relevant legal documents confirming the rights to real estate; - Establishment of property rights associated with the object; - the date of the appraisal is set - the calendar date, as of which the value of the appraisal object is determined; - the objectives of the assessment of the object are indicated; - the type of value is established, which must be determined in accordance with the goal; - limiting conditions are formulated - statements in the report that describe obstacles or circumstances that affect the valuation of the property. At the stage "Preliminary inspection and evaluation plan" it is determined what data are necessary and sufficient for the analysis of the object, the sources of their receipt are established; personnel specializing in the assessment of a given class of objects is selected; an appraisal work plan is drawn up and an agreement is concluded in writing between the appraiser and the customer. The contract does not require notarization and must contain the grounds for concluding the contract, the type of the appraisal object, the type of value (values) of the appraisal object to be determined, the monetary reward for the appraisal of the appraisal object, information about the appraiser's civil liability insurance, an exact indication of the appraisal object (objects), information on whether the appraiser has a license to carry out appraisal activities and the period for which this license has been issued. An appraisal of an object can be carried out by an appraiser only if the requirement for the independence of an appraiser, provided for by the legislation of the Russian Federation on appraisal activities, is observed. If this requirement is not complied with, the appraiser is obliged to inform the customer about this and refuse to conclude an appraisal contract. When concluding an agreement, the appraiser is obliged to provide the customer with information about the requirements of the legislation of the Russian Federation on appraisal activities: on the procedure for licensing appraisal activities, the appraiser's obligations, appraisal standards, requirements for an appraisal agreement. The fact of providing such information should be recorded in the valuation agreement. At the stage "Data collection and verification", the evaluator collects and processes the following information and documentation: - title documents, information about the encumbrance of the object of assessment with the rights of other persons; - accounting and reporting data related to the object of assessment; - information on the technical and operational characteristics of the object of assessment; - information necessary to establish the quantitative and qualitative characteristics of the appraisal object in order to determine its value, as well as other information related to the appraisal object. The appraiser determines and analyzes the market to which the appraisal object belongs, its history, current market conditions and trends, as well as analogues of the appraisal object and justifies their choice. The data collected and analyzed by the evaluator can be divided into general and special. General data includes information on economic, social, state-legal, environmental factors that significantly affect the value of the appraisal object. Special data includes information about the property being valued and its analogues: information about the rights to the object, determining the compliance of the method of use with existing legislation, the characteristics of the building itself and the land plot on which it is located. The next step in the assessment process is an analysis of the best and most efficient use of both the already developed land and the proposed vacant land. Based on the analysis carried out, its value is determined. The stage "Applying valuation approaches" includes determining the value of the object using traditional valuation approaches. When conducting an appraisal, the appraiser is obliged to use cost, comparative and income approaches to appraisal, independently determining specific appraisal methods within each of the appraisal approaches. The appraisal method is understood as a method of calculating the value of the appraised object within the framework of one of the appraisal approaches. Then the obtained results are coordinated. "Agreement on the valuation result" is the receipt of the final valuation of the property based on the results of applying various approaches to valuation. As a rule, one of the approaches is considered basic, the other two are necessary to correct the results obtained. This takes into account the significance and applicability of each approach in a particular situation. Due to the underdevelopment of the market, the specificity of the object or the lack of available information, some of the approaches in a particular situation cannot be applied. Then, taking into account all significant parameters, based on the expert opinion of the appraiser, the final value of the value of the object is established. This value must be expressed in rubles as a single value, unless otherwise provided in the valuation agreement. The final value of the value of the appraisal object indicated in the appraisal report drawn up in the manner and on the basis of the requirements established by the Federal Law "On appraisal activities in the Russian Federation", appraisal standards and regulations on appraisal activities of the authorized body for monitoring appraisal activities in the Russian Federation Federation, may be recognized as recommended for the purposes of making a transaction with the subject of appraisal, if no more than 6 months have passed from the date of drawing up the appraisal report to the date of the transaction with the subject of appraisal or the date of submission of the public offer. At the final stage, an appraisal report is drawn up - a document containing the rationale for the appraiser's opinion on the value of the property. When compiling the appraisal report, the appraiser is obliged to use information that ensures the reliability of the appraisal report as a document containing information of probative value. So, the assessment includes several stages: - establishment of quantitative and qualitative characteristics of the object of assessment; - analysis of the market to which the object of assessment belongs; - the choice of the method or methods of assessment within each of the approaches to the assessment and the implementation of the necessary calculations; - generalization of the results obtained within the framework of each of the approaches to the assessment, and the determination of the final value of the value of the object of assessment; - drawing up and transfer to the customer of the assessment report. When deciding whether to finance investments in real estate, the results obtained using the income approach are considered to be the most significant. 2.5. Approaches to real estate valuation 2.5.1. Comparative approach The comparative approach to valuation is a set of valuation methods based on a comparison of the object of valuation with its analogues, in respect of which there is information on the prices of transactions with them. Conditions for applying the comparative approach: 1. The object must not be unique. 2. Information must be comprehensive, including the conditions for making transactions. 3. Factors influencing the value of comparable analogues of the property being valued must be comparable. Basic requirements for analogue: - the analogue is similar to the object of assessment in terms of the main economic, material, technical and other characteristics; - similar terms of the transaction. The comparative approach is based on the principles: - substitutions; - balance; - supply and demand. Stages of the comparative approach: - market research; - collection and verification of the reliability of information on offered for sale or recently sold analogues of the object of evaluation; - comparison of data on selected analogues and the object of assessment; - adjustment of sales prices of selected analogues in accordance with the differences from the object of assessment; - Establishing the value of the appraisal object. An adjustment to comparable sales is necessary to determine the final value of the property being valued. Calculation and adjustments are made on the basis of a logical analysis of previous calculations, taking into account the significance of each indicator. The most important is the precise determination of the correction factors. Advantages of the comparative approach: 1. The final cost reflects the opinion of typical sellers and buyers. 2. Sales prices reflect changes in financial conditions and inflation. 3. Statistically justified. 4. Adjustments are made for differences in the compared objects. 5. Relatively easy to use and gives reliable results. Disadvantages of the comparative approach: 1. Sales differences. 2. Difficulty in collecting information on practical sales prices. 3. Difficulty in collecting information about the specific terms of the transaction. 4. Dependence on market activity. 5. Dependence on market stability. 6. Difficulty reconciling data on significantly different sales. 2.5.2. Cost approach The cost approach is a set of valuation methods based on determining the costs necessary to restore or replace the object of assessment, taking into account accumulated depreciation. It is based on the assumption that the buyer will not pay more for the finished object than for the creation of an object of similar utility. When applying this approach, the costs of the investor, not the contractor, are taken into account. This approach is based on the principle of substitution. Information needed to apply the cost approach: - wage level; - the amount of overhead costs; - equipment costs; - profit margins for builders in a given region; - market prices for building materials. Stages of the cost approach: - calculation of the cost of the land plot, taking into account the most efficient use (Cz); - calculation of costs for new construction of buildings being assessed (SNS); - calculation of accumulated wear (In): - physical wear and tear - wear associated with a decrease in the performance of an object as a result of natural physical aging and the influence of external adverse factors; - functional wear - wear due to non-compliance with modern requirements for such objects; - external depreciation - depreciation as a result of changes in external economic factors; - calculation of the cost of improvements, taking into account the accumulated wear: Su=Sns-Ci; - determination of the final cost of real estate: Szp = Sz + Su. Advantages of the cost approach: 1. When evaluating new objects, the cost approach is the most reliable. 2. This approach is appropriate and/or the only possible one in the following cases: - analysis of the best and most efficient land plot; - feasibility study of new construction and improvements; - assessment of public-state and special facilities; - valuation of objects in inactive markets; - valuation for insurance and taxation purposes. Disadvantages of the cost approach: 1. Costs are not always equivalent to market value. 2. Attempts to achieve a more accurate assessment result are accompanied by a rapid increase in labor costs. 3. Inconsistency between the costs of acquiring the property under appraisal and the costs of new construction of exactly the same object, since accumulated depreciation is deducted from the cost of construction during the assessment process. 4. Problematic calculation of the cost of reproduction of old buildings. 5. Difficulty in determining the amount of accumulated wear and tear of old buildings and structures. 6. Separate assessment of the land plot from buildings. 7. Problematic evaluation of land plots in Russia. 2.5.3. income approach The income approach is based on the fact that the value of real estate in which capital is invested must correspond to the current assessment of the quality and quantity of income that this property is capable of bringing. The income approach is a set of methods for assessing the value of real estate based on determining the current value of the expected income from it. The main prerequisite for calculating the value of this approach is the lease of the property. Capitalization of income is carried out to convert future income from real estate into current value. Capitalization of income is a process that determines the relationship between future income and the current value of an object. Basic income approach formula (IRV - formula): V=I/R, where V is the value of the property, I - the expected income from the property being valued. Income usually refers to the net operating income that real estate is capable of bringing in for a period R - the rate of return or profit - is the ratio or rate of capitalization. Capitalization ratio - the rate of return, reflecting the relationship between income and the value of the object of assessment. There are two types of capitalization: - direct capitalization; - capitalization of income according to the rate of return on capital. With direct capitalization, two quantities are considered: annual income and the capitalization rate. The capitalization rate is the ratio of the market value of the property to the net income it brings. Expected income is determined by analyzing income during the period of ownership of the property. Discount rate - the rate of compound interest, which is applied when recalculating at a certain point in time the value of cash flows arising from the use of property. Stages of income approach: 1. Calculation of the sum of all possible receipts from the object of assessment. 2. Calculation of the actual gross income. 3. Calculation of costs associated with the object of assessment: - conditionally constant; - conditional variables (operational); - reserves. 4. Determining the amount of net operating income. 5. Convert expected returns to present value. 2.6. Land valuation It is believed that the land has a value, and the rest are improvements, they add a contribution to the value. A typical property consists of land and buildings. It is necessary to distinguish between the terms "land" and "land". A land plot is understood as a part of the earth's territory, which is equipped and ready for use for various purposes. Improvements made to create the site: - external: arrangement of streets, sidewalks, drainage and engineering networks; - internal: planning, landscaping, asphalting, installation of outlets for connecting engineering networks, communication communications, etc. When evaluating a land plot, it is necessary to take into account the set of rights associated with it. Common rights requiring assessment: 1) full ownership - the possibility of using a plot free from tenants in any legal way; 2) the right to lease - the possibility of owning a land plot under a lease agreement. The value of the lease rights is the amount that a potential buyer is willing to pay for the right to own a given site under a lease agreement in order to benefit from this ownership. The valuation of lease rights is used when determining the sale price of the right to lease a land plot, when determining the value of the object of which the leased land plot is a part, and when assessing the damage from the termination of a lease agreement. 2.6.1. Analysis of the best and most efficient use of land When evaluating a land plot, it is necessary to determine the option for its best and most efficient use (NNEI), which is determined by the interaction of a number of factors. The NNEI analysis includes the study of alternative options for the use (development, development) of a land plot and the choice of the optimal one. This takes into account the prospects of the location, the state of market demand, the cost of development, the stability of expected income, etc. When assessing the value of an object consisting of a land plot and buildings, great importance is attached to the analysis of the NNEI, firstly, the alleged vacant land plot and, secondly, the land plot with existing improvements. An analysis of a supposed vacant land plot is a necessary step in determining its value, and it is based on establishing the most profitable option for using the land. An analysis of a land plot with existing improvements involves a decision to demolish, modernize or preserve the improvements existing on the land plot in order to ensure maximum profitability of the object. The probable and most profitable use of the site provides its highest value. Use cases must be legal, physically feasible, and cost-effective. The optimal use of land is determined by the following factors: 1) location - a factor that has a major impact on the cost of a land plot (taking into account the prospects of the location, transport accessibility, the nature of the environment); 2) market demand - a factor that reflects the ratio of supply and demand in the market. It is studied to justify the chosen option for using the land plot (the state and prospects of market demand for the proposed use, competition from other sites, types of taxes and other conditions). It is necessary to single out a segment of the market in which it is necessary to develop activities; 3) financial feasibility - the ability of the project to provide income from the use of the land, which would be sufficient to reimburse investors' expenses and ensure the expected profit; 4) physical suitability of the site - the prospect of making improvements - size, topography, soil quality, climate, engineering-geological and hydro-geological characteristics of the site, existing zoning, environmental parameters, etc.; 5) technological feasibility and physical feasibility - analysis of the ratio of quality, costs and terms of the project, the likelihood of natural disasters, the availability of transport, the ability to connect to utilities, taking into account the size and shape of the site, for example, the size may be small for the construction of an industrial facility; 6) legislative (legal) admissibility - compliance of the option of using the land plot with the current legislation. It is revealed as a result of the analysis of construction, environmental standards, floor restrictions, the presence of temporary bans on construction in a given location, difficulties in the area of historical urban development, a possible change in regulations, compliance with zoning rules, negative moods of the local population; 7) maximum return (maximum property income and site value), which is determined by discounting the future income of alternative use cases, taking into account the risk of investment. 2.6.2. Assessment of the efficiency of urban land use Urban lands are a special category. Their value is influenced by the size of the city and its production and economic potential, the level of development of engineering and social infrastructure, regional natural, environmental and other factors. In addition, there are peculiarities of legislation for this category of land. The same factors can have the opposite effect on the value of a particular site: - heavy traffic is undesirable for a residential area, but increases the value of the site for trade purposes; - location relative to educational institutions and shopping centers, aesthetic merits and amenities taken into account when assessing land for housing construction, practically do not affect the value of territories oriented to industrial development; transport infrastructure and economic zoning are important to them. The main units used for comparison of land plots: - price per 1 ha - for large areas of agricultural, industrial or housing construction; - price per 1 m2 - in business centers of cities, for offices, shops; - price for 1 frontal meter - for commercial use of land in cities. In this case, the cost of the lot is proportional to the length of its boundary along the street or highway, with the standard depth of the lot, which accounts for a small part of the cost; - price per lot - is used to compare standard plots in terms of shape and size in areas of residential, summer cottage development; - price per unit of density - ratio of building area to land area, etc. Most land resources are currently in state and municipal ownership. Practice shows that in market conditions, urban land is a valuable resource and can serve as a stable source of income for the local budget. The city authorities determine the amount of the land tax, the rental rate for land and the standard price of a land plot upon redemption, so the issue of increasing the efficiency of land use is relevant for them. In order for land property to be used more efficiently, i.e., to bring the maximum income from use and contribute to the improvement of the overall investment climate, it is necessary to further develop market relations in the land market, focus on the current market situation and market requirements. In order for land property to be used more efficiently, i.e., to bring the maximum income from use and contribute to the improvement of the overall investment climate, it is first necessary to implement the processes of taxation, lease and redemption of urban land based on its market value. At the same time, a fair distribution of the tax burden is achieved, stimulation of effective use and activation of investments in reconstruction and development in the process of restructuring the territory. In the course of implementing the policy of charging for land resources based on their market value, the following results are achieved: - creation and development of an adequate system of market relations in the system of payment for land resources; - fair distribution of the tax burden; - stimulating the redistribution of land between competing types of land use; - stimulating the effective use and activation of investments in reconstruction and development in the process of restructuring the territory. The redemption of a land plot by an enterprise makes it possible to use land as collateral for a bank loan, expand investment opportunities, sell surplus land, receive income from land lease, increase the value of fixed assets, and increase the market value of shares. There are two views on the value of urban land: - urban planner in the process of functional zoning of the territory as a section of the general plan of the city; - an appraiser in the process of developing a cadastral valuation of land. The basis for the formation of a cadastral valuation of land and functional zoning of the territory should be a comprehensive urban assessment of market value. 2.7. Land valuation methods The normative method consists in determining the normative price of land. It is used when transferring, redeeming land for ownership, establishing common joint (shared) property in excess of the free norm, transferring by inheritance or donation, obtaining a loan secured by security, withdrawing for state or public needs. City lands are assessed taking into account the building density, the prestige of the area, the nature of the surrounding land use, the ecological state, engineering and transport facilities, etc. The lands are divided into zones differentiated by the basic land tax rates and the standard price of land (Law of the Russian Federation "On payment for land") . The normative price of land is fixed in the Land Cadastre. The basis for determining the standard price of land: land tax rates and multiplying factors, land tax benefits are not taken into account. It is often necessary to value an object consisting of a building and a land plot, when the latter has only lease rights. In this case, the cost of land allocation for construction can be taken into account as the cost of land. In market conditions, if the necessary information is available, it is advisable to apply methods based on the analysis of market data. Order of the Ministry of Property of Russia No. 07.03.2002-r dated 568 approved Methodological recommendations for determining the market value of land plots. As a rule, when assessing the market value of land plots, the sales comparison method, the allocation method, the land rent capitalization method, the distribution method, the remainder method, and the division into plots method are used. The sales comparison method is the simplest and most effective valuation method, and can be used to value both actually free and supposedly vacant land; allows you to determine the specific price of a land plot by making percentage adjustments to the sales prices of analogues. In the absence of information on the prices of transactions with land plots, the use of supply (demand) prices is allowed. Common elements of comparison for land plots: ownership, financing conditions, special conditions of sale, market conditions (change over time), location (distance from city and roads, environmental characteristics), zoning conditions, physical characteristics (size, shape and depth of the plot, angular location, soil type, topography), available utilities, economic characteristics, best and most efficient use. When valuing land, you can use several units of comparison, adjusting the price of each of them and getting at the end several values that determine the range of values. Urban lands are a special category, their value is influenced by the size of the city and its production and economic potential, the level of development of engineering and social infrastructure, regional natural, environmental and other factors. The method gives sufficiently accurate results only in a developed information-open competitive market. The Russian land market does not meet these requirements; the cost of a land plot cannot be determined based on information on sales transactions of analogous plots. Therefore, all available information should be collected for the assessment to apply all site assessment methods. The method of capitalization of land rent is based on the fact that if there is sufficient information about the rental rates of land plots, it is possible to determine the value of these plots as the current value of future income in the form of rent for the assessed land plot. Within the framework of this method, the amount of land rent can be calculated as income from the lease of a land plot under the conditions prevailing on the land market. As a regular stream of income, land rents can be capitalized into value by dividing by a capitalization ratio for land determined from market analysis. The initial data for capitalization is obtained from a comparison of sales of leased land and rental values. Based on the rental rate received, the market value of the land is determined using the income approach, usually using the direct capitalization method. The formula for calculating the cost of a land plot is